NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR INDIRECTLY, IN OR INTO, THE UNITED STATES OF AMERICA, AUSTRALIA, BELARUS, CANADA, HONG KONG, JAPAN, NEW ZEALAND, RUSSIA, SINGAPORE, SOUTH AFRICA, SOUTH KOREA OR ANY OTHER JURISDICTION IN WHICH THE RELEASE, DISTRIBUTION OR PUBLICATION WOULD BE UNLAWFUL OR REQUIRE REGISTRATION OR ANY OTHER MEASURE.

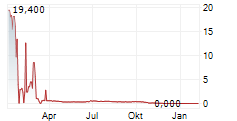

LUND, SE / ACCESS Newswire / October 22, 2025 / Alligator Bioscience (STO:ATORX) - The Board of Directors of Alligator Bioscience AB ("Alligator Bioscience" or the "Company") has today, subject to approval by an extraordinary general meeting on 25 November 2025, resolved to carry out an issue of ordinary shares and warrants ("units") with preferential rights for the Company's existing shareholders of initially approximately SEK 120 million (the "Rights Issue"). The Company has received subscription undertakings and subscription intentions amounting to a total of approximately SEK 6 million, corresponding to approximately 5 percent of the Rights Issue. Furthermore, the Company has received guarantee commitments amounting to a total of approximately SEK 72 million, corresponding to approximately 60 percent of the Rights Issue, which in total is covered by subscription undertakings, subscription intentions and guarantee commitments of approximately SEK 78 million, corresponding up to approximately 65 percent of the Rights Issue. Alligator Bioscience intends to use the proceeds from the Rights Issue, after repayment of the bridge loans and part of the outstanding loan that Alligator Bioscience raised from Fenja Capital II A/S ("Fenja Capital") in 2024, to support the ongoing process to secure a partnership for mitazalimab as well as for furthering other pipeline projects and general corporate purposes. The Rights Issue is subject to approval by an extraordinary general meeting on 25 November 2025. The notice of the extraordinary general meeting will be announced in a separate press release. To secure the Company's liquidity needs until the completion of the Rights Issue, the Company has entered into bridge loan agreements of SEK 17 million in total on market terms. In connection with the Rights Issue, Alligator Bioscience has also renegotiated the outstanding loan from Fenja Capital. As part of the renegotiation, Alligator Bioscience has undertaken to issue warrants to Fenja Capital, free of charge.

Summary

The Rights Issue includes units and will initially, if fully subscribed, provide Alligator Bioscience with approximately SEK 120 million before issue costs. Each unit consists of two (2) ordinary shares and one (1) warrant series TO 14. The warrants series TO 14 are intended to be admitted to trading on Nasdaq Stockholm.

One (1) warrant series TO 14 entitles the holder to subscription of one (1) ordinary share in the Company during the period from and including 5 March 2026 up to and including 19 March 2026. Thus, the Company may receive additional proceeds in March 2026 if the warrants series TO 14 are exercised for subscription of new ordinary shares.

The exercise price for the warrants series TO 14 shall correspond to 70 percent of the volume-weighted average price of the Company's ordinary share on Nasdaq Stockholm during the period from and including 10 February 2026 up to and including 27 February 2026, however not lower than the quota value of the share and not higher than 125 percent of the subscription price per ordinary share in the Rights Issue.

Final terms of the Rights Issue, including subscription price, increase of the share capital and number of ordinary shares and warrants issued, are intended to be published no later than 24 November 2025. The subscription price for each unit is intended to be set based on a discount to TERP (theoretical share price after separation of unit rights) of approximately 35 percent based on the volume-weighted average share price of the Company's ordinary share on Nasdaq Stockholm during the period from and including 18 November 2025 up to and including 24 November 2025, however not less than the new quota value of the share subject to resolution by the extraordinary general meeting on 25 November 2025 (i.e. SEK 0.20) and not more than SEK 1.89, multiplied by two (2) (the "Subscription Price").

The Rights Issue is covered to approximately 5 percent by subscription undertakings and subscription intentions, and to approximately 60 percent by guarantee commitments, corresponding to a total of approximately 65 percent of the Rights Issue in total.

