Hillerstorp 29th of October 2025, 12:30 CET

JULY - SEPTEMBER

- Order intake in the quarter decreased by 6 percent compared with the same period last year and amounted to 62,2 (67,1) MEUR. Adjusted for currency and acquisitions the order intake decreased by 7 percent.

- Sales in the quarter decreased by 7 percent compared with the same period last year and amounted to 64,2 (69,0) MEUR. Adjusted for currency and acquisitions sales decreased by 6 percent.

- Operating profit before amortizations (EBITA) decreased to 10,3 (13,6) MEUR.

- Operating margin before amortizations (EBITA margin) decreased to 16,1 (19,7) percent.

- Financial net was -0,9 (-1,1) MEUR.

- Profit after tax decreased to 6,8 (8,9) MEUR.

- Adjusted earnings per share after dilution amounted to 0,12 (0,16) EUR.

- Earnings per share after dilution amounted to 0,11 (0,15) EUR.

JANUARY - SEPTEMBER

- Order intake in the period decreased by 6 percent compared with the same period last year and amounted to 197,0 (208,9) MEUR. Adjusted for currency and acquisitions the order intake decreased by 6 percent.

- Sales in the period decreased by 5 percent compared with the same period last year and amounted to 201,2 (211,8) MEUR. Adjusted for currency and acquisitions sales decreased by 5 percent.

- Operating profit before amortizations (EBITA) decreased to 29,7 (36,7) MEUR.

- Operating margin before amortizations (EBITA margin) decreased to 14,8 (17,3) percent.

- Financial net was -3,6 (-3,9) MEUR.

- Profit after tax decreased to 13,5 (23,1) MEUR.

- Adjusted earnings per share after dilution amounted to 0,33 (0,41) EUR.

- Earnings per share after dilution amounted to 0,23 (0,39) EUR.

- On 29 October 2025, a press release regarding new financial targets has been published, which can be accessed on Troax's website: www.troax.com.

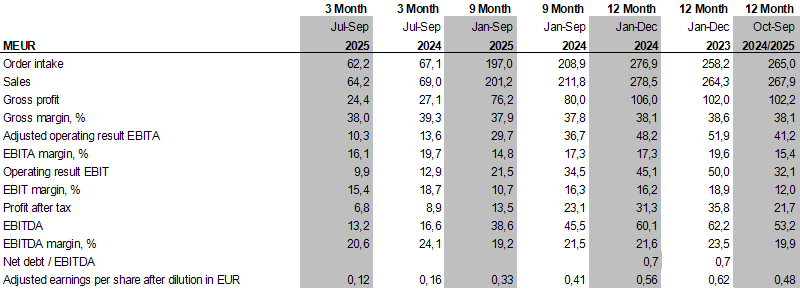

TROAX GROUP FIGURES

COMMENTS FROM THE PRESIDENT AND CEO

When summarizing the third quarter for 2025, I note that the uncertain global environment largely persisted from the second quarter, and that a recovery in the more mature markets has yet to take shape. Customers, particularly in North America, remain cautious in making major investment decisions. Demand in Europe also continued to develop weakly, while Asia maintained strong growth momentum. During the third quarter, however, we observed a modest increase in activity in parts of Central Europe and in specific segments such as automated warehousing and data centers. Despite the ongoing uncertainty, these signs give me reason for cautious optimism as we look ahead to 2026.

Within the Group, we have maintained a strong focus on developing and future-proofing our operations. As announced during the second quarter, we have worked diligently to optimize our factory footprint and product portfolio within the warehouse segment in Europe. By closing the facility in Poland and consolidating with the operations in Sweden, we will strengthen our competitiveness and gradually improve profitability.

In parallel with the efficiency measures in Europe, the factory investment in North America is progressing according to plan. This initiative aims to increase capacity and enhance cost efficiency by 2026. Our product portfolio review has continued, and as a result, we have divested our subsidiary Lagermix AB. Finally, we are continuing to develop our digital tools with the goal of improving both operational efficiency and customer experience.

