Burlington, Ontario--(Newsfile Corp. - November 17, 2025) - Silver Bullet Mines Corp. (TSXV: SBMI) (OTCQB: SBMCF) ("SBMI" or "the Company") is pleased to announce the first batch of what it believes to be high grade gold/silver concentrates, processed from surface material taken from the KT Gold Mine in Arizona, was received by the Buyer on October 29. This shipment comprised of roughly 4000 pounds of concentrate from the KT Gold Mine.

This first shipment also included 2000 pounds of concentrate processed from material taken from the SC Mine in Arizona.

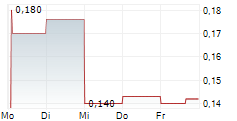

SBMI announces a second shipment of gold/silver concentrates processed from surface material taken from the KT Gold Mine in Arizona, is scheduled to be picked up this week at the Company's mill site in Globe, Arizona. This second shipment, a picture of which is below, consists of roughly 2500 pounds of concentrate.

Second Shipment of Concentrate from KT Material Awaiting Pickup

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8464/274833_b5c516a4f4ee1ba3_001full.jpg

The Company has begun processing further surface material from the KT Gold Mine to support a third shipment of concentrate. The Company intends to continue processing material from the KT Gold Mine in amounts sufficient to make additional shipments on as close to a biweekly schedule as possible, with each shipment intended to range from roughly 2500 pounds to roughly 4000 pounds of concentrate.

As to the grade of such concentrates, the Company is awaiting the Buyer's comparative assay results so the Company and the Buyer can agree upon the precise value of such shipments.

Pursuant to the terms of agreement with the Buyer, on initial shipments payment to SBMI will be made 60 days from date of receipt at the refinery. The Company is negotiating payment terms for subsequent shipments.

With respect to the concentrate produced from the SC Mine, SBMI announces it has finally received the initial assay results from the independent lab. Extremely positive for the Company is that all of the concentrate samples tested returned values over the detection limits, which means the results were higher than the highest numbers in the lab's testing parameters. Additional samples need be provided to the lab so that different tests can be run to determine with greater precision the contents of the concentrate. At this time, the Company sees greater value in concentrate produced from material taken from the KT Mine, and will not be directing significant resources to produce additional concentrate from SC Mine material. The SC Mine is being maintained in good standing and will be revisited at an appropriate time.

Line on the Shaker Table on Nov 15/25 from KT Mine material

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8464/274833_b5c516a4f4ee1ba3_002full.jpg

As a result of queries from a number of investors, SBMI would like to provide clarification of its processes and determination of the amount of concentrates it produces for shipment.

The Company strives to produce the highest grades possible for each ton of concentrate shipped. By doing so, it avoids additional extra refining and smelting fees along with additional transportation and handling costs. The concentration ratio of the input (initial host rock) to the output (concentrate) is different for each mine. The Company does not yet have enough data to advise what it believes the concentration ratio could be for the KT Mine.

Mineralized material from the mines is processed through the Company's mill using gravitational processes which cause metal with a higher specific gravity (like gold and silver) to separate from the host material within which it is contained. The output from that process is mineral concentrate (gold or silver in SBMI's case). The important factor is not the number of tons of concentrates but the grade of the material in the original host material.

Using an example set of parameters it may make this easier to understand. Any of the numbers in this analysis are not to be considered in any way to be representative of actual tonnage or grade. They are for illustrative purposes only.

Assume 100 tons of original mineralized material from the KT Mine contained a head grade of .3 oz of gold per ton. This would mean there are 30 ounces of gold in the 100 tons of original mineralized material. Also assume a 90% recovery rate. Using these assumptions and processing that material at the Company's mill, the milling process would result in the concentrate containing 90% of the 30 ounces in the original mineralized material, or 27 ounces residing in approximately 500 pounds of concentrate. Extrapolating this hypothetical example would result in 108 ounces of gold in one ton of concentrate.

SBMI reiterates that it is important to keep in mind the key factor is not the number of tons of concentrate produced. Rather, the key factor is the gold grade in the original host material and thus the gold grade in the concentrate.

The Company reiterates that the figures above are for demonstration purposes only, should not be used as an indication of head grade or potential cash receivable, and are extremely simplistic for the complex field of metallurgy.

SBMI trusts this helps explain the mill process in Arizona and provides clarity to that process.

SBMI also announces John MacKenzie has rejoined the board of directors. Mr. MacKenzie is an experienced Chief Executive Officer, CFO and Director with a demonstrated history of working in the mining and metals industry. He is skilled in Operations Management and Governance, and as a chartered accountant is financially literate. He is a Life Member of CPA Ontario. He will join the Company's Audit Committee.

The Company also announces it has issued 258,675 shares as payment of interest pursuant to the previously announced terms of outstanding debentures.

For further information:

John Carter

Silver Bullet Mines Corp., CEO

cartera@sympatico.ca

+1 (905) 302-3843

Peter M. Clausi

Silver Bullet Mines Corp., VP Capital Markets

pclausi@brantcapital.ca

+1 (416) 890-1232

Cautionary and Forward-Looking Statements

This news release contains certain statements that may constitute forward-looking statements as they relate to SBMI and its subsidiaries. Forward-looking statements are not historical facts but represent management's current expectation of future events, and can be identified by words such as "believe", "expects", "will", "intends", "plans", "projects", "anticipates", "estimates", "continues" and similar expressions. Although management believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that they will prove to be correct.

By their nature, forward-looking statements include assumptions and are subject to inherent risks and uncertainties that could cause actual future results, conditions, actions or events to differ materially from those in the forward-looking statements. If and when forward-looking statements are set out in this new release, SBMI will also set out the material risk factors or assumptions used to develop the forward-looking statements. Except as expressly required by applicable securities laws, SBMI assumes no obligation to update or revise any forward-looking statements. The future outcomes that relate to forward-looking statements may be influenced by many factors, including but not limited to: the impact of SARS CoV-2 or any other global pathogen; reliance on key personnel; the thoroughness of its QA/QA procedures; the continuity of the global supply chain for materials for SBMI to use in the exploration for and the production and processing of mineralized material; the results of exploration and development activities; the results of mining and mill operations; shareholder and regulatory approvals; activities and attitudes of communities local to the location of the SBMI's properties; risks of future legal proceedings; income tax and tariff matters; fires, floods, snowfall, spring thaw and other natural phenomena; the rate of inflation; counterparty risk with respect to any buyer of the Company's products; availability and terms of financing; distribution of securities; commodities pricing; currency movements, especially as between the USD and CDN; effect of market interest rates on price of securities; and, potential dilution. SARS CoV-2 and other potential global pathogens create risks that at this time are immeasurable and impossible to define.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/274833

SOURCE: Silver Bullet Mines Corp.