Vertiseit AB (publ) ("Vertiseit" or the "Company"), through its subsidiary Visual Art International Holding AB, has acquired Muse Content GmbH ("Muse") and its generative AI platform StokedAI. Muse is a pioneer in AI-powered solutions for Digital In-store and In-store Audio. The acquisition expands Vertiseit's In-store Experience Management platform (IXM), brings deep expertise in AI development and establishes In-store Audio as a new strategic component of its offering thereby unlocking new revenue streams. Muse generated approximately 3 MEUR in revenue in 2024, with a Cash EBITDA-margin of around 25 percent. The transaction was completed on a cash- and debt-free basis for a purchase price of approximately 3.4 MEUR, with sellers entitled to an additional earn-out of up to 0.6 MEUR over three years, contingent upon Muse achieving certain financial targets. The purchase price is primarily paid in cash at closing, alongside newly issued Vertiseit class B shares at a subscription price of 73 SEK per share, subject to a three-year lock-up. The cash consideration has been financed through Vertiseit's own funds and existing credit facilities. The acquisition was completed today, November 18, 2025, and will be consolidated into the group's financial reporting as of Q4 2025.

ABOUT MUSE

Muse owns and develops a generative AI platform for In-store Voice Messaging and In-store Music under the StokedAI brand. The company's platform and AI-generated music library is expected to complement Vertiseit's current Digital In-store offering and create opportunities to increase revenue from its existing customer base. In-store Audio represents a significant share of the global Digital In-store market. For Vertiseit, In-store Audio is a natural addition to the Company's offering and enhances the group's IXM platform.

"The acquisition is an important step in our ambition to lead AI innovation in In-store Experience Management. In-store Audio is undergoing a major transformation, with AI-generated, royalty-free music redefining the landscape. The team behind Muse and StokedAI brings products and expertise that will accelerate our development and strengthen our offering," says Johan Lind, CEO and co-founder of Vertiseit.

"My ambition has always been to create the best possible customer experience and take it to the next level. To move this vision forward, we are now joining forces with Vertiseit. As the clear market leader in In-store Experience Management, Vertiseit is the natural and strongest partner for shaping this next chapter. By combining AI capabilities, resources, and exceptional talent, we are laying the foundation for a new generation of retail customer experiences," comments Marco Burkhardtsmayer, CEO and co-founder of Muse and StokedAI.

Marco Burkhardtsmayer, one of two co-founders and CEO of Muse, joins Grassfish as CXO and becomes part of Vertiseit's group management. A European pioneer in applied AI for retail, he leads the development of data-driven customer experiences and has been recognized by RETHINK Retail as a globally leading retail expert. He holds a degree from the University of Hamburg and AI program diplomas from Harvard and MIT.

Filip Mitov, the other co-founder of Muse, will lead Vertiseit's newly established In-store Audio division within Visual Art. Educated at the Liverpool Institute for Performing Arts (LIPA), he brings extensive industry expertise and creativity.

TRANSACTION OVERVIEW

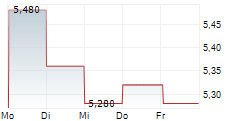

Muse, headquarterd in Hamburg, primarily serves leading German brands and employs around ten people. Muse generated approximately 3 MEUR in revenue in 2024. Over a quarter of the revenue comes from SaaS, with the remainder evenly split between Consulting and Systems, and a Cash EBITDA margin of around 25 percent. The acquisition adds approximately 0,8 MEUR in annual recurring revenue (ARR). The purchase price totals approximately 3.4 MEUR, of which 65 percent is paid in cash and 35 percent through a directed share issue of Vertiseit class B shares at a price of 73 SEK per share (the "Directed Issue"), with an additional potential earn-out of up to 0.6 MEUR over the next three years. The subscription price of 73 SEK per B share represents a 19 percent premium to the closing price on November 17, 2025, on Nasdaq First North Growth Market. The sellers of Muse have agreed to a 36-month lock-up on the shares received. After the Directed Issue, the sellers' ownership represents approximately 0.6 percent of Vertiseit's total outstanding shares.

