The report is available as an online version and as a PDF.

"Strong revenue growth, record gross margin and continued progress toward cash-flow positive operations." - Adam Philpott, CEO

Highlights

- Revenue increased by 47 percent in constant currency terms compared to Q3 2024.

- Gross margin reached 68.6 percent in Q3 2025, supported by a favorable mix.

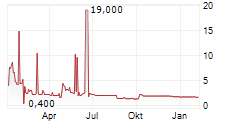

- On October 3, FPC announced its third IP monetization and licensing transaction in 11 months - a new PixArt Imaging Inc. deal worth SEK 19 million upfront, plus royalty potential, with payment due in Q4 2025.

Third quarter of 2025

- Revenues amounted to SEK 20.4 M (15.2)

- The gross margin was 68.6 percent (56.3)

- EBITDA amounted to negative SEK 9.8 M (neg: 40.8)

- Adjusted EBITDA amounted to negative SEK 9.8 M (neg: 40.8)

- The operating result was negative SEK 18.8 M (neg: 246.6)

- Earnings per share before and after dilution amounted to negative SEK 0.42 (neg: 192.15) **

- Cash flow from operating activities was negative SEK 2.0 M* (neg: 25.2), including a positive SEK 6.6 M attributable to discontinued operations

January - September 2025

- Revenues amounted to SEK 54.4 M (35.6)

- The gross margin was 58.7 percent (57.4)

- EBITDA amounted to negative SEK 19.5 M (neg: 154.2)

- Adjusted EBITDA amounted to negative SEK 19.5 M (neg: 154.2)

- The operating result was negative SEK 49.6 M (neg: 383.1)

- Earnings per share before and after dilution amounted to negative SEK 5.04 (neg: 339.27) **

- Cash flow from operating activities was negative SEK 56.7 M* (neg: 162.0), including a negative SEK 15.2 M attributable to discontinued operations

* Including discontinued operations.

** Adjusted to reflect the reverse share split completed in September 2025.

CEO's comments

Strong revenue growth, record gross margin and continued progress toward cash-flow positive operations

Our transformation continues to deliver tangible results. In the third quarter, revenue increased by 35 percent (47 percent in constant currency) to SEK 20.4 million, reflecting strong performance across all revenue streams. Gross margin reached 69 percent, supported by a favorable mix that included SEK 4.8 million in license income from Egis Technology. Excluding that effect, margin was approximately 58 percent, confirming a structurally higher profitability level across the business.

With a lean cost base and disciplined execution, we continued to improve our financial metrics. EBITDA and operating cash flow both improved year-on-year and sequentially, keeping us firmly on the path toward positive EBITDA and cash-flow. Operating cash flow improved to SEK -2.0 million (-25.2), another critical step forward. Our balance sheet remains robust, with SEK 28.3 million in cash at the end of the third quarter. Liquidity will be further reinforced in the fourth quarter as the SEK 19 million upfront payment from our PixArt licensing agreement is received, adding financial flexibility to support growth initiatives.

Monetization driving scalable growth

Early in my tenure I made a commitment to diversify our revenue streams. Licensing and technology monetization are now key components of our business model, complementing product sales.

First, we have successfully monetized legacy assets, such as the Mobile and PC-related assets licensed to Egis - turning non-core technologies into high-margin revenue.

Looking ahead, we are also building multiple pricing models that enable us to create value from our active assets and capabilities:

- Active assets - like our iris recognition technology, licensed to Smart Eye, which remains part of our ongoing innovation platform while generating additional value through external use.

- Capabilities - our engineering, algorithmic and software know-how that can be leveraged in collaborative sensor and system development with other companies.

- Royalties and future revenue - partnerships with high-volume producers where FPC contributes IP and expertise in markets where we choose not to compete directly.

Together, these monetization channels create a scalable and capital-light growth engine. They enable us to capture the full value of our capabilities and assets while reinforcing relationships with industry partners. A recent example is our PixArt licensing agreement, announced in October, worth approximately SEK 19 million (USD 2.0 million) plus future royalty potential. The PixArt deal follows the Egis Technology agreement signed in August, covering PC-related assets valued at approximately SEK 24 million (USD 2.5 million), with additional royalties linked to Egis's shipment volumes to PC OEMs.

