Aino Health Management Oy, wholly owned subsidiary of Aino Health AB, receives significant financing totaling 7,7 million SEK from Finnvera and major shareholders - strengthens growth and international expansion.

Aino Health Management Oy ("Aino Health Management"), has today received a loan from Finnvera Oyj, a state-owned specialized financing company in Finland.

Key terms of the financing:

• Finnvera has granted a loan of EUR 560,000 (approximately SEK 6.2 million).

• The loan carries an annual interest rate of 4,1%.

• The loan will be amortized over 5 years, with the first 12 months being amortization-free.

• In addition, Aino Health Management has received EUR 140,000 (approximately SEK 1.5 million) a subordinated capital loan from the company's four largest owners: Nexit III ky, Tenendum Oy, Jyrki Eklund and Jochen Saxelin. The company's board has approved the terms of the loan and confirms that the terms are on market-based conditions.

• This subordinated capital loan is an equity-type "junior loan" with an annual interest rate of 9%. However, interest cannot be paid, and the loan cannot be amortized except from distributable equity and only after all other loans have been repaid.

• The subordinated capital loan was granted in line with Finnvera's requirement to ensure sufficient owner commitment to the company's development.

Purpose of the financing:

The primary objective of this financing is to strengthen the Aino Groups' capabilities for international expansion and to support the further development of its product offering in selected target markets. The financing enables investments in growth and market entry, strengthening the company's competitiveness internationally.

About Finnvera:

Finnvera Oyj is Finland's state-owned specialized financing company that supplements the financial market by supporting SMEs, exports, and internationalization. It serves as Finland's official Export Credit Agency (ECA), providing loans, guarantees, and export credit guarantees. Finnvera finances its operations through long-term international funding, including its Euro Medium Term Note (EMTN) program, and its obligations are backed by a state guarantee.

For more information

Jyrki Eklund, CEO Aino Health

Phone: +358 40 042 4221

Email: jyrki.eklund@ainohealth.com

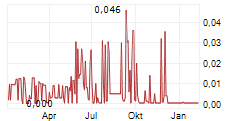

Aino Health AB (publ) is listed on Nasdaq Stockholm First North Growth Market (Ticker: AINO).

Certified Adviser

Tapper Partners AB

More info:?https://investors.ainohealth.com/certified-adviser/

This information is information that Aino Health is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-11-26 13:25 CET.

About Aino Health (publ)

Aino Health is the leading provider of Software as a Service (SaaS) solutions for Corporate Health Management. Our platform helps organizations reduce sickness absences, identify root causes of health challenges, and systematize proactive support for employees. For more information, please visit?ainohealth.com.