WASHINGTON (dpa-AFX) - Following the lackluster performance seen during Tuesday's session, stocks moved mostly lower during trading on Wednesday. The major averages all moved to the downside on the day, with the Dow pulling back off yesterday's record closing high.

The major averages climbed well off their worst levels in late-day trading but remained firmly negative. The Nasdaq slumped 213.67 points or 0.9 percent to 22,740.40, the Dow slid 334.33 points or 0.7 percent to 46,590.41 and the S&P 500 fell 35.95 points or 0.5 percent to 6,699.40.

The slump by the tech-heavy Nasdaq was partly due to a steep drop by shares of Netflix (NFLX), with the streaming giant plunging by 10.1 percent to a five-month closing low.

Netflix camed under pressure after the company reported weaker than expected third quarter earnings, citing a dispute with Brazilian tax authorities.

Shares of Texas Instruments (TXN) also tumbled by 5.6 percent after the chipmaker provided disappointing fourth quarter guidance.

On the other hand, shares of Intuitive Surgical (ISRG) soared by 13.9 percent after the robotic-assisted surgery systems maker reported third quarter results that beat expectations.

The weakness on Wall Street also came amid renewed uncertainty about trade relations between the U.S. and China following the latest remarks from President Donald Trump.

During a lunch with Republican lawmakers in the White House Rose Garden on Tuesday, Trump said he expects to be able to reach a 'good deal' with Chinese President Xi Jinping but also suggested a meeting between the two leaders may not happen.

'Maybe it won't happen,' Trump said. 'Things can happen where, for instance, maybe somebody will say, 'I don't want to meet, it's too nasty.' But it's really not nasty. It's just business.'

The major averages fell to their lows of the session after a report from Reuters indicated the Trump administration is considering a plan to curb an array of software-powered exports to China.

Reuters said the plan is not the only option on the table but noted it would make good on Trump's threat to bar 'critical software' exports to China in retaliation for Beijing's latest round of rare earth export restrictions

Sector News

Semiconductor stocks came under significant selling pressure over the course of the session, with the Philadelphia Semiconductor Index tumbling by 2.4 percent.

Considerable weakness also emerged among airline stocks, as reflected by the 1.9 percent loss posted by the NYSE Arca Airline Index.

Retail, housing and networking stocks also saw notable weakness on the day, while energy stocks bucked the downtrend amid a sharp increase by the price of crude oil.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance on Wednesday. Hong Kong's Hang Seng Index slid by 0.9 percent and Japan's Nikkei 225 Index edged slightly lower, while South Korea's Kospi surged by 1.6 percent.

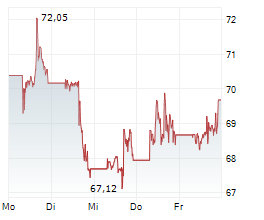

The major European markets also ended the day mixed. While the U.K.'s FTSE 100 Index advanced by 0.9 percent, the French CAC 40 Index fell by 0.6 percent and the German DAX Index declined by 0.7 percent.

In the bond market, treasuries fluctuated over the course of the session before closing modestly higher. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, dipped 1.0 basis points to 3.953 percent.

Looking Ahead

Reaction to the latest earnings news may continue to drive trading on Thursday, with Tesla (TSLA) and IBM Corp. (IBM) among the companies releasing their quarterly results after the close of today's trading.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News