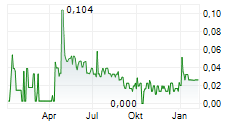

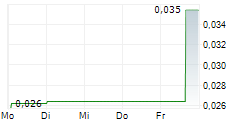

Toronto, Ontario--(Newsfile Corp. - November 26, 2025) - Clear Blue Technologies International Inc. (TSXV: CBLU) (FSE: OYA0) ("Clear Blue"), the Smart Off-Grid Company, announces its financial results for the third quarter of 2025 ("Q3 2025") ending September 30, 2025. A complete set of Financial Statements and Management's Discussion & Analysis ("MD&A") has been filed at www.sedarplus.ca. All dollar amounts are denominated in Canadian dollars.

For the quarter ended September 30, 2025 ("Q3 2025"):

- Q3 2025 new bookings were $745,175 an increase of 682% from $95,277 in Q3 2024.

- Q3 2025 revenue was $953,972, a 158% increase from $369,297 in Q3 2024. The increase is mainly attributed to an increase in North American lighting activity.

- Recurring revenue comprised $164,032 of the quarter's revenue compared to $102,686 in Q3 2024, a 60% increase.

- Gross Profit for Q3 2025 was $352,574 compared to $169,323 for Q3 2024, a 108% increase. The Gross Margin percentage for the quarter was 37%, decreasing from 46% from the comparative period of 2024.

- Quarterly Non-IFRS Adjusted EBITDA was ($331,032) versus ($782,589) in Q3 2024, a 58% improvement from the comparative period of 2024.

- Net loss for the fiscal quarter was $789,437 versus $1,576,826, a 50% improvement from the comparative period of 2024.

Subsequent to the fiscal third quarter:

- On November 11, 2025, Clear Blue was awarded a repeat $1.5 million order from its long-time partner iSat Africa ("iSat") for sites in The Democratic Republic of Congo, South Sudan, Liberia, and Zambia. The order is expected to ship throughout the next two quarters and iSat is expected to increase their investments going forward.

- Following the approval of Budget 2025 in Canada, the Company expects to qualify for the enhanced federal SR&ED refundable credit. The anticipated annual cash refund of approximately $500,000 to $600,000 is subject to the enactment of final legislation and the Company maintaining its eligibility and qualifying R&D activities.

- New bookings for the year (as of November 26, 2025) were $5,742,309, a 161% improvement over all of 2024's bookings of $2,196,669.

- In Q4 2025, the Company identified another opportunity to further reduce operating expenses by approximately $200,000 in 2026 through additional cloud software licence cost optimizations. Clear Blue will continue its cost management program going into 2026.

For the nine months ended September 30, 2025 ("YTD 2025):

- As of September 30, 2025, year-to-date bookings were $4,203,699 compared to $1,441,444 in the same period in 2024, an increase of 192%.

- For the nine months ended September 30, 2025, revenue was $3,139,229, a 43% increase from $2,192,540 in the corresponding previous period.

- For the nine months ended September 30, 2025, recurring revenue was $508,401 a 11% decrease from $572,578 in the corresponding previous period.

- For the nine months ended September 30, 2025, Gross Profit increased to $1,397,999 compared to $753,226 in the comparable period, an 86% increase. The gross margin percentage increased to 45% from 34% compared with the corresponding period of 2024.

- Non-IFRS Adjusted EBITDA for the period was ($942,927) as compared to ($2,216,176) for the previous period, a 57% improvement from the comparative period of 2024. This is primarily the result of reduced operating expenses, improved gross margins and higher revenue.

- Net loss for the period was $1,174,335, an improvement of 71% from $4,038,902 in the corresponding previous period.

Management Commentary & Outlook

"With our larger-scale customers actively executing their 2026 roll-out plans, we have visibility to stronger demand in our telecom sector," said Miriam Tuerk, CEO of Clear Blue. "With the previously announced $1.5M order from iSat, and other projects in our pipeline, we are on track for a solid start to 2026. Along with our goal to drive revenue growth with key commercial partners, we continue our expense management program to ensure we can achieve improved financial results in the coming year."

Private Placement Equity Raise

The Company also announced today that it has closed an initial tranche of a non-brokered private placement (the "Offering"), raising aggregate proceeds in this tranche of $300,000.

Pursuant to the closing of the initial tranche of the Offering, 6,000,000 units of the Company were issued, with each unit comprised of one common share and one common share purchase warrant at a price per unit of $0.05, and each warrant exercisable for a period of 36 months at a strike price of $0.06, for gross proceeds of up to $1 million. The net proceeds from the Offering are expected to be used for sales and business development, as well as working capital. The Company may elect to complete an additional tranche of the Offering in the coming weeks, with further disclosure to be provided.

