Original-Research: Villeroy & Boch AG - from Quirin Privatbank Kapitalmarktgeschäft

Classification of Quirin Privatbank Kapitalmarktgeschäft to Villeroy & Boch AG

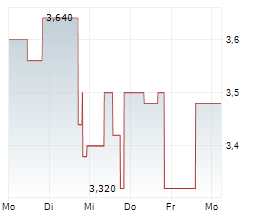

9M 2025: Despite no tailwind from the macro side, stable development In 9M-25 period, Villeroy & Boch generated consolidated sales of EUR 1,075.2m, which was EUR 67.4m or 6.7% higher than in the previous year due to acquisitions. As a result of the Ideal Standard acquisition and the increase in the internationalization of the Villeroy & Boch group, the company achieved strong revenue growth of 10.6% to EUR 92.1m, particularly in EMEA (Europe, Middle East, Africa). Villeroy & Boch achieved this primarily in Western Europe (+ EUR 29.9m/+11.3% yoy) and Southern Europe (+EUR 26.8m/+26.1% yoy). In the 9M-25 period, the company achieved an operating EBIT of EUR 65.1m, thus slightly above the previous year (EUR 64.5m) by 0.9% yoy. The reported EBIT at EUR 40.6m was considerably above the previous year, which closed with EUR 23.4m). Our updated sum-of-the-parts valuation approach confirms our EUR 34.50 TP, and the recommendation remains Buy. You can download the research here: VILLEROY20251027 For additional information visit our website: https://research.quirinprivatbank.de/ Contact for questions: Quirin Privatbank AG Institutionelles Research Schillerstraße 20 60313 Frankfurt am Main research@quirinprivatbank.de https://research.quirinprivatbank.de/ The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. | ||||||||||||||||||

2219050 27.10.2025 CET/CEST

© 2025 EQS Group