NEW YORK, NY / ACCESS Newswire / December 3, 2025 / A new front in global sanctions enforcement is opening, and it is not happening through banks, shipping logs, or border checkpoints. It is happening inside the gold supply itself. Gold has become the preferred currency of sanctioned regimes, shadow networks, and illicit finance because it moves easily, hides origins flawlessly, and loses its history the moment it touches a furnace. Unlike oil, grains, rare earths, or semiconductors, gold can vanish on contact with heat. As a result, billions in prohibited gold slip through global markets every year, and regulators have no way to tell the difference.

That loophole is now a geopolitical liability. Western governments cannot enforce sanctions effectively when the world's oldest store of value still moves through documentation systems designed for the 1950s. Certificates are forged. Serial numbers are tampered with. Bars are recast without a record. Once a bar is melted, even the most experienced refiner cannot tell where it came from. This blind spot is why sanctioned gold keeps reaching global vaults, and why enforcement agencies often discover violations years after the damage is done.

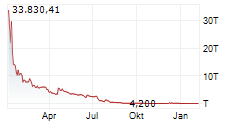

SMX (NASDAQ:SMX) stepped into this world with a technology that finally closes the gap between policy and enforcement. Gold with molecular identity cannot hide. It cannot launder itself through melting pots. It cannot erase its past. And with SMX's new $111.5 million equity purchase agreement ("EPA"), the company now has access to the capital needed to scale this verification architecture across the markets where sanctions matter most.

Sanctioned Gold Moves Because It Is Invisible; SMX Exposes It

The mechanics of sanctions evasion in gold are painfully simple. Take gold from a restricted region. Melt it with untainted material. Cast new bars with new stamps. Attach fresh documentation. And export through a permissive jurisdiction. The moment the metal changes form, the paper trail becomes fiction. This is not rare. It is the unspoken backbone of black-market gold flows. The system allows it because, before SMX stepped in, there was no forensic tool to stop it.

That invisibility gives hostile actors a funding channel that rivals oil and crypto. It gives sanctioned regimes an off-the-books export economy. It gives illicit miners a global laundering pipeline. And it leaves Western regulators chasing ghosts instead of catching criminals. The gold market was never designed for modern sanctions. It cannot police itself because the metal's identity disappears every time it's melted and cast.

SMX destroys the invisibility problem. Its molecular markers survive melting and refining, meaning the identity of gold survives every transformation. Regulators no longer have to trust certificates. They can authenticate the metal itself. Vaults no longer have to fear tainted inventory. They can verify bars with a scan. Enforcement agencies no longer lag years behind violations. They can intercept illicit gold before it enters the global system.

A Two-Tier Market: Compliant Gold and Everything Else

Once molecular identity enters the market, gold separates into two categories. Verified gold that meets sanctions requirements with forensic precision. And unverified gold that cannot prove anything. This split is not hypothetical. It is unavoidable. And here's why companies and miners may want to choose the verified side: Governments will favor the gold they can audit. Banks will prefer the gold they can insure. Exchanges will list the gold that carries no geopolitical risk. Everything else becomes a liability.

It's never been a secret that markets reward certainty and punish opacity. In this case, verified gold can command higher premiums, move faster, and clear compliance screens at levels legacy bullion never could. Unverified gold becomes a discount asset with regulatory baggage. The shift mirrors what happened in diamonds, scrap metals, and conflict minerals. Verification changes economic behavior because it eliminates doubt.

SMX is positioned to own the compliant tier. And it wants to share. Through its work with Goldstrom, DMCC, and sovereign-facing ecosystems, it is already aligning with markets where sanctions pressure is highest. The company's EPA gives it the strength to scale these systems across continents, making regulatory-grade verification accessible to refiners, vaults, and central banks.

Sanctions Will Be Enforced by Proof, Not Paper

Don't believe otherwise. The next decade of sanctions enforcement will not rely on diplomatic pressure or inspection programs. It will rely on forensic verification embedded inside the materials themselves. Gold is a battleground where this shift begins. Countries that trade verified gold will shape global standards. Countries that cling to legacy documentation will fall behind.

SMX built the tool that makes sanctions enforceable. It turns the world's most powerful asset into a transparent one. The governments that understand this first will control the flow of compliant gold. The refiners that adopt it early will win the highest-value markets. And the vaults that demand it will become the safest liquidity pools on earth. Not a bad trifecta. And certainly a massive opportunity for SMX.

About SMX

As global businesses face new and complex challenges relating to carbon neutrality and meeting new governmental and regional regulations and standards, SMX is able to offer players along the value chain access to its marking, tracking, measuring and digital platform technology to transition more successfully to a low-carbon economy.

Forward-Looking Statements

The information in this press release includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words "anticipate," "believe," "contemplate," "continue," "could," "estimate," "expect," "forecast," "intends," "may," "will," "might," "plan," "possible," "potential," "predict," "project," "should," "would" and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this press release may include, for example: matters relating to the Company's fight against abusive and possibly illegal trading tactics against the Company's stock; successful launch and implementation of SMX's joint projects with manufacturers and other supply chain participants of steel, rubber and other materials; changes in SMX's strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans; SMX's ability to develop and launch new products and services, including its planned Plastic Cycle Token; SMX's ability to successfully and efficiently integrate future expansion plans and opportunities; SMX's ability to grow its business in a cost-effective manner; SMX's product development timeline and estimated research and development costs; the implementation, market acceptance and success of SMX's business model; developments and projections relating to SMX's competitors and industry; and SMX's approach and goals with respect to technology. These forward-looking statements are based on information available as of the date of this press release, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing views as of any subsequent date, and no obligation is undertaken to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include: the ability to maintain the listing of the Company's shares on Nasdaq; changes in applicable laws or regulations; any lingering effects of the COVID-19 pandemic on SMX's business; the ability to implement business plans, forecasts, and other expectations, and identify and realize additional opportunities; the risk of downturns and the possibility of rapid change in the highly competitive industry in which SMX operates; the risk that SMX and its current and future collaborators are unable to successfully develop and commercialize SMX's products or services, or experience significant delays in doing so; the risk that the Company may never achieve or sustain profitability; the risk that the Company will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; the risk that the Company experiences difficulties in managing its growth and expanding operations; the risk that third-party suppliers and manufacturers are not able to fully and timely meet their obligations; the risk that SMX is unable to secure or protect its intellectual property; the possibility that SMX may be adversely affected by other economic, business, and/or competitive factors; and other risks and uncertainties described in SMX's filings from time to time with the Securities and Exchange Commission.

Contact: info@securitymattersltd.com

SOURCE: SMX (Security Matters) Public Limited

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/business-and-professional-services/the-sanctions-battleground-no-one-saw-coming-verified-vs-unverif-1114290