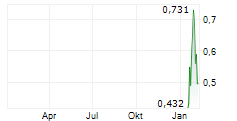

Sotkamo Silver AB | Stock Exchange Release | November 21, 2025 at 15:30:00 EET

Sotkamo Silver AB's silver production for 2025 is expected to fall below the lower end of the previously estimated production guidance. This is due to lower-than-expected mining volumes and silver grade. As a result, the EBITDA margin is also expected to fall short of the guidance.

The company's production volumes were weaker than anticipated in the early part of the year, due to factors such as insufficient mining capacity and technical challenges in the mining. Production volumes improved from the first half of the year, but not entirely in line with our expectations. A new mining contractor will start on January 1, 2026, which we believe will increase confidence in achieving mining targets.

The new guidance for year 2025 given 21 November 2025:

- The Company expects to produce 0.8 -0.9 million ounces of silver

- The Company expects annual EBITDA margin to be 16%

- The Company expects net debt-to-EBITDA to be below 2.5 at year-end

The Company's profitability is significantly affected by external factors, such as metal prices and exchange rates and internal factors like uncertainties related to ore volumes and metal grades. The achievement of the guidance assumes that metal prices and EUR/USD rate stay approximately at the current level of the time when the guidance was published (21 November 2025).

The old guidance given 31 July 2025:

- The Company expects to produce 1.0 -1.2 million ounces of silver

- Annual EBITDA margin to be at least 22%

- Net debt-to-EBITDA to be below 2.5 at year-end

The Company's profitability is significantly affected by external factors, such as metal prices and exchange rates and internal factors like uncertainties related to ore volumes and metal grades. The achievement of the guidance assumes that metal prices and EUR/USD rate stay approximately at the current level of the time when the guidance was published (31 July 2025).

Mikko Jalasto

CEO of Sotkamo Silver AB

Sotkamo Silver in brief

Sotkamo Silver is a mining and ore prospecting company that develops and utilises mineral deposits in the Kainuu region in Finland. Sotkamo Silver supports the global development towards green transition technologies and produces the metals needed responsibly and by taking local stakeholders into account. Sotkamo Silver's main project is a silver mine located in Sotkamo, Finland. In addition to silver, the mine produces gold, zinc and lead. The company also has mining and ore prospecting rights for mineral deposits in the vicinity of the silver mine in Kainuu. Sotkamo Silver Group consists of the parent company Sotkamo Silver AB and its wholly-owned Finnish subsidiary (Sotkamo Silver Oy). Sotkamo Silver AB is listed at NGM Main Regulated in Stockholm (SOSI), Nasdaq Helsinki (SOSI1), and Börse Berlin.

Read more about Sotkamo Silver on www.silver.fi/en/

This information is information that Sotkamo Silver AB is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-11-21 15:30 EET.