Provided that the Rights Issue is approved by the extraordinary general meeting on 25 November 2025, the record date for the Rights Issue will be 2 December 2025, and the subscription period will run from and including 4 December 2025 up to and including 18 December 2025.

The last day of trading in the Company's shares including right to receive unit rights in the Rights Issue is 28 November 2025 and the first day of trading in the Company's shares without the right to receive unit rights in the Rights Issue is 1 December 2025.

Trading in unit rights will take place on Nasdaq Stockholm from and including 4 December 2025 up to and including 15 December 2025.

To secure the Company's liquidity needs until the completion of the Rights Issue, the Company has entered into bridge loan agreements of SEK 17 million in total on market terms.

In connection with the Rights Issue, Alligator Bioscience has renegotiated the outstanding loan raised in 2024 from Fenja Capital.

The Company intends to publish a prospectus regarding the Rights Issue around 28 November 2025 (the "Prospectus").

Søren Bregenholt, CEO of Alligator Bioscience, comments:

"The upcoming Rights Issue and the renegotiated loan agreement with Fenja Capital will provide Alligator Bioscience with 6-9 months of additional financial runway in 2026. This will enable us to continue advancing mitazalimab towards Phase 3 development, progress our broader pipeline, and pursue our ongoing business development activities. In a challenging market environment, we remain appreciative of the continued trust and support shown by our shareholders."

Background and reason for the Rights Issue

Alligator Bioscience is a research-based biotechnology company developing antibody-based pharmaceuticals for cancer treatment. The Company specializes in the development of tumor-directed immunotherapies, in particular agonistic mono- and bispecific antibodies. In immunotherapy, the patients' immune system is activated to cure cancer. The term tumor-directed means that the drug is administered or designed such that the pharmacological effect is localized to the tumor. This results in an advantageous efficacy and safety profile.

The clinical drug candidate mitazalimab (previously ADC-1013) is an agonistic, or stimulatory, antibody that targets CD40, a receptor on the dendritic cells of the immune system, which are the cells that detect enemies such as cancer cells. In preclinical experimental models, mitazalimab has been shown to induce a potent tumor-targeted immune response and provide long-lasting tumor immunity. In addition, preclinical data have demonstrated how mitazalimab can be used against multiple types of cancer. The study OPTIMIZE-1 is an open-label, multi-center trial assessing the clinical efficacy of mitazalimab in combination with chemotherapy (mFOLFIRINOX) in patients with first line metastatic pancreatic cancer. The trial was initiated in Q3 2021, and top line data was announced on 29 January 2024 showing that the trial met the primary endpoint. On 22 September 2025, the Company announced final 30-month data. The final readout confirms data maturity, demonstrating both primary and secondary efficacy endpoints that compare favorably with historical controls. As previously reported, the objective response rate (ORR) was 54.4 percent (42.1 percent confirmed). The median duration of response was 12.6 months, with a median progression-free survival (PFS) of 7.8 months. Median OS reached 14.9 months, with OS rates of 58 percent, 37 percent, 26 percent, and 21 percent at 12, 18, 24, and 30 months, respectively-an unprecedented outcome in this hard-to-treat cancer. These results underscore a durable benefit, with a meaningful proportion of patients achieving long-term survival beyond two years. These results further strengthen the rationale for advancing mitazalimab into a pivotal Phase 3 trial in metastatic pancreatic cancer together with a partner.

Given the capital needs that the Company's development and commercialization plans give rise to, Alligator Bioscience assesses that its existing working capital is not sufficient to cover the Company's capital needs. To ensure continued successful progress in accordance with the Company's business plan and strategy, including the ongoing process to secure a partnership for mitazalimab and further develop other pipeline projects, the Board of Directors has decided to carry out the Rights Issue.

Upon full subscription in the Rights Issue, the Company will initially receive approximately SEK 120 million before issue costs. The costs related to the Rights Issue are estimated at full subscription, to amount to a maximum of approximately SEK 17 million, of which approximately SEK 9 million is attributable to guarantee compensation (provided that all guarantors choose to receive the compensation in cash). The expected net proceeds from the Rights Issue are thus estimated to amount to approximately SEK 103 million. The net proceeds from the Rights Issue, after repayment of the bridge loans and part of the loan that Alligator Bioscience raised from Fenja Capital in 2024 (as detailed below), are intended to support the ongoing process to secure a partnership for mitazalimab as well as for furthering other pipeline projects and general corporate purposes.

