Catena AB's Board of Directors has decided to adjust certain company targets in its business plan for 2026.

23 October 2025 5.20 p.m. CEST

The previously communicated objective of achieving at least 10 percent total growth annually is to be replaced by the following targets:

- Profit from property management shall achieve at least 10 percent in annual compounded growth rate per share over a five-year period

- The company shall generate an average annual compounded growth rate of at least 12 percent per share in net asset value (NRV) over a five-year period

The Board has also decided to adjust the sustainability target of net zero greenhouse gas emissions by 2030. The new target is net zero GHG emissions, across all scopes, by 2040, with an interim target of at least 50 percent by 2030. Our objectives regarding biodiversity remain unchanged, while the certification target and the objective of Catena exerting a positive influence on stakeholders and the environment by participating in societal development will, as before, not be included in the business plan. These objectives remain but are now deemed more to be interim goals and activities on the way to achieving our ultimate targets.

"We welcome clearly defined targets that focus on the values we create for owners, customers and society, and support Catena's overarching objective to generate a strong cash flow from operating activities to enable sustainable growth and stable returns," says Catena CEO Jörgen Eriksson.

The dividend policy and finance policy remain unchanged.

For further information, please contact:

Jörgen Eriksson, CEO, Tel. +46 (0)730 70 22 42, jorgen.eriksson@catena.se

Amanda Thynell, Head of sustainability, Tel. +46 (0)725 10 03 01 amanda.thynell@catena.se

Follow us: catena.se / LinkedIn

This is information that Catena AB (publ) is obliged to publish under the EU Market Abuse Regulation (MAR) 596/2014. The information was provided by the above contacts for publication at the aforementioned time.

About Catena

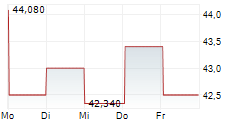

Catena is a listed property company that sustainably develops and durably manages efficient logistics facilities through collaboration. Its strategically located properties supply the Scandinavian metropolitan areas and are adapted for both current and future flows of goods. The overarching objective is to generate a strong cash flow from operating activities to enable sustainable growth and stable returns. As of 30 June 2025, the properties had a total value of SEK 42,346 million. Catena shares are traded on NASDAQ Stockholm, Large Cap.