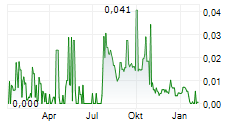

OXE Marine AB (publ)

First Quarter 2025

- Consolidated Net turnover amounted to SEK 50.5 m (SEK 39.2 m).

- Consolidated Gross Profit amounted to SEK 16.9 m (SEK 10.7 m) with a gross margin of 34% (27%).

- Consolidated EBITDA amounted to SEK -5.2 m (SEK -18.9 m).

- The consolidated result for the quarter amounted to SEK -10.7 m (SEK -33.3 m).

- Consolidated EPS and Diluted EPS amounted to SEK -0.02 (SEK -0.10).

Significant events during the first quarter

- OXE Marine receives the largest order in the company's history of USD 6.6 m to supply a United States Governmental agency.

- OXE Marine AB changes Certified Adviser to Redeye AB.

Comments from CEO

Highest propulsion sales in a quarter

"OXE achieved the highest ever propulsion sales in a quarter as well as highest ever total sales for the first quarter. It was also the best operating result for a quarter in the company's history which is a positive signal that things are moving in the right direction. Despite the improvement, we are not fully satisfied with the result and have full focus on achieving profitability."

It was a strong start to the year, with OXE receiving the largest order in the company's history, USD 6.6 m to supply a U.S. Governmental agency. In addition, it is also the strongest Q1 in the company's history, where Q1 has traditionally been the slowest quarter of the year. Total sales amounted to SEK 50.5 m (SEK 39.2), marking the highest level of propulsion sales in a quarter and an increase of 29% relative to the same quarter of the previous year.

OXE's wholly owned subsidiary in the US, OXE Marine INC, achieved profitability at the bottom line during the quarter. It is pleasing to see the positive contribution to the group as a result of the merger in 2022. OXE's local presence in the US is an advantage to the company.

Business Performance

During the quarter, sales of propulsion reached SEK 41.5 m (SEK 25.1 m), representing a 65% increase compared to the same quarter of the previous year. A large portion of this growth is attributable to the delivery of OXE200 inboard engines.

Sales of Parts & Accessories (P&A) amounted to SEK 9.0 m (SEK 14.2 m). Despite the decrease we still see a consistent inflow of spare parts orders for engines in operation.

Gross margin for the quarter improved to 34% (27%), a clear increase compared to both the same quarter of the previous year, Q1 2024 and the previous quarter, Q4 2024. As stated in the Q4 2024 report, excluding the increase in provisions, gross margin would have amounted to 34%. We are therefore pleased to see the consistent margin improvement in the underlying business. The improvement in margin is driven by a greater proportion of direct to OEM sales and a reduction in warranty costs.

Operating expenses (OPEX) for the quarter amounted to SEK 21.9 m (SEK 28.0 m). We were pleased with this improvement which is below our targeted maximum of SEK 25 m a quarter. The reduction is a combination of a stronger SEK/USD as well as a reflection of underlying efforts to enhance profitability through disciplined cost control across the board.

Cash flow from operating activities before changes in working capital was SEK -8.6 m (SEK -16.9 m). The quarter closed with SEK 15.2 m (SEK 15.6 m) in cash. Since the beginning of the year, significant capital has been allocated to strengthen inventory levels in order to improve operational efficiency. Cash flow attributable to changes in working capital amounted to SEK -18.3 m (SEK 2.6). The main changes were as a result of increases in accounts receivable which is mainly due to a delivery of one large order during the quarter which falls due in Q2. In addition, there was an increase in inventory which was done intentionally to improve operational efficiency and gear up for growth as well as reducing freight costs.

US Tariffs

The tariffs in the US will have an impact on the business in the long term with the current 10% blanket tariff on EU imports to the US. In the short term, we have moved as much finished goods as possible to the US ahead of the anticipated larger tariff increases and having a US facility is certainly advantageous under these circumstances. Management continues to follow the developments in tariff changes and will attempt to mitigate the risks as much as possible. The inboard business in the US is largely unaffected as the engines are assembled in the US and the majority of components are already physically located in the US. The outboard business is what is mostly impacted, being assembled in Poland and will be factored into future business quoted in the US as far as possible.

Looking Ahead

Our two main focus areas are achieving profitability and growing sales. The company has increased selected marketing activities during the year and will continue to work on larger projects.

Thank you to the dedicated team at OXE, who in addition to being passionate about the product and company have worked diligently in improving the overall development and performance of the company.

- Paul Frick, CEO

The Interim report is available for download at: https://www.oxemarine.com/investors/financial-reports

For further information, please contact:

Paul Frick, CEO, OXE Marine AB, paul.frick@oxemarine.com, +46 (0) 703 25 06 20

Jonas Wikström, Chairman of the Board, OXE Marine AB jonas.wikstrom@oxemarine.com, +46 (0) 70 753 65 66

About OXE Marine

OXE Marine AB (publ) is the company behind the world's first high performance diesel outboard. The company's unique and patented solutions for high torque transmission between powerhead and lower leg has led to a global high demand for the company's outboards. Enabling improved performance and fuel efficiency in an outboard, OXE Marine redefines possibilities in the marine sector.

OXE Marine AB (publ) is listed on the NASDAQ First North Growth Market (STO: OXE). Redeye AB is the Company's Certified Adviser.

This information is information that OXE Marine is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-04-29 07:00 CEST.