NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR INDIRECTLY, IN OR INTO, THE UNITED STATES OF AMERICA, AUSTRALIA, BELARUS, CANADA, HONG KONG, JAPAN, NEW ZEALAND, RUSSIA, SINGAPORE, SOUTH AFRICA, SOUTH KOREA OR ANY OTHER JURISDICTION IN WHICH THE RELEASE, DISTRIBUTION OR PUBLICATION WOULD BE UNLAWFUL OR REQUIRE REGISTRATION OR ANY OTHER MEASURE.

On 22 October 2025, the Board of Directors of Alligator Bioscience AB ("Alligator Bioscience" or the "Company") resolved on an issue of units, consisting of ordinary shares and warrants, with preferential rights for the Company's existing shareholders (the "Rights Issue"). The Rights Issue is subject to approval by the extraordinary general meeting on 25 November 2025 and today, the Board of Directors of Alligator Bioscience announces the final terms of the Rights Issue.

Summary

- The subscription price in the Rights Issue has been set to SEK 0.40 per unit, corresponding to SEK 0.20 per ordinary share. The subscription price has been determined in accordance with the principles set out in the Company's press release of 22 October 2025, where the subscription price has been set based on the condition that the subscription price per share shall not be less than SEK 0.20. The warrants series TO 14 are issued free of charge.

- Anyone who is registered as a shareholder in Alligator Bioscience on the record date, 2 December 2025, will receive seven (7) unit rights per each (1) existing ordinary share in the Company. One (1) unit right entitles the holder to subscribe for one (1) unit. Each unit consists of two (2) ordinary shares and one (1) warrant series TO 14. The warrants series TO 14 are intended to be admitted to trading on Nasdaq Stockholm.

- The Rights Issue entails the issuance of a maximum of 306,695,704 units, corresponding to 613,391,408 ordinary shares and 306,695,704 warrants series TO 14.

- One (1) warrant series TO 14 entitles the holder to subscription of one (1) ordinary share in the Company during the period from and including 5 March 2026 up to and including 19 March 2026.

- Upon full subscription in the Rights Issue, Alligator Bioscience will initially receive approximately SEK 123 million before issue costs. In the event the warrants series TO 14 are fully exercised for subscription of new ordinary shares, at the same subscription price per ordinary share as in the Rights Issue, the Company will receive additional proceeds of approximately SEK 61 million in March 2026, before issue costs.

- The subscription period in the Rights Issue will run from and including 4 December 2025 up to and including 18 December 2025.

- The Company intends to use the net proceeds from the Rights Issue, after repayment of the bridge loans and part of the loan that Alligator Bioscience raised from Fenja Capital II A/S ("Fenja Capital") in 2024, to support the ongoing process to secure a partnership for mitazalimab as well as for general corporate purposes.

- The Rights Issue is covered by subscription undertakings up to approximately 5 percent and by guarantee commitments up to approximately 59 percent, corresponding to a total of up to approximately 64 percent of the Rights Issue.

Terms of the Rights Issue

The Rights Issue was resolved by the Board of Directors on 22 October 2025 and is subject to approval by the extraordinary general meeting on 25 November 2025. Anyone who is registered as a shareholder in Alligator Bioscience on the record date, 2 December 2025, will receive seven (7) unit rights per each (1) existing ordinary share in the Company. One (1) unit right entitles the holder to subscribe for one (1) unit. Each unit consists of two (2) ordinary shares and one (1) warrant series TO 14. The warrants series TO 14 are intended to be admitted to trading on Nasdaq Stockholm.

The Rights Issue entails the issuance of a maximum of 306,695,704 units, corresponding to 613,391,408 ordinary shares and 306,695,704 warrants series TO 14. The subscription price in the Rights Issue has been set to SEK 0.40 per unit, corresponding to SEK 0.20 per ordinary share. The subscription price has been determined in accordance with the principles set out in the Company's press release of 22 October 2025, where the subscription price has been set based on the condition that the subscription price per share shall not be less than SEK 0.20. The warrants series TO 14 are issued free of charge.

Upon full subscription in the Rights Issue, Alligator Bioscience will initially receive approximately SEK 123 million before issue costs. In the event the warrants series TO 14 are fully exercised for subscription of new ordinary shares, at the same subscription price per ordinary share as in the Rights Issue, the Company will receive additional proceeds of approximately SEK 61 million in March 2026, before issue costs.

Subscription of units with or without preferential rights shall be made during the period from and including 4 December 2025 up to and including 18 December 2025. Unit rights that are not exercised during the subscription period become invalid and lose their value. Trading in unit rights takes place on Nasdaq Stockholm during the period from and including 4 December 2025 up to and including 15 December 2025 and trading in BTU (paid subscribed units) during the period from and including 4 December 2025 up to and including 13 January 2026.