These initiatives have led to one-off negative effects on profitability in the third quarter, partially offset by the cost-saving measures implemented in the second quarter. We look forward to completing these key projects and reaping the benefits starting in 2026.

Low volumes and transformation effects weigh on profitability

The demand environment remains subdued, and we report a total order intake decline of seven (7) percent, primarily driven by North America and Northern Europe. The quarter was particularly impacted by a one-off effect of approximately EUR 3 million, resulting from the temporary order intake halt associated with the closure and relocation of our Polish operations to Sweden. A clear highlight continues to be the order growth in the APAC region, where all relevant markets and segments grew again this quarter. In both Europe and North America, demand from the automotive industry was weaker than before, although this was partially offset by slightly stronger momentum in the warehouse segment. As in previous quarters, demand in the construction segment remained weak. Invoicing closely followed the order intake from the previous quarter, resulting in a six (6) percent decline in sales for the quarter, excluding currency effects.

Despite the low volumes, our overall gross margin remained at an acceptable level. In Europe, we maintained price discipline, benefited from relatively low and stable material costs, and implemented factory adjustments to mitigate much of the under-absorption effects caused by lower volumes. In North America, however, we were not fully able to offset higher raw material costs and faced operational challenges. This combination, along with lower volumes, contributed to reduced profitability.

Thanks to the cost-saving measures implemented in the second quarter, our underlying selling and administrative expenses have started to decline. The workforce reduction was carried out with strategic priorities in mind, and necessary investments in customer experience, digitalization, and continued expansion into new markets and segments remain in place. In the short term, this means that our selling and administrative expenses are still too high relative to sales. These costs will largely remain during the fourth quarter but are expected to decrease going into 2026. I remain confident that these targeted initiatives will lead to both higher sales and improved sales efficiency over time.

While I am generally satisfied with how we have executed the cost-saving measures and structural projects within the Group, I must also acknowledge that our EBITA margin is not at the desired level (16.1% vs. 19.7% in Q3 2024). In addition to lower volumes, the main factors are the negative earnings impact of the Polish factory closure, and the delayed price adjustments in North America. The temporary impact from the Polish factory transfer project stems from ramping down deliveries quicker than reducing operational costs during the and accounts for just over 1 percentage point of EBITA. Although the pricing in the U.S. has now been adjusted for input cost increases, the negative earnings effects of about 1 percentage point of EBITA in the quarter, will partly remain through the fourth quarter.

In summary…

In the third quarter, headwinds persisted in Europe and North America, but we also saw early signs of gradually improving activity in key geographic markets and segments. Troax Group remains the largest player in our niche and the only global provider capable of meeting customer needs with a regional sales and supply chain setup that meets global standards.

Our decentralized organization is beginning to take shape, and we are making solid progress toward becoming an even faster and more attractive partner to our customers. When the market turns, we will be in a stronger position than ever to grow profitably and gain market share.

Martin Nyström, President and CEO

TEAMS WEBINAR

Invitation to presentation of the latest quarter result:

Martin Nyström, CEO, and Anders Eklöf, CFO, will present the results at a Teams webinar on the 29th of October 2025 at 13:00 CET. The conference will be held in English. For more information, please refer tohttps://www.troax.com/investors/press-releases/

For additional information, please contact:

Martin Nyström

President and CEO

martin.nystrom@troax.com

Tel: +46 370 828 31

Anders Eklöf

CFO

anders.eklof@troax.com

Tel +46 370 828 25

This information is information that Troax Group AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation 596/2014. The information was submitted for publication, through the agency of the contact person set out above, at 12:30 CET on the 29th of October 2025.

About Troax

Troax Group is the leading global supplier of indoor perimeter protection for manufacturing and warehousing environments.

Troax develops high quality and innovative safety solutions to protect people, property and processes.

Troax Group AB (publ), Reg. No. 556916-4030, is a global company with a strong sales force and efficient supply chain. With local presence we offer excellent customer service and quick deliveries. We are represented in 42 countries and employ roughly 1200 people. The Company's head office is located in Hillerstorp, Sweden and our sales amounted to 279 MEUR (2024)