Stable Consolidated Revenue and Maintained Group Profitability

Sustained Growth Momentum in the Aeronautics Sector Up 22%

Progress in Aeronautics and Optical Communications Affected by the Downturn in the Medical Sector

Ramp-up of Sales Derived From the "Engine Control" Program"

Solid Outlook Supported by a Sustainable and Profitable Industrial Model

Investor Conference Call

Tuesday, October 28, 2025 at 6:00 pm

(Non-audited data)

- Quarterly consolidated revenue at EUR 2,622 trdusand (vs. EUR 2,626 thousand in Q3 2024)

- Strong growth in the Aeronautics segment, driven by the development of the "Engine Control" program and its derivative products

- Sharp decline in Medical activities offset by the sustained momentum in the Aeronautics and Optical Communications segments

- Quarterly adjusted EBITDA1 of EUR 346 thousand for the quarter (13.2% of revenue) and EUR 1,084 thousand over nine months (12.4% of revenue)

- Quarterly operating profit of EUR 151 thousand for the quarter (5.7% of revenue) and EUR 684 thousand over nine months (7.8% of revenue)

- Group's net profit of EUR 176 thousand for the quarter (6.7% of revenue) and EUR 539 thousand over nine months (6.2% of revenue)

- Solid outlook, supported by the ongoing development of the "Engine Control" activities and their derivative applications

- Investor conference call: Tuesday, October 28, 2025 at 6:00 PM

Registration link: https://app.livestorm.co/euroland-corporate/memscap-webinaire-actionnaires-resultats-t3-2025

Regulatory News:

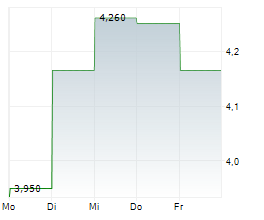

MEMSCAP (Euronext Paris: MEMS), leading provider of high-accuracy, high-stability pressure sensor solutions for the aerospace and medical markets using MEMS technology (Micro Electro Mechanical Systems), today announced its earnings for the third quarter of 2025 ending September 30, 2025.

Analysis of consolidated revenue

During the third quarter of 2025, MEMSCAP's consolidated revenue from continuing operations (non-audited) amounted to EUR 2,622 thousand, compared to EUR 2.626 thousand recorded in the third quarter of 2024. While overall revenue remained stable year-on-year, performance varied across the Group's business segments. The breakdown of consolidated revenue from continuing operations by business segment for the third quarter of 2025 and the first nine months of fiscal year 2025 is presented below:

Market segments Revenue

| Q3 2024

| Q3 2024

| Jan.-Sept. 2024 (9 months) | Jan.-Sept.

| Q3 2025

| Q3 2025

| Jan.-Sept. 2025 (9 months) | Jan.-Sept.

|

Aerospace | 1,569 | 60% | 6,468 | 65% | 1,912 | 73% | 6,640 | 76% |

Medical | 769 | 29% | 2,432 | 25% | 297 | 11% | 955 | 11% |

Optical communications | 273 | 10% | 940 | 9% | 393 | 15% | 1 110 | 13% |

Others (Royalties from licensed trademarks) | 16 | 1% | 61 | 1% | 20 | 1% | 60 | 1% |

Total revenue from continuing operations | 2,626 | 100% | 9,901 | 100% | 2,622 | 100% | 8,766 | 100% |

(Any apparent discrepancies in totals are due to rounding.)

The Aeronautics segment continued its strong growth momentum, representing 73% of quarterly revenue, compared to 60% in the third quarter of 2024. With revenue of EUR 1,912 thousand, up 22% year-on-year, this segment benefited from the strengthening of both civil and military aeronautics programs, as well as the ramp-up in sales derived from the "Engine Control" program and its related products. Over the first nine months of fiscal year 2025, Aeronautics sales reached EUR 6,640 thousand, up 3% compared to the same period in 2024, confirming its position as the Group's main growth driver.

The Medical segment recorded revenue of EUR 297 thousand in the third quarter of 2025, compared to EUR 769 thousand in the third quarter of 2024, representing a 61% decline. As indicated in previous publications, this decrease reflects a temporary reduction in orders from two major long-standing customers. Over the first nine months of 2025, the Medical segment generated EUR 955 thousand, down sharply from EUR 2,432 thousand in the same period of 2024.

The Optical Communications segment posted a solid increase of 44% during the quarter, with revenue of EUR 393 thousand compared to EUR 273 thousand in the third quarter of 2024. This performance reflects the gradual recovery in demand for Variable Optical Attenuators (VOA), supported by renewed investment in telecommunications infrastructure in Asian markets. Over the first nine months of 2025, this segment reached EUR 1,110 thousand, up 18% compared to 2024.

Finally, royalties from brand licenses amounted to EUR 20 thousand for the quarter, in line with the level recorded in the third quarter of 2024.

Overall, the Group's revenue structure continues to evolve favourably toward its high value-added strategic segments, particularly Aeronautics, which now represents nearly three-quarters of total activity.