One (1) warrant series TO 14 entitles the holder the right to subscribe for one (1) new ordinary share in the Company at a subscription price corresponding to seventy (70) percent of the volume-weighted average price of the Company's ordinary share on Nasdaq Stockholm during the period from and including 10 February 2026 up to and including 27 February 2026, however not lower than the quota value of the share and not higher than SEK 0.25, corresponding to 125 percent of the subscription price per ordinary share in the Rights Issue. Subscription of ordinary shares by exercise of warrants series TO 14 shall be made during the period from and including 5 March 2026 up to and including 19 March 2026.

If not all units are subscribed for by exercise of unit rights, allotment of the remaining units shall be made within the highest amount of the issue: firstly, to those who have subscribed for units by exercise of unit rights (regardless of whether they were shareholders on the record date or not) and who have applied for subscription of units without exercise of unit rights and if allotment to these cannot be made in full, allotment shall be made pro rata in relation to the number of unit rights that each and every one of those, who have applied for subscription of units without exercise of unit rights, have exercised for subscription of units; secondly, to those who have applied for subscription of units without exercise of unit rights and if allotment to these cannot be made in full, allotment shall be made pro rata in relation to the number of units the subscriber in total has applied for subscription of units; and thirdly, to those who have provided guarantee commitments with regard to subscription of units, in proportion to such guarantee commitments. To the extent that allotment in any section above cannot be done pro rata, allotment shall be determined by drawing of lots.

Upon full subscription in the Rights Issue, the share capital will increase by a maximum of SEK 122,678,281.60 to SEK 131,441,016.00 (based on the share's quota value after the reduction of the share capital proposed by the Board of Directors to the extraordinary general meeting on 25 November 2025) by the issuance of a maximum of 613,391,408 new ordinary shares, resulting in that the total number of outstanding shares in the Company will increase from 43,813,672 to 657,205,080, whereof all outstanding shares are ordinary shares. Shareholders who choose not to participate in the Rights Issue will, provided that the Rights Issue is fully subscribed, have their ownership of ordinary shares diluted by approximately 93 percent, but are able to financially compensate for this dilution by selling their unit rights.

If all warrants series TO 14 are fully exercised for subscription of new ordinary shares in the Company, the share capital will increase by an additional maximum of SEK 61,339,140.80 to SEK 192,780,156.80 (based on the share's quota value after the reduction of the share capital proposed by the Board of Directors to the extraordinary general meeting on 25 November 2025), by the issuance of an additional maximum of 306,695,704 ordinary shares, resulting in that the total number of outstanding shares in the Company will increase to 963,900,784, whereof all outstanding shares are ordinary shares. Shareholders who choose not to exercise their warrants will have their ownership of ordinary shares diluted by an additional approximately 32 percent.

The total dilution effect in the event that both the Rights Issue and all warrants series TO 14 are subscribed for, and exercised, in full, amounts to approximately 95 percent.

Subscription undertakings and guarantee commitments

The Company has received subscription undertakings from a number of larger existing shareholders, amounting in total to approximately SEK 6 million, corresponding to approximately 5 percent of the Rights Issue. No compensation will be paid for subscription undertakings.

The Company has also entered into agreements with certain existing shareholders and a number of external investors on guarantee commitments of a total of approximately SEK 72 million, corresponding to approximately 59 percent of the Rights Issue. According to the guarantee agreements, cash compensation is paid with 12 percent of the guaranteed amount, corresponding to a total of approximately SEK 8.7 million, or 14 percent of the guaranteed amount in the form of newly issued units in the Company, with the same terms and conditions as for units in the Rights Issue, including the subscription price in the Rights Issue.

In total, the Rights Issue is covered by subscription undertakings and guarantee commitments amounting up to approximately SEK 78 million, corresponding to approximately 64 percent of the Rights Issue.

In order to enable issue of units as guarantee compensation to the guarantors who choose to receive guarantee compensation in the form of newly issued units, the Board of Directors has proposed that the extraordinary general meeting on 25 November 2025, among other things, resolves to authorize the Board of Directors to resolve on issue of such units to guarantors.

A subscription of units in the Rights Issue (other than by exercising preferential rights) which result in an investor acquiring a shareholding corresponding to or exceeding a threshold of ten (10) percent or more of the total number of votes in the Company following the completion of the Rights Issue, must prior to the investment be filed with the Inspectorate of Strategic Products (Sw. Inspektionen för strategiska produkter, "ISP"). To the extent any guarantors' fulfilment of their guarantee commitment entails that the investment must be approved by the ISP in accordance with the Swedish Screening of Foreign Direct Investments Act (Sw. lagen (2023:560) om granskning av utländska direktinvesteringar), such part of the guarantee is conditional upon notification that the application of the transaction is left without action or that approval has been obtained from the ISP.

