Catena continues to deliver growth with controlled risk. Profit from property management for the quarter amounted to SEK 401 million - an increase of 32 percent compared to the same period last year.

24 October 2025, 8.00 a.m. CEST

- Rental income rose by 25 percent to SEK 1,963 million (1,566).

- Net operating surplus increased by 28 percent to SEK 1,633 million (1,276).

- Profit from property management rose by 32 percent to SEK 1,202 million (911).

- Earnings per share from property management were SEK 19.91 (16.78).

- EPRA Earnings per share totalled SEK 18.93 (15.97).

- The change in the value of properties amounted to SEK 294 million (13).

- Profit for the period increased to SEK 1,128 million (597), corresponding to earnings per share of SEK 18.69 (10.99).

- EPRA NRV Long-term net asset value per share rose to SEK 437.95 (416.41).

- A total of 58 percent of lettable area, corresponding to 1,815,000 m², is environmentally certified.

Catena's CEO Jörgen Eriksson comments on the interim report:

"With a low loan-to-value ratio and strong cash flow, we are always ready to act when the right opportunity arises."

"Our long-term approach and proactive working methods underpin Catena's strong earnings capacity, allowing us to offer logistics facilities that meet the requirements of customers and stakeholders that seek to position themselves as industry leaders."

At 10.00 a.m. on October 24, a presentation will commence for the interim report for January-September 2025. The presentation will be broadcasted live and participants may access the event via live audiocast and teleconference through the following link: https://investorcaller.com/events/catena/catena-q3-report-2025.

To participate in the event, attendees are required to register. To join the Q&A session, participants must dial in to the teleconference. After registering, they will receive a dial-in number, a conference ID, and a personal user ID to access the conference. Questions can be submitted either verbally via the teleconference line or in writing through the audiocast.

For further information, please contact

Jörgen Eriksson, CEO, Tel. + 46 730-70 22 42, jorgen.eriksson@catena.se

Magnus Thagg, CFO, Tel. + 46 70-425 90 33 magnus.thagg@catena.se

Follow us: catena.se / LinkedIn

This information is such that Catena AB (publ) is obliged to publish under the EU Market Abuse Regulation. The information was provided by the contact persons mentioned in this press release, for publication at the time stated above.

About Catena

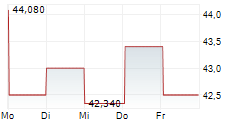

Catena is a listed property company that sustainably and through collaboration develops and durably manages efficient logistics facilities. Its strategically located properties supply the Scandinavian metropolitan areas and are adapted for both current and future goods flows. The overarching objective is to generate strong cash flow from operating activities to enable sustainable growth and stable returns. As of 30 September 2025, the properties had a total value of SEK 43,873 million. Catena's shares are traded on NASDAQ Stockholm, Large Cap.