THE DIRECTED SHARE ISSUE

The Board of Directors has today resolved on a Directed Issue of 189,162 class B shares at a subscription price of 73 SEK per share. The Directed Issue was resolved based on the authorization granted by the Annual General Meeting on April 24, 2025.

The newly issued class B shares will increase Vertiseit's share count from 30,143,981 to 30,333,143, consisting of 2,429,510 class A shares and 27,903,633 class B shares. The Company's share capital will increase from 1,507,199.05 SEK to 1,516,657.10 SEK. The issue results in dilution of approximately 0.62 percent of the total number of shares and about 0.36 percent of the total number of votes in Vertiseit.

PURPOSE AND USE OF PROCEEDS

The purpose of the Directed Issue is primarily to create long-term incentives for the sellers of Muse, who will become key employees within the Vertiseit Group. The issue has been carried out as a set-off issue, where the sellers' purchase price claims were converted into Vertiseit B shares. The proceeds have therefore been exclusively used to finance the acquisition of Muse.

REASON FOR DEVIATION FROM SHAREHOLDER'S PREFERENTIAL RIGHTS

Before deciding on the Directed Issue, the Board carefully considered alternative financing options, including the feasibility of a rights issue for existing shareholders. The reason for deviating from shareholders' preferential rights was an agreement with the creditors, also the sellers of Muse, that part of the purchase price would be paid through newly issued B-shares. Additionally, the Board assessed that a rights issue would entail significantly longer execution time and higher costs than the Directed Issue and would not create incentives for the sellers of Muse, who are expected to be actively employed in the Vertiseit Group. The Board has therefore concluded that the reasons for the Directed Issue outweigh the arguments for a rights issue and that the Directed Issue is in the best interest of both Vertiseit and all shareholders.

The subscription price has been determined by the Board through arm's-length negotiations with the sellers of Muse, taking into account the overall terms of the transaction. The Board considers the subscription price to reflect current market conditions and demand and therefore to be fair.

INVITATION TO INVESTOR CALL

Johan Lind, CEO, and Jonas Lagerqvist, CFO, will present the acquisition of Muse. During the presentation, there will be an opportunity to ask questions. The call will be held in English.

VIDEO CONFERENCE

Time: Wednesday, November 19, at 09.30 CET

Participation: To join the call - click here

ADVISORS

CMS Wistrand is legal advisor to Vertiseit in connection with the transaction, and Nordic Issuing is the issuing agent for the Directed Issue.

Contacts

Johan Lind, Vertiseit CEO / Media Contact

johan.lind@vertiseit.com

+46 703 579 154

Jonas Lagerqvist, Vertiseit Deputy CEO / CFO / Investor Relations

jonas.lagerqvist@vertiseit.com

+46 732 036 298

Redeye AB is the company's Certified Adviser

About Vertiseit

Vertiseit is a leading platform company within In-Store Experience Management (IXM). The company operates through its subidiaries Dise, Grassfish and Visual Art that enable global brands and leading retailers to strengthen the customer experience by offering a seamless customer journey through connecting the physical and digital meeting. The company has around 270 employees in Sweden, Norway, Denmark, Finland, Austria, Germany, Spain, UK and USA. During the period 2012-2024, Vertiseit performed an average profitable growth of recurring SaaS revenue (ARR) of 50 percent (CAGR). For the full year of 2024, the group's net revenue amounted to SEK 464 million, with an adjusted EBITDA margin of 21 percent. Since 2019, Vertiseit's B-share is listed on Nasdaq First North Growth Market.

VERTISEIT AB (publ)

Phone: +46 340 848 11

E-mail: info@vertiseit.com

Kyrkogatan 7, 432 41 Varberg, Sweden

Org.no: 556753-5272

www.vertiseit.com

This information is information that Vertiseit is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-11-18 17:18 CET.