In addition, pursuant to the guarantee commitment provided by Fenja Capital, Fenja Capital's obligation to fulfil its guarantee commitment in connection with the Rights Issue may be postponed in order to secure that Fenja Capital's shareholding in the Company does not amount to or exceed 30 percent of the Company's votes after the completion of the Rights Issue.

Lock-up agreements

In connection with the Rights Issue, all shareholding members of the Board of Directors and senior management in Alligator Bioscience have undertaken towards Vator Securities AB, subject to customary exceptions, not to sell or carry out other transactions with a similar effect as a sale unless, in each individual case, first having obtained written approval from Vator Securities AB. Decisions to give such written consent are resolved upon by Vator Securities AB and an assessment is made in each individual case. Consent may depend on both individual and business reasons. The lock-up undertakings only cover the shares held prior to the Rights Issue and the lock-up period lasts for 180 days after the announcement of the Rights Issue.

Extraordinary general meeting and voting commitments

The Board of Directors' resolution on the Rights Issue is subject to approval by the extraordinary general meeting on 25 November 2025. The resolution on the Rights Issue is subject to and conditional upon that the extraordinary general meeting also resolves to reduce the share capital to cover loss, to amend the Articles of Association in accordance with the Board of Directors' proposal to the extraordinary general meeting, as well as to authorize the Board of Directors to resolve on issue of units to the guarantors and warrants to Fenja Capital.

The Company has received irrevocable voting commitments from certain of the Company's shareholders, who together hold approximately 5 percent of the votes in the Company. The voting commitments mean that the shareholders have committed to vote in favor of the Rights Issue and all relevant resolutions at the extraordinary general meeting on 25 November 2025.

Prospectus

Full terms and conditions for the Rights Issue, as well as other information about the Company and information about subscription undertakings, guarantee commitments and lock-up agreements will be presented in the prospectus

(the "Prospectus") that the Company is expected to publish on or around 28 November 2025.

Preliminary time plan for the Rights Issue

| 25 November 2025 | Extraordinary general meeting |

| 28 November 2025 | Estimated publication of the Prospectus |

| 28 November 2025 | Last day of trading incl. preferential rights |

| 1 December 2025 | First day of trading excl. preferential rights |

| 2 December 2025 | Record date in the Rights Issue |

| 4 - 15 December 2025 | Trading in unit rights |

| 4 - 18 December 2025 | Subscription period |

| 22 December 2025 | Estimated publication of the outcome of the Rights Issue |

| 4 December 2025 - 13 January 2026 | Trading in paid subscribed units (BTU) |

Advisers

Vator Securities AB acts as Sole Global Coordinator and bookrunner in connection with the Rights Issue. Setterwalls Advokatbyrå AB is legal adviser to Alligator Bioscience in connection with the Rights Issue. Vator Securities AB acts as the issuing agent in connection with the Rights Issue.

For further information, please contact:

Søren Bregenholt, CEO

E-mail: soren.bregenholt@alligatorbioscience.com

Phone: +46 (0) 46 540 82 00

The information was submitted for publication, through the agency of the contact person set out above, at 09:00 p.m. CET on 24 November 2025.

About Alligator Bioscience

Alligator is a clinical-stage biotechnology company developing tumor-directed immuno-oncology antibody drugs focused on the CD40 receptor. This validated approach promotes priming of tumor-specific T cells and reversing the immunosuppressive nature of the tumor microenvironment, with significant potential benefits for cancer patients across multiple types of cancer. The Company's lead drug candidate mitazalimab is currently ready for Phase 3 development, and has previously presented unprecedented survival data at 24-months follow up in first-line metastatic pancreatic cancer patients in the Phase 2 trial OPTIMIZE-1.

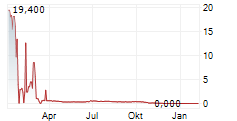

Alligator is listed on Nasdaq Stockholm (ATORX) and headquartered in Lund, Sweden.

For more information, please visit alligatorbioscience.com.

IMPORTANT INFORMATION

The information in this press release does not contain or constitute an offer to acquire, subscribe or otherwise trade in shares, warrants or other securities in Alligator Bioscience. No action has been taken and measures will not be taken to permit a public offering in any jurisdictions other than Sweden. Any invitation to the persons concerned to subscribe for units in Alligator Bioscience will only be made through the Prospectus that Alligator Bioscience estimates to publish on or around 28 November 2025 on Alligator Bioscience's website, www.alligatorbioscience.com. The upcoming approval of the Prospectus by the Swedish Financial Supervisory Authority shall not be regarded as an approval of the shares, warrants or any other securities.