In connection with the first tranche of the Offering, the Company also paid aggregate finder's fees of $10,600 in cash and 177,333 finder's warrants ("Finder's Warrants") to certain finders. Each Finder's Warrant will entitle the holder thereof to purchase one Common Share at a price of $0.06 for a period of 36 months from the grant date.

The initial closing of the Offering remains subject to the Company receiving all necessary regulatory approvals, including the approval of the TSXV. The securities issued pursuant to the Offering are subject to a hold period of four months and one day from the issuance date in accordance with applicable securities laws.

Certain insiders participated in the Offering and the participation of such insiders is considered a related party transaction subject to Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company intends to rely on exemptions from the formal valuation and minority shareholder approval requirements provided under subsections 5.5(a) and 5.7(1)(a) of MI 61-101 on the basis that participation in the Transactions by insiders will not exceed 25% of the Company's market capitalization.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described in this news release. Such securities have not been, and will not be, registered under the U.S. Securities Act, or any state securities laws, and, accordingly, may not be offered or sold within the United States, or to or for the account or benefit of persons in the United States or "U.S. Persons", as such term is defined in Regulation S promulgated under the U.S. Securities Act, unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption from such registration requirements.

Conference Call Notice

Clear Blue Technologies International Inc. will host a conference call on Thursday, November 27, 2025, at 11:00 AM Eastern Time to discuss the quarterly results, outlook, and growth strategy for 2026.

All interested parties are invited to participate in the call. To register for the conference call, please use the following link: https://us06web.zoom.us/webinar/register/WN_g5tAqTuDSaqC3Qlyl5HtfA

About Clear Blue Technologies International

Clear Blue Technologies provides Smart Off-Grid power solutions and services for mission-critical infrastructure such as telecommunications, Internet of Things (IoT), and street lighting. The Company's technology enables cost savings, predictive maintenance, and reliable power in remote or challenging environments.

For Further Information:

Clear Blue Technologies International Inc.

Miriam Tuerk

Co-Founder and CEO

Phone: +1 (416) 433-3952

Email: investors@clearbluetechnologies.com

Website: www.clearbluetechnologies.com

Panolia Investor Relations Inc.

Brandon Chow

Principal & Founder

Phone: +1 (647) 598-8815

Email: brandon@panoliair.com

Legal Disclaimer

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described in this news release. Such securities have not been, and will not be, registered under the U.S. Securities Act, or any state securities laws, and, accordingly, may not be offered or sold within the United States, or to or for the account or benefit of persons in the United States or "U.S. Persons", as such term is defined in Regulation S promulgated under the U.S. Securities Act, unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption from such registration requirements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statement

This press release contains certain "forward-looking information" and/or "forward-looking statements" within the meaning of applicable securities laws. Such forward-looking information and forward-looking statements are not representative of historical facts or information or current condition but instead represent only Clear Blue's beliefs regarding future events, plans or objectives, many of which, by their nature, are inherently uncertain and outside of Clear Blue's control. Generally, such forward-looking information or forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or may contain statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "will continue", "will occur" or "will be achieved". The forward-looking information contained herein may include, but is not limited to, information concerning the Company's current and future financial position.

By identifying such information and statements in this manner, Clear Blue is alerting the reader that such information and statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Clear Blue to be materially different from those expressed or implied by such information and statements.

An investment in securities of Clear Blue is speculative and subject to several risks including, without limitation, the risks discussed under the heading "Risk Factors" in Clear Blue's listing application dated July 12, 2018. Although Clear Blue has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information and forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended.

In connection with the forward-looking information and forward-looking statements contained in this press release, Clear Blue has made certain assumptions. Although Clear Blue believes that the assumptions and factors used in preparing, and the expectations contained in, the forward-looking information and statements are reasonable, undue reliance should not be placed on such information and statements, and no assurance or guarantee can be given that such forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information and statements. The forward-looking information and forward-looking statements contained in this press release are made as of the date of this press release. All subsequent written and oral forward- looking information and statements attributable to Clear Blue or persons acting on its behalf is expressly qualified in its entirety by this notice."

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described in this news release. Such securities have not been, and will not be, registered under the U.S. Securities Act, or any state securities laws, and, accordingly, may not be offered or sold within the United States, or to or for the account or benefit of persons in the United States or "U.S. Persons", as such term is defined in Regulation S promulgated under the U.S. Securities Act, unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption from such registration requirements.

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276103

SOURCE: Clear Blue Technologies International Inc.