In March 2026, the Company may receive additional proceeds if the warrants series TO 14 issued in the Rights Issue are exercised for subscription of new ordinary shares. The net proceeds from the exercise of warrants series TO 14 are intended to be used with up to 50 percent of the part exceeding SEK 6 million to repay the outstanding loan from Fenja Capital (as detailed below) and the remaining part as working capital for the Company.

Terms of the Rights Issue

The Board of Directors has today, subject to the approval by the extraordinary general meeting on 25 November 2025, resolved on an issue of units consisting of ordinary shares and warrants series TO 14, with preferential rights for existing shareholders. Through the Rights Issue, Alligator Bioscience may receive initial issue proceeds of approximately SEK 120 million, excluding the additional proceeds that may be received upon exercise of the warrants series TO 14 that are issued in the Rights Issue. Those who are registered as shareholders in the Company on the record date 2 December 2025 are entitled to subscribe for units with preferential rights.

Final terms of the Rights Issue, including Subscription Price, increase of the share capital and number of ordinary shares and warrants issued, are intended to be published no later than 24 November 2025. Each unit consists of two (2) ordinary shares and one (1) warrant series TO 14. The warrants series TO 14 are issued free of charge. The Subscription Price is intended to be set based on a discount to TERP (theoretical share price after separation of unit rights) of approximately 35 percent based on the volume-weighted average share price of the Company's ordinary share on Nasdaq Stockholm during the period from and including 18 November 2025 up to and including 24 November 2025, however not less than the new quota value of the share subject to resolution by the extraordinary general meeting on 25 November 2025 (i.e. SEK 0.20) and not more than SEK 1.89, multiplied by two (2). The warrants series TO 14 are intended to be admitted to trading on Nasdaq Stockholm.

Subscription of units with or without preferential rights shall be made during the period from and including 4 December 2025 up to and including 18 December 2025. Unit rights that are not exercised during the subscription period will become invalid and lose their value. Trading in unit rights takes place on Nasdaq Stockholm during the period from and including 4 December 2025 up to and including 15 December 2025 and trading in BTU (paid subscribed units, "BTU") during the period from and including 4 December 2025 up to and including 13 January 2026.

One (1) warrant series TO 14 entitles the holder the right to subscribe for one (1) new ordinary share in the Company at a subscription price corresponding to 70 percent of the volume-weighted average price of the Company's ordinary share on Nasdaq Stockholm during the period from and including 10 February 2026 up to and including 27 February 2026, however not lower than the quota value of the share and not higher than 125 percent of the Subscription Price per ordinary share in the Rights Issue. Subscription of ordinary shares by exercise of warrants series TO 14 shall be made during the period from and including 5 March 2026 up to and including 19 March 2026.

If not all units are subscribed for by exercise of unit rights, allotment of the remaining units shall be made within the highest amount of the issue: firstly, to those who have subscribed for units by exercise of unit rights (regardless of whether they were shareholders on the record date or not) and who have applied for subscription of units without exercise of unit rights and if allotment to these cannot be made in full, allotment shall be made pro rata in relation to the number of unit rights that each and every one of those, who have applied for subscription of units without exercise of unit rights, have exercised for subscription of units; secondly, to those who have applied for subscription of units without exercise of unit rights and if allotment to these cannot be made in full, allotment shall be made pro rata in relation to the number of units the subscriber in total has applied for subscription of units; and thirdly, to those who have provided guarantee commitments with regard to subscription of units, in proportion to such guarantee commitments. To the extent that allotment in any section above cannot be done pro rata, allotment shall be determined by drawing of lots.