Core revenue growth

Sales of our AllKey family of products gained momentum in the quarter, reflecting customer adoption of our most integrated biometric system to date, and illustrating our shift from sensors to higher-value systems. Built for speed, security, and simplicity, AllKey integrates the sensor, processor, software, and memory into a single compact module, enabling device makers to add high-performance biometric authentication with minimal effort or prior expertise.

AllKey is a strong example of how value creation benefits both FPC and our customers. The platform enables customers to reduce development effort, integration cost, and system complexity, while FPC captures higher average selling prices and wallet share through the delivery of complete biometric systems rather than individual components. Customer feedback has been highly positive, especially highlighting ease of integration, reliability and lower total cost. The transition of existing customers to the AllKey platform is increasing average selling prices by roughly three times compared with legacy components. The pipeline for AllKey continues to grow, positioning it as a scalable platform for long-term revenue growth and a cornerstone of our strategy in secure authentication.

Expanding reach through new growth initiatives

Our collaboration with Anonybit continues to gain traction. In October, we jointly launched our privacy-preserving biometric authentication solution on the Microsoft Entra Marketplace, part of Microsoft's unified identity and access management platform used by more than 700,000 organizations worldwide. This milestone makes our joint biometric solution available through Microsoft Entra, enabling rapid, passwordless deployment. It further illustrates how our collaboration with Anonybit is helping enterprises enhance and unify their identity strategy. By eliminating passwords, the solution helps enterprises reduce account takeover risks, lower IT costs, and improve user experience while ensuring privacy and regulatory compliance. It represents a major step forward in our ambition to make secure, privacy-first identity available everywhere it matters.

Turning now to adoption, we have expanded our go-to-market capacity, adding two dedicated sellers in the United States focused on enterprise engagements. Together with AI-driven marketing and lead-generation engines, these initiatives are enhancing our commercial reach and building a growing pipeline of enterprise opportunities.

Business modernization

We remain focused on modernizing our operations to drive productivity and scalability across the organization, growing the topline without increasing operating expenses. Our AI-driven agentic marketing and lead-generation engine is enhancing sales efficiency and customer targeting, while AI-enabled coding tools in Engineering shorten development cycles and improve quality. Across Business Services, automation and data-driven workflows are streamlining operations. These initiatives collectively strengthen our ability to scale revenue without adding cost and support sustainable margin expansion.

Next phase of growth

We have continued to improve our operating cash flow and remain laser-focused on closing the gap to positive EBITDA and cash generation. While quarterly development can be somewhat cyclical, reflecting the timing of licensing income and customer projects, our cost discipline and high-margin business model provide a strong foundation for sustainable profitability. At the same time, we are investing selectively to drive long-term growth, particularly in the fast-growing cybersecurity and identity market, a USD 120 billion segment expanding at over 20 percent annually. This is a highly fragmented market with many smaller players, and we see opportunities to unify technologies and ecosystems - whether through deeper partnerships or other forms of collaboration - to create a more integrated and scalable platform for secure, privacy-first digital identity. I believe that FPC can play a unifying role in the identity ecosystem, bringing technologies and partners together to deliver integrated solutions and capture higher value from each customer.

Adam Philpott, CEO

Today at 09:00 CET, Fingerprints' CEO Adam Philpott will present the report together with CFO Fredrik Hedlund in a combined webcast and telephone conference. The presentation will be held in English.

The report will be available at fpc.com

The presentation will be webcast, and participants can register via this link: https://edge.media-server.com/mmc/p/hzh2fwjv

For media and analysts: Registration for the teleconference is carried out via this link: https://register-conf.media-server.com/register/BI51971390830540659bcb81c7e6a151d9

For information, please contact:

Adam Philpott, CEO

Investor Relations:

+46(0)10-172 00 10

investrel@fpc.com

Press:

+46(0)10-172 00 10

press@fpc.com

About FPC

Fingerprint Cards AB (FPC) is a global biometrics leader, offering intelligent edge to cloud biometrics. We envision a secure, seamless world where you are the key to everything. Our solutions - trusted by enterprises, fintechs, and OEMs - power hundreds of millions of products, enabling billions of secure, convenient authentications daily across devices, cards, and digital platforms. From consumer electronics to cybersecurity and enterprise, our cloud-based identity management platforms support multiple biometric modalities, including fingerprints, iris, facial, and more. With improved security and user experience, we are driving the world to passwordless. Discover more at our website and follow us on LinkedIn and X for the latest updates. FPC is listed on Nasdaq Stockholm (FING B).

This information is information that Fingerprint Cards AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-10-28 07:00 CET.