OXE Marine AB (publ)

Third Quarter 2025

- Consolidated Net turnover amounted to SEK 42.8 m (SEK 45.6 m).

- Consolidated Gross Profit amounted to SEK 12.8 m (SEK 18.1 m) with a gross margin of 30% (40%).

- Consolidated EBITDA amounted to SEK -9.9 m (SEK -5.7 m).

- The consolidated result for the quarter amounted to SEK -16.8 m (SEK -14.8 m).

- Consolidated EPS and Diluted EPS amounted to SEK -0.02 (SEK -0.04).

January - September 2025

- Consolidated Net turnover amounted to SEK 154 m (SEK 130.2 m).

- Consolidated Gross Profit amounted to SEK 51.9 m (SEK 42.6 m) with a gross margin of 34% (33%).

- Consolidated EBITDA amounted to SEK -16.4 m (SEK -36.4 m).

- The consolidated result for the quarter amounted to SEK -37.7 m (SEK -68.7 m).

- Consolidated EPS and Diluted EPS amounted to SEK -0.05 (SEK -0.21).

Significant events during the third quarter

- No significant events during the quarter

Significant events during the year until September

- OXE Marine receives the largest order in the company's history of USD 6.6 m to supply a United States Governmental agency.

- OXE Marine AB changes Certified Adviser to Redeye AB.

Significant events after the reporting period

- No significant events after the quarter

Comments from CEO

Resilient growth in Propulsion

"While the quarter presented challenges; a slower marine market and aggressive price promotions from the major gasoline outboard brands, OXE outboard sales remained resilient with 15% growth in propulsion sales. We continue to see opportunities for growth and continue to build our market and see increased requests for OXE engines in larger projects."

Apart from fulfilling existing US contracts, new sales during the quarter came from Europe, Asia and South America showing the increasing diversification of OXE projects. The OXE brand continues to grow and gain trust among marine professionals worldwide.

During the quarter, OXE Marine released a series of videos highlighting its collaboration with North Star (UK), a leading offshore windfarm service operator that powers its fleet of daughter crafts with the OXE300 (see front cover).

Business Performance

Total sales amounted to SEK 42.8 m (SEK 45.6 m), a decline of 6% relative to the same quarter of the previous year. During the quarter, Propulsion Sales amounted to SEK 34.8 m (SEK 30.3 m), a 15% increase compared to the same quarter of the previous year. During the quarter the company completed the USD 5.9 m contract to a US boat builder, previously communicated in July 2024, which meant a lower contribution from inboard sales to Propulsion Sales relative to previous quarters. Sales of Parts & Accessories (P&A) amounted to SEK 7.6 m (SEK 15.3 m), representing a 50% decrease compared to the same quarter of the previous year. One of the main reasons is that OXE has cleared its P&A order backlog, meaning improved delivery performance to end customers, which contributed towards lower P&A sales relative to the prior year. In addition, several deliveries during the quarter associated with the discount campaign (see below) did not include rigging accessories as the customers chose to take delivery of these items at a later stage.

Gross margin amounted to 30% (40%). In response to an increasingly competitive outboard market, with several industry-wide discount campaigns, OXE ran targeted discount programs in select markets to maintain competitiveness. This resulted in a weaker gross margin for the quarter, although this is not expected to continue going forward. Gross margins were also negatively affected by a stronger SEK against the USD and EUR.

Operating expenses (OPEX) for the quarter decreased by 6% and amounted to SEK -22.6 m (SEK -24.0 m), showing continued cost control. We are pleased with this improvement, as it remains below our target ceiling of SEK 25 m per quarter. The reduction reflects both a stronger SEK/USD and ongoing efforts to enhance profitability through disciplined cost management. At the operating level, EBITDA amounted to SEK -9.9 m (SEK -5.7 m), with the weaker result driven by lower sales and reduced gross profit.

Cash flow from operating activities amounted to SEK 5.3 m (SEK -2.0 m), supported by positive changes in working capital. The quarter closed with SEK 9.3 m (SEK 6.1 m) in cash. Accounts receivable was higher at SEK 39.6 m (SEK 24.7 m), while accounts payable was lower at SEK 22.4 m (SEK 37.4 m) - both placing downward pressure on cash flow from working capital. The company maintained sufficient headroom in its US working capital facility at quarter-end.

US Tariffs & US Government Shutdown

Although not yet finalized, the proposed tariff increases in the US have already had an impact, rising from 2.5% to 15% on engines. Management continues to closely monitor developments, working to mitigate risks and explore available tariff relief measures. In the long term, finalized tariff levels will be incorporated into US product pricing.

At the time of writing, the ongoing US government shutdown may also cause delays in new project awards and current business operations.

Looking Ahead

Despite a slower quarter, we remain confident in the company's outlook. OXE propulsion solutions are being specified into several new global projects, the majority of which are in the US, where OXE Marine Inc. maintains a strong local presence.

In the fourth quarter, production will begin for the new 2026 model based on the current OXE300 platform and includes several exciting new features. The product launch will take place at the METS trade show in November.

I would like to extend my sincere thanks to the dedicated OXE team for their continued hard work and commitment.

- Paul Frick, CEO

The Interim report is available for download at: https://www.oxemarine.com/investors/financial-reports

For further information, please contact:

Paul Frick, CEO, OXE Marine AB, paul.frick@oxemarine.com, +46 (0) 703 25 06 20

Jonas Wikström, Chairman of the Board, OXE Marine AB jonas.wikstrom@oxemarine.com, +46 (0) 70 753 65 66

About OXE Marine

OXE Marine AB (publ) is the company behind the world's first high performance diesel outboard. The company's unique and patented solutions for high torque transmission between powerhead and lower leg has led to a global high demand for the company's outboards. Enabling improved performance and fuel efficiency in an outboard, OXE Marine redefines possibilities in the marine sector.

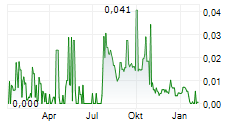

OXE Marine AB (publ) is listed on the NASDAQ First North Growth Market (STO: OXE). Redeye AB is the Company's Certified Adviser.

This information is information that OXE Marine is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-10-24 07:00 CEST.