Subscription undertakings, subscription intentions and guarantee commitments

The Company has received subscription undertakings from a number of existing shareholders, amounting in total to approximately SEK 5.2 million, corresponding to approximately 4.4 percent of the Rights Issue. In addition, the Company's Chairman of the Board of Directors, Hans-Peter Ostler, CEO, Søren Bregenholt, and CFO, Johan Giléus, have expressed their intention to subscribe for units in the Rights Issue for their respective pro rata share of the Rights Issue, amounting in total to approximately SEK 0.7 million, corresponding to approximately 0.6 percent of the Rights Issue. Members of the Company's Board of Directors and management are prevented, under applicable rules on market abuse, from entering into undertakings to subscribe for units in the Rights Issue, as a result of the Company being in a so-called closed period until the publication of the interim report for the third quarter of 2025, and are expected to enter into binding subscription undertakings after the closed period has ended. No compensation will be paid for subscription undertakings or subscription intentions.

The Company has also entered into agreements with certain existing larger shareholders and a number of external investors on guarantee commitments of a total of approximately SEK 72 million, corresponding to approximately 60 percent of the Rights Issue. According to the guarantee agreements, cash compensation is paid with 12 percent of the guaranteed amount, corresponding to a total of approximately SEK 8.7 million, or 14 percent of the guaranteed amount in the form of newly issued units in the Company, with the same terms and conditions as for units in the Rights Issue, including the Subscription Price in the Rights Issue.

In total, the Rights Issue is covered by subscription undertakings, subscription intentions and guarantee commitments amounting up to approximately SEK 78 million, corresponding to approximately 65 percent of the Rights Issue. Neither the subscription undertakings, the subscription intentions, nor the guarantee commitments are secured by bank guarantees, blocked funds, pledges or similar arrangements.

In order to enable issue of units as guarantee compensation to the guarantors who choose to receive guarantee compensation in the form of newly issued units, the Board of Directors has proposed that the extraordinary general meeting on 25 November 2025, among other things, resolves on approval of the Rights Issue and authorization for the Board of Directors to resolve on issue of such units to guarantors.

A subscription of units in the Rights Issue (other than by exercising preferential rights) which result in an investor acquiring a shareholding corresponding to or exceeding a threshold of ten (10) percent or more of the total number of votes in the Company following the completion of the Rights Issue, must prior to the investment be filed with the Inspectorate of Strategic Products (Sw. Inspektionen för strategiska produkter, "ISP"). To the extent any guarantors' fulfilment of their guarantee commitment entails that the investment must be approved by the ISP in accordance with the Swedish Screening of Foreign Direct Investments Act (Sw. lagen (2023:560) om granskning av utländska direktinvesteringar), such part of the guarantee is conditional upon notification that the application of the transaction is left without action or that approval has been obtained from the ISP.

In addition, pursuant to the guarantee commitment provided by Fenja Capital, Fenja Capital's obligation to fulfil its guarantee commitment in connection with the Rights Issue may be postponed in order to secure that Fenja Capital's shareholding in the Company does not amount to or exceed 30 per cent of the Company's votes after the completion of the Rights Issue.

Preliminary time plan for the Rights Issue

24 November 2025 | Publication of final terms of the Rights Issue, including Subscription Price |

25 November 2025 | Extraordinary general meeting |

28 November 2025 | Estimated publication of the Prospectus |

28 November 2025 | Last day of trading incl. preferential rights |

1 December 2025 | First day of trading excl. preferential rights |

2 December 2025 | Record date in the Rights Issue |

4 - 15 December 2025 | Trading in unit rights |

4 - 18 December 2025 | Subscription period |

22 December 2025 | Estimated publication of the outcome of the Rights Issue |

4 December 2025 - 13 January 2026 | Trading in paid subscribed units (BTU) |

Lock-up agreements

In connection with the Rights Issue, all shareholding members of the Board of Directors and senior management in Alligator Bioscience have undertaken towards Vator Securities AB, subject to customary exceptions, not to sell or carry out other transactions with a similar effect as a sale unless, in each individual case, first having obtained written approval from Vator Securities AB. Decisions to give such written consent are resolved upon by Vator Securities AB and an assessment is made in each individual case. Consent may depend on both individual and business reasons. The lock-up undertakings only cover the shares held prior to the Rights Issue and the lock-up period lasts for 180 days after the announcement of the Rights Issue.

