BoMill AB has received an order for BoMill InSight worth EUR 550,000 from the French agricultural cooperative group VIVESCIA, in collaboration with Tripette & Renaud, the exclusive distributor of BoMill in France.

Specialized in producing and adding value to grain, VIVESCIA is an international cooperative agri-food group owned by 9,000 farmers from the North-East of France.

The Group strives to take care of grain, from field to fork, thanks to a collective of men and women who are committed to sustainable plant-based industries. The Cooperative and its agricultural subsidiaries collect 2.8 million tons of grain every year. 2,000 beers brewed with

Malteurop malt are enjoyed every second worldwide. 1 Francine product is purchased every second in France. 1 in 3 French artisan bakers work with Grands Moulins de Paris. VIVESCIA also has expertise in the milling maize industry, with KALIZEA; in animal nutrition with NEALIA; and in biotechnology and the plant chemistry ecosystem with ARD.

The cooperative VIVESCIA is always thriving to increase the benefits for its farmer members and provide the best quality to its customers. BoMill InSight gives the opportunity to add value throughout the value chain.

The value of this order is EUR 550,000 and includes the supply and installation of BoMill InSight, at one of VIVESCIA cooperative's sites in France. The installation is scheduled for Q2 2026.

"We are really excited to receive this order from VIVESCIA and look forward to developing our relationship with such a renowned group, in collaboration with our partner Tripette & Renaud", said Andreas Jeppsson, CEO of BoMill AB.

"This order is an important step in our journey to establish BoMill InSight in the French market. We look forward to starting our collaboration and support VIVESCIA in adding further value to their business", commented Marc Doligé, President at Tripette & Renaud.

This press release contains inside information that BoMill AB (publ) is required to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication on November 28, 2025, at 14:10 CET.

For more information about BoMill, please contact:

Andreas Jeppsson, CEO - Phone: +46 (0)727 00 11 82 - E-mail: andreas.jeppsson@bomill.com

BoMill has developed and markets a patented technology for sorting grain on a commercial scale, based on the internal qualities of each kernel. The method is the only one of its kind on the market today and is estimated to have the potential to become a Golden Standard within the industry.

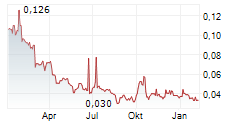

The company is listed on Nasdaq Stockholm First North Growth Market under the ticker: BOMILL.

Certified Adviser: Svensk Kapitalmarknadsgranskning AB - www.skmg.se

For more information about BoMill, please visit www.bomill.com

About VIVESCIA Group

VIVESCIA is an international, cooperative agri-food group with 7,000 employees in 25 countries, generating revenue of €3.8 billion for the year ending 30 June 2025. Specialising in producing and adding value to grain, VIVESCIA is owned by 9,000 farming entrepreneurs from the north-east of France.

The Group strives to take care of grain, from field to fork, thanks to a collective of men and women who are committed to sustainable plant-based industries. The Cooperative and its agricultural subsidiaries collect 2.8 million tonnes of grain every year. 2,000 beers brewed with Malteurop malt are enjoyed every second worldwide. 1 Francine product is purchased every second in France. 1 in 3 French artisan bakers work with Grands Moulins de Paris. We also have expertise in the milling maize industry, with KALIZEA; in animal nutrition with NEALIA; and in biotechnology and the plant chemistry ecosystem with ARD.

For more information: https://www.vivescia.com

For more information about VIVESCIA Group, please contact:

Marie Pfeiffer

E-mail: marie.pfeiffer@vivescia.com

Phone: +33 6 81 19 95 18