Toronto, Ontario--(Newsfile Corp. - November 6, 2025) - Minera Alamos Inc. (TSXV: MAI) (OTCQX: MAIFF) ("Minera Alamos" or the "Company") is pleased to announce an update on the development plans underway for its 100% owned Copperstone Mine gold project ("Copperstone Mine" or the "Project") located in Western Arizona, along the Walker Lane Belt near the town of Quartzsite. With final amendments to the existing Mine Plan of Operations ("MPO") submitted in final form in July 2025 and with approvals expected before year end, the Company is concurrently preparing an updated technical study that would allow for a positive Board decision for a full restart of the Copperstone project.

Highlights:

The current NI 43-101 compliant technical report - Preliminary Economic Assessment*1 ("PEA") demonstrates robust project economics, with an after-tax Net Present Value (NPV) of US$66 million at a gold price of US$1,800/oz and over US$200 million at US$2,800/oz. The after-tax Internal Rate of Return (IRR) ranges from 53.6% to 152.7% across these pricing scenarios.

The underground mining Resource Estimate*1 for the Copperstone project (US$1,800/oz gold price) contains 300,000 ounces of Measured and Indicated gold resources (1.2 Mt at 7.7 g/t) and an additional 197,000 oz of Inferred gold resources (0.97 Mt at 6.3 g/t).

Engineering activities have been ramped up to optimize plans for the mine restart and process plant installation. An updated technical study is planned for release in the first half of 2026 to demonstrate the positive impact of these efforts which, when combined with the current elevated gold prices, will allow the Board of Directors to make a production decision soon after.

Under the authorization of the existing permits, site development activities can be initiated in parallel with the pending MPO amendment to "fast-track" the project restart. An inexpensive transfer of existing process plant equipment currently owned by the Company to the Copperstone site is underway and is expected to be largely complete prior to year end 2025 so work can begin on its refurbishment and installation.

An extensive review of existing exploration data has concluded that the gold mineralization at the Copperstone project appears to be typical of an iron oxide-copper-gold (IOCG) deposit hosted by a shallow dipping thrust fault zone. The implications of the new geological interpretation and evaluation are that the mineralized underground mining zones drilled previously may continue to depths significantly beyond what was previously mined. Further, potential shallow, open pit accessible gold mineralization also occurs in areas that outcrop immediately adjacent to the historic open pit operations which is reported to have produced over 500,000 ounces of gold from the late 1980s through the early 1990s.

*1 "National Instrument 43-101 Technical Report: Preliminary Economic Assessment for the Copperstone Project, La Paz County, Arizona, USA" with an effective date of February 6, 2025.

Darren Koningen, CEO of Minera Alamos commented: "The impact of current gold prices on the overall economics of the Copperstone mine cannot be overstated. While the Company awaits the receipt of the final approvals for the Copperstone project our technical teams have been extremely busy planning for the fast-track restart of operations while gaining a better understanding of the significant resource upside potential for the entire project area. The Company is concurrently preparing an updated technical report to quantify these impacts on the overall restart plans while also ensuring that the rebuilt processing facilities incorporate maximum operating flexibility to accommodate future growth for the project. Combining this work with the new geological insights offers an exciting opportunity for the Copperstone mine to significantly increase the Company's gold production and free cash flow profile well beyond the previously published PEA expectations."

Permitting

The final version of the Mine Plan of Operations ("MPO") amendment for the Copperstone project has been submitted to meet the requirements of Title 43, Subpart 3809 of the United States Code of Federal Regulations, as administered by the U.S. Bureau of Land Management ("BLM"). This application represents the primary permitting milestone for a restart of operations at the site and is expected to be received prior to YE-2025. While awaiting its receipt a number of other minor amendments to other existing site permits are also being prepared. This includes:

An update to Aquifer Protection Permit (APP) which is expected to be submitted shortly, followed by an amendment to Air Quality Control Permit under the Title V Class I air quality permit program.

A minor revision to the reclamation plan, reflecting modest changes to the process plant infrastructure, is anticipated to be completed in the second half of the year, with final approval of the closure plan expected by the end of the year.

Around the end of 2025, the Company is expected to have secured all required permit amendments for the Copperstone project to support a planned restart of gold mining operations in 2026.

Engineering and Development Activities

Management has identified several opportunities to enhance the value of the Copperstone project that will be evaluated during the current development phase. The Company is considering various engineering, procurement, construction, and management approaches, including hybrid models that maximize the use of internal expertise to ensure an efficient and cost-effective transition from development to mining operations. Additional opportunities include:

Mining - Evaluate whether gold mineralization previously determined to be lower-grade material can now be included in the updated mine plan under current economic conditions and if access costs are minimized by pre-developed stopes. Additional efforts will focus on optimizing mine design, including access points, ventilation raises, and adjustments to stope heights and widths.

Process Plant - Assess opportunities to ensure excess capacity exists within the new plant facilities so that future increases in plant throughput are possible in line with higher mining rates and potential resource expansion. Additional metallurgical studies are to be completed to maximize process flexibility assuming additional resource zones will ultimately be added to the mine plan.

Used Equipment - Finalize engineering details in order to maximize the use of used equipment to reduce capital costs and lead times, including equipment already owned by the Company.