Extraordinary general meeting and voting commitments

The Board of Directors' resolution on the Rights Issue is subject to approval by the extraordinary general meeting on 25 November 2025. The resolution on the Rights Issue is subject to and conditional upon that the extraordinary general meeting also resolves to reduce the share capital to cover loss, to amend the Articles of Association in accordance with the Board of Directors' proposal to the extraordinary general meeting, as well as to authorize the Board of Directors to resolve on issue of units to the guarantors and warrants to Fenja Capital. Notice of the extraordinary general meeting will be announced in a separate press release.

The Company has received irrevocable voting commitments from certain of the Company's major shareholders, who together hold approximately 4.4 percent of the votes in the Company. The voting commitments mean that the shareholders have committed to vote in favor of the Rights Issue and all relevant resolutions at the extraordinary general meeting on 25 November 2025.

Bridge loans and renegotiation of previous loan

In order to secure the Company's liquidity needs until the Rights Issue has been completed, the Company has raised bridge loans of SEK 17 million in total from Fenja Capital, Linus Berger and Philip Olsson. As compensation for the loans, an arrangement fee of 3 percent and a monthly interest rate of 0.75 percent are paid. Pursuant to the bridge loan agreements, the lenders are not obliged to disburse the bridge loans until the extraordinary general meeting on 25 November 2025 has approved the Rights Issue but may nonetheless resolve to do so. According to the bridge loans, the loans shall be repaid in connection with the Rights Issue or no later than 31 January 2026.

In June 2024, Alligator Bioscience entered into a financing agreement with Fenja Capital pursuant to which Fenja Capital provided loans with an aggregate nominal amount of SEK 68 million and furthermore also subscribed for convertibles with an aggregate nominal amount of SEK 12 million (the "Initial Financing"). For further details on the Initial Financing, please see the Company's press release from 25 June 2024. In connection with the rights issue carried out during December 2024 - February 2025, the Company renegotiated the Initial Financing, which led to the arrangement of a new loan (the "Previous Loan") as well as the repayment of all outstanding convertibles. The Previous Loan has subsequently been renegotiated in May 2025 and September 2025, respectively. As a result of the renegotiations, the repayment structure was amended and the maturity date of the Previous Loan was extended to 31 December 2025. In addition, the parties agreed that Fenja Capital could choose to convert all or part of the outstanding nominal amount under the Previous Loan into new ordinary shares in the Company through set-off. For further information on the renegotiations of the Previous Loan, please see the Company's press releases from 9 May 2025 and 8 September 2025, respectively.

The outstanding amount under the Previous Loan amounts to approximately SEK 23.1 million. In connection with the Rights Issue, Alligator Bioscience has renegotiated the Previous Loan with Fenja Capital. The Company will, in connection with the Rights Issue, repay a total amount of approximately SEK 11.2 million (including a repayment fee of approximately SEK 0.5 million), after which the remaining nominal amount under the loan will be SEK 12.5 million (the "New Loan"). In connection with the Rights Issue, Fenja Capital has provided a guarantee commitment of SEK 30 million, as well as a bridge loan of SEK 10 million (as detailed above). Pursuant to the bridge loan agreement, the arrangement fee of the bridge loan as well as the repayment fee and the amendment fee pursuant to the New Loan agreement plus any additional outstanding interest of the New Loan will be deducted from the bridge loan upon disbursement of the bridge loan to the Company. Furthermore, to the extent the guarantee commitment is exercised, Fenja Capital shall be entitled and obliged to pay for the amount so exercised through set-off against the bridge loan, the repayment amount and the amendment fee pursuant to the New Loan agreement as well as the accrued interest outstanding under the bridge loan and the New Loan (provided that such amounts have not been deducted already in connection with the disbursement of the bridge loan as described above), subject to the provisions of the New Loan agreement. To the extent the guarantee commitment is exercised for an amount in excess of the above-mentioned set-off amounts, the remaining part of the guarantee commitment shall be paid in cash. Furthermore, the previous right for Fenja Capital to request conversion of all or part of the outstanding nominal loan amount into new ordinary shares in the Company through set-off has been terminated through the New Loan agreement.

