FINANCIAL REPORT Q1-Q3 2025 [January 1st - September 30th, 2025]

The report has not been audited.

Copenhagen October 28th, 2025

Q3 2025 HIGHLIGHTS

- Extraordinary General Meeting held with new Chairman of the Board of Directors, Kim Mikkelsen, appointed and with further appointment of Dansk Revision as auditor.

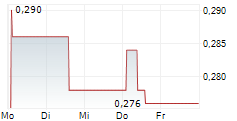

- ABG Sundal Collier was appointed as liquidity provider for Nexcom A/S' shares traded on Nasdaq First North Copenhagen.

- A capital increase carried through in August 2025 has been successfully completed and resulted in new shares issued at a share price of DKK 2.53 of an amount of MDKK 5.9 based on both conversion of debt and cash injection, increasing the amount of shares from 22.6m to 25.0m.

- Revenue Growth: Q1-Q3 2025 revenue increased by 9%, to MDKK 6.2 from MDKK 5.7 last year, primarily driven by an increase in the annual recurring revenue.

- Staff costs in Q1-Q3 increased by MDKK 1.5 due to the team additions previously announced with the aim of improving the operation and strengthening the organization. These improvements will result in a lower cost base and therefore cost reductions in the future.

- Other external costs in Q1-Q3 2025 went up from MDKK 4.8 last year to MDKK 5.5, mainly driven by one-offs in recruitment and consultancy costs.

- EBITDA in Q1-Q3 2025 decreased by MDKK 1.7 from MDKK -5.4 last year to MDKK -7.1, mainly due to the organizational changes mentioned above.

- Customer retention: A single business unit in a global agreement has decided to discontinue our services, impacting ARR negatively.

- VIBE successfully launched across partner networks in Q3 2025.

EVENTS AFTER THE REPORTING PERIOD

- Adjusted guidance for 2025: Expected revenue between MDKK 8 and MDKK 11 and EBITDA between MDKK -9 and MDKK -6.

- Contract for taxi booking VIBE entered with Hreyfill on Iceland.

DISCLAIMER

This report contains forward-looking statements based on management's current expectations. All statements about the future are subject to inherent risks and uncertainties, and many factors can lead to actual results and developments that differ materially from those expressed or implied in such statements.

FURTHER INFORMATION

Rolf Adamson | CEO

Phone: +45 4576 4820

E-mail: press@nexcomglobal.com

COMPANY

Nexcom A/S

Toldbodgade 59B, K9

1253 København K

Tlf. +45 4576 4820

www.nexcomglobal.com

CERTIFIED ADVISOR

Kapital Partner A/S

Ewaldsgade 9

2200 København N

Tlf. + 45 8988 7846

www.kapitalpartner.dk

INCOME STATEMENT Q1-Q3 2024 [January 1st - September 30th, 2025]

The report has not been audited.

| TDKK | Q1-Q3 2024 | Q1-Q3 2025 |

| Revenue | 5,687 | 6,195 |

| TOTAL REVENUE | 5,687 | 6,195 |

| Personnel | 6,329 | 7,820 |

| Other external costs | 4,779 | 5,454 |

| EBITDA | -5,421 | -7,079 |

| Depreciation | 2,846 | 2,285 |

| EBIT | -8,267 | -9,364 |

| Financial expenses | 9,101 | 4,295 |

| PROFIT/LOSS BEFORE TAX | -17,368 | -13,659 |

| Tax | 0 | -15 |

| PROFIT/LOSS AFTER TAX | -17,368 | -13,674 |

| Number of employees | 12 |

| Outstanding shares | 24,968,329 |

| Earnings per share (DKK) | -0.55 |

CASHFLOW STATEMENT Q1-Q3 2025 [January 1st - September 30th, 2025]

The report has not been audited.