Exploration Activities

A recent review of the Copperstone gold project was completed by the Company and comprised inspections of available drill core along with field investigations of the gold mineralization as exposed in the open pit and underground workings. The main results of this program are summarized below.

The gold and subsidiary copper mineralization is confirmed to be hosted by a shallowly northeast-dipping fault zone, which is suspected to be a thrust rather than an extensional listric normal fault as traditionally assumed.

The gold mineralization occurs with stockworks of specular hematite partly transformed to magnetite, an association typical of iron oxide-copper-gold (IOCG) deposits. An IOCG affiliation implies that gold mineralization could be developed over a large vertical extent rather than being confined to a shallow, near-surface interval as would be dictated by an epithermal interpretation (historical deposit interpretation).

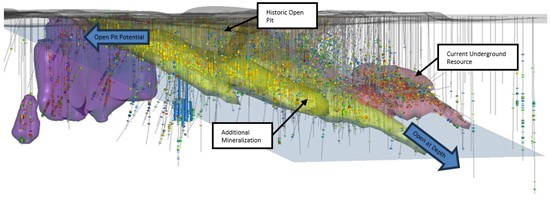

The current underground mining resource area appears to be open both along strike and at depth (see Figure 1 below).

Potential shallow open-pit, lower-grade gold mineralization occurs close to the current pit limits, especially to the southeast.

The Copperstone deposit appears to be hosted by one of a stacked series of faults, with others inferred from previous drilling to occupy a footwall position farther southwest. Shallow, up-dip parts of these gold-mineralized footwall structures may be followed and drill defined to develop additional open-pit resource potential.

Figure 1. Copperstone drillhole identified mineralization (looking NNW)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4183/273398_minera%20alamos%201.jpg

A Phase 1 drill program is currently being finalized for the Copperstone project. The program is expected to begin in Q1, 2026 and will initially focus on shallow mineralization adjacent to the current historic open pit and areas along strike and at depth of the currently outlined underground resources. While this work program is underway the Company's exploration team will also be evaluating the potential of new mineralized structures outside of the current area which had previously been identified by historic exploration drill programs.

PEA Cautionary Note

Readers are cautioned that the PEA is preliminary in nature and includes inferred resources that are considered too speculative to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA results will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability. Additional work is needed to upgrade these mineral resources to mineral reserves.

Qualified Person

Mr. Darren Koningen, P. Eng., Minera Alamos' CEO, is the Qualified Person responsible for the technical content of this press release under National Instrument 43-101.

About Minera Alamos

Minera Alamos is a gold production and development Company. The Company owns and operates the Pan heap leach gold mine in Nevada and owns two development projects near the Pan mine. The Company also owns the Copperstone mine and associated infrastructure in La Paz Country, Arizona, an advanced development asset with a permitted plan of operations that can be developed in parallel with planned project advancements in Mexico. The Company maintains a portfolio of high-quality Mexican assets, including the 100%-owned Santana open-pit, heap-leach mine in Sonora. The 100%-owned Cerro de Oro oxide gold project in northern Zacatecas has considerable past drilling and metallurgical work completed and the proposed mining project is currently being guided through the permitting process by the Company's permitting consultants. The La Fortuna open pit gold project in Durango (100%-owned) has a positive, robust PEA completed, and the main Federal permits are in place. Minera Alamos is built around its operating team that together brought three open pit heap leach gold mines into successful production in Mexico over the last 14 years. The Company's strategy is to develop very low capex assets while expanding the projects' resources and continuing to pursue complementary strategic acquisitions.

For Further Information, Please Contact:

| Minera Alamos Inc. Darren Koningen, Chief Executive Officer Tel: 416-306-0990 ext 201 Email: dkoningen@mineraalamos.com Website: www.mineraalamos.com | Darren Blasutti, EVP Corporate Development Tel: 416-306-0990 ext 208 Email: dblasutti@mineraalamos.com |

Caution Regarding Forward-Looking Statements

This press release includes certain "forward-looking information" within the meaning of applicable Canadian securities legislation. All information herein, other than information of historical fact, constitutes forward-looking information. Forward-looking information is frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events, conditions, or results "will", "may", "could", or "should" occur or be achieved. This information is based on information currently available to Minera Alamos and Minera Alamos provides no assurance that actual results will meet management's expectations.

The forward-looking information is based on assumptions and addresses future events and conditions that, by their very nature involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated in forward-looking information for many reasons. Minera Alamos' financial condition and prospects could differ materially from those currently anticipated in forward-looking information for many reasons such as: an inability to receive requisite permits for mine operation, exploration or expansion; an inability to finance and/or complete updated resource and reserve estimates and technical reports which support the technical and economic viability of mineral production; changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with Minera Alamos' activities; and other matters discussed in this press release and in filings made with securities regulators. This list is not exhaustive of the factors that may affect any of Minera Alamos' forward-looking information. These and other factors should be considered carefully, and readers should not place undue reliance on Minera Alamos' forward-looking information. Minera Alamos does not undertake to update any forward-looking information that may be made from time to time by Minera Alamos or on its behalf, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273398

SOURCE: Minera Alamos Inc.