The New Loan is subject to an arrangement fee of approximately SEK 0.6 million and bears an annual interest rate at STIBOR 3M (however minimum 3 percent) plus an interest margin of 10 percent, paid on a quarterly basis. In addition to the repayment in connection with the Rights Issue, the Company shall, upon exercise of warrants series TO 14, use up to 50 percent of the part of the net proceeds that exceeds SEK 6 million for repayment of the New Loan, including the repayment fee and accrued interest on the amount so paid. Furthermore, to the extent that the outstanding New Loan at the end of a calendar quarter, after the exercise of the warrants series TO 14, exceeds 10 percent of the Company's market capitalization, the Company shall repay an amount of SEK 2 million. The maturity date for the New Loan is 30 September 2026.

In connection with the New Loan, Alligator Bioscience has also undertaken to issue warrants series 2025/2030 to Fenja Capital, free of charge. The number of warrants to be issued shall correspond to a total dilution of five percent calculated on the total number of ordinary shares outstanding in the Company immediately after the completion of the Rights Issue (including any ordinary shares issued as part of the units issued to guarantors that have chosen to receive remuneration in units). The exercise price for the warrants shall correspond to 140 percent of the Subscription Price, rounded to the nearest whole öre. The warrants will be subject to terms and conditions that contain customary recalculation terms. The Board of Directors intends to resolve on the issue of warrants series 2025/2030 to Fenja Capital pursuant to an authorization from the extraordinary general meeting intended to be held on 25 November 2025, no later than five business days following the registration of the Rights Issue with the Swedish Companies Registration Office. The warrants will be exercisable for subscription of ordinary shares in the Company from the date of registration of the warrants with the Swedish Companies Registration Office up to and including 31 October 2030. The warrants will not be admitted to trading.

Prospectus

Full terms and conditions for the Rights Issue, as well as other information about the Company and information about subscription undertakings, guarantee commitments and lock-up agreements will be presented in the Prospectus that the Company is expected to publish on or around 28 November 2025.

Advisers

Vator Securities AB acts as Sole Global Coordinator and bookrunner in connection with the Rights Issue. Setterwalls Advokatbyrå AB is legal adviser to Alligator Bioscience in connection with the Rights Issue. Vator Securities AB acts as the issuing agent in connection with the Rights Issue.

For further information, please contact:

Søren Bregenholt, CEO

E-mail: soren.bregenholt@alligatorbioscience.com

Phone: +46 (0) 46 540 82 00

This information is information that Alligator Bioscience is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-10-22 23:05 CEST.

About Alligator Bioscience

Alligator is a clinical-stage biotechnology company developing tumor-directed immuno-oncology antibody drugs focused on the CD40 receptor. This validated approach promotes priming of tumor-specific T cells and reversing the immunosuppressive nature of the tumor microenvironment, with significant potential benefits for cancer patients across multiple types of cancer. The Company's lead drug candidate mitazalimab is currently ready for Phase 3 development, and has previously presented unprecedented survival data at 24-months follow up in first-line metastatic pancreatic cancer patients in the Phase 2 trial OPTIMIZE-1.

Alligator is listed on Nasdaq Stockholm (ATORX) and headquartered in Lund, Sweden.

For more information, please visit alligatorbioscience.com.

IMPORTANT INFORMATION

The information in this press release does not contain or constitute an offer to acquire, subscribe or otherwise trade in shares, warrants or other securities in Alligator Bioscience. No action has been taken and measures will not be taken to permit a public offering in any jurisdictions other than Sweden. Any invitation to the persons concerned to subscribe for units in Alligator Bioscience will only be made through the Prospectus that Alligator Bioscience estimates to publish on or around 28 November 2025 on Alligator Bioscience's website, www.alligatorbioscience.com. The upcoming approval of the Prospectus by the Swedish Financial Supervisory Authority shall not be regarded as an approval of the shares, warrants or any other securities.

This release is not a prospectus in accordance with the definition in the Prospectus Regulation (EU) 2017/1129 ("Prospectus Regulation") and has not been approved by any regulatory authority in any jurisdiction. This announcement does not identify or suggest, or purport to identify or suggest, the risks (direct or indirect) that may be associated with an investment in shares, warrants or other securities in Alligator Bioscience. In order for investors to fully understand the potential risks and benefits associated with a decision to participate in the Rights Issue, any investment decision should only be made based on the information in the Prospectus. Thus, investors are encouraged to review the Prospectus in its entirety. In accordance with article 2 k of the Prospectus Regulation, this press release constitutes an advertisement.