| TDKK | Q1-Q3 2024 | Q1-Q3 2025 |

| Profit/loss before financial items and tax (EBIT) | -8,267 | -9,364 |

| Depreciation and amortization | 2,846 | 2,285 |

| Adjustment for other non-cash items | -645 | 485 |

| CASH FLOW FROM PRIMARY ACTIVITIES | -6,067 | -6,594 |

| Financial income received | -3 | 7 |

| Financial costs paid | -366 | -403 |

| Other operating effects | 0 | 1,217 |

| Income taxes paid/received | 0 | 0 |

| CASH FLOW FROM OPERATION ACTIVITIES | -6,435 | -5,773 |

| Payments for intangible assets | -699 | -841 |

| CASH FLOW FROM INVESTING ACTIVITIES | -699 | -841 |

| Proceeds from capital increase | 2,300 | 5,909 |

| Proceeds from loans | 6,028 | 1,700 |

| Repayment of loans | -915 | -896 |

| CASH FLOW FROM FINANCING ACTIVITIES | 7,412 | 6,713 |

| NET CASH FLOW FOR THE PERIOD | 278 | 99 |

| TDKK | Q1-Q3 2024 | Q1-Q3 2025 |

| Cash and cash equivalents at the beginning of the year | -105 | -103 |

| Net cash flow for the year | 278 | 99 |

| Exchange rate adjustments on cash/cash equivalents | 0 | 0 |

| CASH AND CASH EQUIVALENTS AT THE END OF THE PERIOD | 173 | -4 |

BALANCE SHEET SUMMARY Q3 2025 [September 30th, 2025]

The report has not been audited.

| TDKK | Q3-2024 | Q3-2025 |

| ASSETS | ||

| Intangible assets | 12,762 | 10,064 |

| Material assets | 24 | 298 |

| Deposits | 50 | 52 |

| TOTAL NON-CURRENT ASSETS | 12,836 | 10,414 |

| TOTAL CURRENT ASSETS | 5,878 | 7,023 |

| TOTAL ASSETS | 18,714 | 17,437 |

| TDKK | Q3-2024 | Q3-2025 |

| EQUITY AND LIABILITIES | ||

| Share capital | 9,860 | 12,484 |

| Capital increase | 3,578 | 4,741 |

| Foreign currency translation reserve | 693 | 1,616 |

| Retained earnings | -20,791 | -19,080 |

| EQUITY | -6,660 | -239 |

| Long-term liabilities | 3,222 | 3,628 |

| Short-term liabilities | 16,886 | 9,588 |

| Other debt | 5,266 | 4,460 |

| LIABILITIES | 25,374 | 17,676 |

| TOTAL EQUITY AND LIABILITIES | 18,714 | 17,437 |

- The company's total assets amount to MDKK 17.4 as per September 30th, 2025.

EQUITY STATEMENT Q1-Q3 2025 [January1st - September 30th, 2025]

The report has not been audited.

| TDKK | Share Capital | Share premium | Reserve for foreign currency translation | Retained earnings | Equity |

| Equity January 1st, 2025 | 11,316 | - | -1,236 | -5,406 | 4,674 |

| Capital increase | 1,168 | 4,741 | - | - | 5,909 |

| Exchange rate adjustment | - | - | 2,852 | - | 2,852 |

| Profit/loss for the period | - | - | - | -13,674 | -13,674 |

| EQUITY SEPTEMBER 30th, 2025 | 12,484 | 4,741 | 1,616 | -19,080 | -239 |

- The company's equity totals MDKK -0.2 as per September 30th, 2025.

MANAGEMENT STATEMENT Q1-Q3 2025 [January 1st - September 30th, 2025]

The Board of Directors and Management have today considered and approved this interim financial report of Nexcom A/S. The interim financial report has not been audited or reviewed by the company's independent auditors.

The interim financial report for the first three quarters of 2025 has been prepared in accordance with the provision of the Danish Financial Statements Act for Accounting Class B with the option of certain principles for Accounting Class C and additional disclosure requirements for companies admitted to trading on Nasdaq First North Growth Market. The accounting policies adopted are consistent with those applied in the annual report 2024.

In our opinion the accounting policies applied are appropriate to the effect that the interim financial report gives a true and fair view of the company's assets, liabilities, cashflow and financial position on September 30th, 2025. Furthermore, in our opinion, the Management review gives a true and fair view of the development in the activities and the financial situation, the financial result for the period and the financial position of the company, Nexcom.

Risks and uncertainties have not changed in relation to the conditions mentioned in the company description prepared in connection with Nexcom share listing on Nasdaq First North Growth Market, Copenhagen.

Copenhagen October 28th, 2025

MANAGEMENT

Rolf Adamson

CEO

BOARD OF DIRECTORS

Kim Mikkelsen

Chairman

Charlotte Enlund

Christian Hein

Thomas Krogh Skou