Analysis of consolidated income statement

MEMSCAP's consolidated earnings for the third quarter of 2025 and the first 9 months of 2025 are given within the following table:

In thousands of euros Non-audited | Q3 2024

| Jan.-Sept. 2024

| Q3 2025

| Jan.-Sept. 2025

|

Revenue from continuing operations | 2,626 | 9,901 | 2,622 | 8,766 |

Cost of revenue | (1,489) | (5,828) | (1 562) | (5,139) |

Gross margin | 1,138 | 4,073 | 1,060 | 3,626 |

% of revenue | 43.3% | 41.1% | 40.4% | 41.4% |

Operating expenses | (927) | (2,965) | (909) | (2,942) |

Operating profit (loss) | 210 | 1,109 | 151 | 684 |

Financial profit (loss) | (27) | 84 | 26 | (139) |

Income tax expense | (6) | (23) | 0 | (6) |

Net profit (loss) | 178 | 1,170 | 176 | 539 |

* Net of research development grants.

(Any apparent discrepancies in totals are due to rounding.)

The gross margin for the quarter amounted to EUR 1,060 thousand, representing 40.4% of revenue, compared to EUR 1,138 thousand and 43.3% in the third quarter of 2024. For the first nine months of fiscal year 2025, the gross margin stood at EUR 3,626 thousand, or 41.4% of revenue, slightly up from 41.1% over the same period in 2024, reflecting effective control of industrial costs in a context marked by lower sales volumes in the Medical segment.

Operating expenses (net of research grants and excluding cost of sales) amounted to EUR 909 thousand for the quarter, slightly down from EUR 927 thousand in the third quarter of 2024. This evolution reflects tight control over structural costs, while maintaining continued investment efforts in the Group's strategic development projects.

As a result, operating profit amounted to EUR 151 thousand (5.7% of consolidated revenue) compared to EUR 210 thousand in the third quarter of 2024 (8.0% of consolidated revenue). Over the first nine months of 2025, operating profit totalled EUR 684 thousand (7.8% of consolidated revenue), down from EUR 1,109 thousand (11.2% of consolidated revenue) for the same period in 2024, reflecting the decline in Medical segment revenue and the portfolio transition toward Aeronautics activities.

The financial result for the quarter was positive at EUR 26 thousand, compared with a loss of EUR 27 thousand in the third quarter of 2024. Over nine months, the financial result showed a loss of EUR 139 thousand, compared with a gain of EUR 84 thousand in 2024, mainly due to continued volatility in exchange rates. The recorded tax charge corresponds to the variation of a deferred tax asset and has no impact on the Group's cash position.

The consolidated net profit for the quarter amounted to EUR 176 thousand (6.7% of consolidated revenue), a level similar to that achieved in the third quarter of 2024. For the first nine months of 2025, the Group's net profit reached EUR 539 thousand (6.2% of consolidated revenue) compared to EUR 1,170 thousand for the first nine months of 2024 (11.8% of consolidated revenue).

MEMSCAP reported a positive adjusted EBITDA1 of EUR 346 thousand in the third quarter of 2025 (13.2% of consolidated revenue) and EUR 1,084 thousand over the first nine months of 2025 (12.4% of consolidated revenue) compared to EUR 369 thousand for the third quarter of 2024 and EUR 1,778 thousand for the first nine months of 2024 (18.0% of consolidated revenue). It should be noted that R&D expenses were fully expensed during this nine-month period, with no capitalization recognized in the Group's balance sheet.

1 Adjusted EBITDA means operating profit before depreciation, amortisation, and share-based payment charge (IFRS 2) and including foreign exchange gains/losses related to ordinary activities.

This performance confirms the operational resilience of MEMSCAP's business model, despite a mixed environment across segments, and illustrates the financial strength of the Group, supported by its high value-added Aeronautics activities.

Perspectives

In an environment marked by caution and macroeconomic disruptions, MEMSCAP's corporate vision remains firmly focused on achieving profitable growth, leveraging its key strengths, solid technological barriers, and a sustainable business model. The aeronautics business is becoming the key driver of the Group's performance and profitability. In particular, the development of "Engine Control" activities and their derivatives supports these ambitions for the coming years, while the Group continues to strengthen its operational and financial performance.

Shareholders and investors video conference Tuesday, October 28, 2025, at 6:00 PM

Registration link: https://app.livestorm.co/euroland-corporate/memscap-webinaire-actionnaires-resultats-t3-2025

You may submit your questions in advance at: https://memscap.com/en/visio/

Q4 2025 revenue and earnings: January 27, 2026.

About MEMSCAP

MEMSCAP is a leading provider of MEMS based pressure sensors, best-in-class in term of precision and stability (very low drift) for two market segments: aerospace and medical.

MEMSCAP also provides variable optical attenuators (VOA) for the optical communications market.

For more information,

visit our website at:

www.memscap.com

MEMSCAP is listed on Euronext Paris (Euronext Paris Memscap

- ISIN code: FR0010298620 Ticker symbol: MEMS)

View source version on businesswire.com: https://www.businesswire.com/news/home/20251027845465/en/

Contacts:

Yann Cousinet

Chief Financial Officer

Ph.: +33 (0) 4 76 92 85 00

yann.cousinet@memscap.com