The information in this press release may not be released, distributed or published, directly or indirectly, in or into the United States of America, Australia, Belarus, Canada, Hong Kong, Japan, New Zealand, Russia, Singapore, South Africa, South Korea or any other jurisdiction in which such action would be unlawful or would require registration or any other measures than those required by Swedish law. Actions in violation of these restrictions may constitute a violation of applicable securities laws. No shares, warrants or other securities in Alligator Bioscience have been registered, and no shares, warrants or other securities will be registered, under the United States Securities Act of 1933, as amended (the "Securities Act") or the securities legislation of any state or other jurisdiction in the United States of America and no shares, warrants or other securities may be offered, sold or otherwise transferred, directly or indirectly, in or into the United States of America, except under an available exemption from, or in a transaction not subject to, the registration requirements under the Securities Act and in compliance with the securities legislation in the relevant state or any other jurisdiction of the United States of America.

Within the European Economic Area ("EEA"), no public offering of shares, warrants or other securities ("Securities") is made in other countries than Sweden. In other member states of the EU, such an offering of Securities may only be made in accordance with the Prospectus Regulation. In other member states of the EEA which have implemented the Prospectus Regulation in its national legislation, any offer of Securities may only be made in accordance with an applicable exemption in the Prospectus Regulation and/or in accordance with an applicable exemption under a relevant national implementation measure. In other member states of the EEA which have not implemented the Prospectus Regulation in its national legislation, any offer of Securities may only be made in accordance with an applicable exemption under national law.

In the United Kingdom, this document and any other materials in relation to the securities described herein is only being distributed to, and is only directed at, and any investment or investment activity to which this document relates is available only to, and will be engaged in only with, "qualified investors" (within the meaning of the United Kingdom version of the EU Prospectus Regulation (2017/1129/ EU) which is part of United Kingdom law by virtue of the European Union (Withdrawal) Act 2018) who are (i) persons having professional experience in matters relating to investments who fall within the definition of "investment professionals" in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order"); (ii) high net worth entities etc. falling within Article 49(2)(a) to (d) of the Order; or (iii) such other persons to whom such investment or investment activity may lawfully be made available under the Order (all such persons together being referred to as "relevant persons"). In the United Kingdom, any investment or investment activity to which this communication relates is available only to, and will be engaged in only with, relevant persons. Persons who are not relevant persons should not take any action on the basis of this press release and should not act or rely on it.

This press release may contain forward-looking statements which reflect the Company's current view on future events and financial and operational development. Words such as "intend", "will", "expect", "anticipate", "may", "believe", "plan", "estimate" and other expressions which imply indications or predictions of future development or trends, and which are not based on historical facts, are intended to identify forward-looking statements. Forward-looking statements inherently involve both known and unknown risks and uncertainties as they depend on future events and circumstances. Forward-looking statements do not guarantee future results or development and the actual outcome could differ materially from the forward-looking statements.

This information, opinions and forward-looking statements contained in this press release applies only as of the date hereof and may be subject to change without notice. Alligator Bioscience makes no commitment to publicly update or revise any forward-looking statements, future events or similar circumstances other than as required by applicable law.

Vator Securities AB is acting for Alligator Bioscience in connection with the transaction and no one else and will not be responsible to anyone other than Alligator Bioscience for providing the protections afforded to its clients nor for giving advice in relation to the transaction or any other matter referred to herein.

Since Alligator Bioscience is considered to conduct essential services according to the Swedish Screening of Foreign Direct Investments Act (Sw. lag (2023:560) om granskning av utländska direktinvesteringar), certain investments in the Rights Issue may require review by the ISP. The Company will, no later than in connection with the publication of the Prospectus, publish more information about this on the Company's website, www.alligatorbioscience.com.

The English text is an unofficial translation of the original Swedish text. In case of any discrepancies between the Swedish text and the English translation, the Swedish text shall prevail.

Attachments

Alligator Bioscience carries out a rights issue of units of approximately SEK 120 million and raises bridge loans

SOURCE: Alligator Bioscience

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/biotechnology/alligator-bioscience-carries-out-a-rights-issue-of-units-of-approximately-sek-120-mil-1090904