Growth in recurring subscription revenue partially offsets decline in perpetual license sales

- 9% growth in recurring subscription revenue: $4.6 million

- 4% increase in ARR from subscriptions as of September 30, 2025: $18.3 million

- Consolidated revenue: $9.8 million (-31% vs. Q3 2024)

Regulatory News:

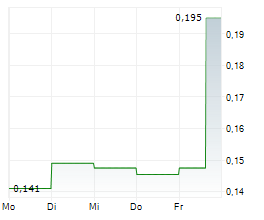

VERIMATRIX (Euronext Paris: VMX, FR0010291245), a leading provider of user security solutions for a safer connected world, announces its third-quarter revenue for fiscal year 2025 (July 1 to September 30).

Verimatrix is continuing with the transformation plan launched in 2021 towards a subscription-based cybersecurity software solutions model, as illustrated by the growth in recurring revenues (+9%). However, the past quarter reflects a certain wait-and-see attitude on the part of our customers and prospects, in a still uncertain economic environment. This reduced visibility is lengthening or delaying decision-making cycles and temporarily weighing on our business, resulting in a slowdown in ARR growth from subscriptions (+4%). Nevertheless, the fundamentals of our markets remain solid. The strengthening of the regulatory framework and the rise in cybersecurity requirements are encouraging our customers to make long-term investments in protecting their video content and applications. In this context, Verimatrix remains one of their trusted partners, recognized for its ability to secure its customers' digital assets and support them in creating value," said Laurent Dechaux, CEO of VERIMATRIX

Laurent Dechaux, CEO, and Jean-François Labadie, Chief Financial Officer, will host a webcast today at 6:00 p.m. to present the third quarter 2025 revenue figures.

To join the webcast, click on the following link: "Third Quarter 2025 Revenue

To join the webcast via audio only, call the following number:

France: +33 (0) 4 88 80 09 30

Phone Conference ID: 654 951 603#

- Slowdown in activity despite growth in recurring revenue from subscriptions

The Group's business slowed in Q3, with revenue down 31% to €9.8 million, despite continued growth in recurring subscription revenue (+9%). This improvement illustrates the rise of the subscription model, although it was not enough to offset both the decline in non-recurring revenue (-64%) and in maintenance (-25%).

As a result of the transformation plan undertaken by the group, the revenue mix is evolving favorably, with recurring subscription revenues now representing 59% of the total recurring revenue in Q3 (56% over 9 months) compared to 50% in Q3 2024 (50% over 9 months in 2024).

Anti-Piracy revenue amounted to $32.5 million, representing 90% of the Group's total business, down 19% over nine months, penalized by the contraction in sales in Asia and South America. Extended Threat Defense (XTD) revenue amounted to $3.8 million over nine months, down 17% compared to the same period in fiscal year 2024, reflecting difficulties in expanding the international customer base, particularly in the Americas.

(in USD million | Q3 2025 | Q3 2024 | Var. | 9 months 2025 | 9 months 2024 | Var. | ||

Recurring revenue | 7.7 | 8.4 | -8% | 25.0 | 25.4 | -2% | ||

of which subscriptions | 4.6 | 4.2 | +9% | 13.9 | 12.8 | +9% | ||

of which maintenance | 3.2 | 4.2 | -25% | 11.1 | 12.7 | -13% | ||

Non-recurring revenue | 2.1 | 5.7 | -64% | 11.3 | 19.5 | -42% | ||

Total revenue | 9.8 | 14.1 | -31% | 36.3 | 44.9 | -19% | ||

ARR | 31.3 | 32.9 | -5% | |||||

of which subscriptions | 18.3 | 17.6 | +4% | |||||

of which maintenance | 13.0 | 15.4 | -15% | |||||

Recurring revenue

Recurring revenue from subscriptions continued to perform well, reaching $4.6 million compared to $4.2 million a year earlier, representing a further increase of +9% in the third quarter of 2025. This growth mainly reflects the activation of new contracts, primarily with telecom operators.

Including maintenance revenues, which were down 25% to $3.2 million (compared to $4.2 million in the third quarter of 2024), recurring revenues amounted to $8.4 million, down 8% compared to the third quarter of 2024. Recurring revenues now account for 79% of the Group's total revenues, compared with 60% a year earlier.

Over the first nine months of the fiscal year, recurring revenue declined more moderately (-2% to $25 million), driven by higher subscription revenue ($13.9 million, up +9%), which partially offset the decline in maintenance revenue ($11.1 million, down 13%). Recurring revenues accounted for 69% of the Group's total revenues for the first nine months of 2025, compared with 57% for the same period in 2024.

Non-recurring revenue

Non-recurring revenue amounted to $2.1 million in the third quarter (-64%) and $11.3 million over nine months (-42%).

These changes are mainly due to a decline in activity in Asia and Latin America. In the LATAM region most countries are experiencing difficult economic conditions which is prompting our customers to postpone their purchases of perpetual licenses.

Annual recurring revenue (ARR)

As of September 30, 2025, total ARR reached $31.3 million, down 5% compared to September 30, 2024.

However, ARR from subscriptions continued to grow, up +4.1% to $18.3 million (compared to $17.6 million a year earlier), driven by the excellent momentum of the Anti-Piracy business, whose subscription revenues recorded sustained growth of +8%.

This performance illustrates Verimatrix's strong positioning in this strategic segment. Conversely, subscriptions related to the Extended Threat Defense (XTD) business declined by 9%, reflecting a market that is still in the process of structuring itself.

- 2025 objectives

For the full 2025 financial year, the Group confirms its ambition to achieve another year of double-digit growth in its subscription ARR compared to 2024. Given the current revenue trend the Group is expected a lower Ebitda compared to the full year of 2024.

Next event

Publication of FY 2025 revenue and results: 12 March 2026 (after market)

About VERIMATRIX

VERIMATRIX (Euronext Paris: VMX) is contributing to making the connected world safer through its user-friendly security solutions. The Group protects content, applications and smart objects by providing intuitive, unconstrained and fully user-oriented security. The leading players in the market trust VERIMATRIX to protect their content, including premium films, sports streaming, sensitive financial and medical data, and the mobile applications essential to their business. VERIMATRIX ensures a relationship of trust that its customers count on to deliver quality content and service to millions of consumers worldwide. VERIMATRIX supports its partners, bringing them faster access to the market and helping them to develop their business, safeguard their revenue and win new customers. Find out more at www.verimatrix.com.

Forward-looking statements

This press release contains certain forward-looking statements concerning Verimatrix. Although Verimatrix believes its expectations to be based on reasonable assumptions, they do not constitute guarantees of future performance. Accordingly, the Company's actual results may differ materially from those anticipated in these forward-looking statements owing to a number of risks and uncertainties.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251022374689/en/

Contacts:

Investor:

Jean-François Labadie

Chief Financial Officer

finance@verimatrix.com

Jean-Yves Barbara

SEITOSEI.ACTIFIN

jean-yves.barbara@seitosei-actifin.com

Media:

USA

Matthew Zintel

Public Relations

matthew.zintel@zintelpr.com

EUROPE

Michael Scholze

SEITOSEI.ACTIFIN

michael.scholze@seitosei-actifin.com