This release is not a prospectus in accordance with the definition in the Prospectus Regulation (EU) 2017/1129 ("Prospectus Regulation") and has not been approved by any regulatory authority in any jurisdiction. This announcement does not identify or suggest, or purport to identify or suggest, the risks (direct or indirect) that may be associated with an investment in shares, warrants or other securities in Alligator Bioscience. In order for investors to fully understand the potential risks and benefits associated with a decision to participate in the Rights Issue, any investment decision should only be made based on the information in the Prospectus. Thus, investors are encouraged to review the Prospectus in its entirety. In accordance with article 2 k of the Prospectus Regulation, this press release constitutes an advertisement.

The information in this press release may not be released, distributed or published, directly or indirectly, in or into the United States of America, Australia, Belarus, Canada, Hong Kong, Japan, New Zealand, Russia, Singapore, South Africa, South Korea or any other jurisdiction in which such action would be unlawful or would require registration or any other measures than those required by Swedish law. Actions in violation of these restrictions may constitute a violation of applicable securities laws. No shares, warrants or other securities in Alligator Bioscience have been registered, and no shares, warrants or other securities will be registered, under the United States Securities Act of 1933, as amended (the "Securities Act") or the securities legislation of any state or other jurisdiction in the United States of America and no shares, warrants or other securities may be offered, sold or otherwise transferred, directly or indirectly, in or into the United States of America, except under an available exemption from, or in a transaction not subject to, the registration requirements under the Securities Act and in compliance with the securities legislation in the relevant state or any other jurisdiction of the United States of America.

Within the European Economic Area ("EEA"), no public offering of shares, warrants or other securities ("Securities") is made in other countries than Sweden. In other member states of the EU, such an offering of Securities may only be made in accordance with the Prospectus Regulation. In other member states of the EEA which have implemented the Prospectus Regulation in its national legislation, any offer of Securities may only be made in accordance with an applicable exemption in the Prospectus Regulation and/or in accordance with an applicable exemption under a relevant national implementation measure. In other member states of the EEA which have not implemented the Prospectus Regulation in its national legislation, any offer of Securities may only be made in accordance with an applicable exemption under national law.

In the United Kingdom, this document and any other materials in relation to the securities described herein is only being distributed to, and is only directed at, and any investment or investment activity to which this document relates is available only to, and will be engaged in only with, "qualified investors" (within the meaning of the United Kingdom version of the EU Prospectus Regulation (2017/1129/ EU) which is part of United Kingdom law by virtue of the European Union (Withdrawal) Act 2018) who are (i) persons having professional experience in matters relating to investments who fall within the definition of "investment professionals" in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order"); (ii) high net worth entities etc. falling within Article 49(2)(a) to (d) of the Order; or (iii) such other persons to whom such investment or investment activity may lawfully be made available under the Order (all such persons together being referred to as "relevant persons"). In the United Kingdom, any investment or investment activity to which this communication relates is available only to, and will be engaged in only with, relevant persons. Persons who are not relevant persons should not take any action on the basis of this press release and should not act or rely on it.

This press release may contain forward-looking statements which reflect the Company's current view on future events and financial and operational development. Words such as "intend", "will", "expect", "anticipate", "may", "believe", "plan", "estimate" and other expressions which imply indications or predictions of future development or trends, and which are not based on historical facts, are intended to identify forward-looking statements. Forward-looking statements inherently involve both known and unknown risks and uncertainties as they depend on future events and circumstances. Forward-looking statements do not guarantee future results or development and the actual outcome could differ materially from the forward-looking statements.

This information, opinions and forward-looking statements contained in this press release applies only as of the date hereof and may be subject to change without notice. Alligator Bioscience makes no commitment to publicly update or revise any forward-looking statements, future events or similar circumstances other than as required by applicable law.

Vator Securities AB is acting for Alligator Bioscience in connection with the transaction and no one else and will not be responsible to anyone other than Alligator Bioscience for providing the protections afforded to its clients nor for giving advice in relation to the transaction or any other matter referred to herein.

Since Alligator Bioscience is considered to conduct essential services according to the Swedish Screening of Foreign Direct Investments Act (Sw. lag (2023:560) om granskning av utländska direktinvesteringar), certain investments in the Rights Issue may require review by the ISP. The Company will, no later than in connection with the publication of the Prospectus, publish more information about this on the Company's website, www.alligatorbioscience.com.

The English text is an unofficial translation of the original Swedish text. In case of any discrepancies between the Swedish text and the English translation, the Swedish text shall prevail.