Aiforia Technologies announced that it had successfully carried out a directed share issuance, whereby it raises some € 4.2m in gross proceeds, issuing a total of 2m new shares. This coupled with reduced operating expenses should put the company notably closer to sustainable cash generation.

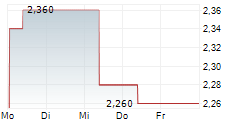

In detail, Aiforia issued 6.3% new shares at a 10% discount to previous day's close price of € 2.34. The directed share issuance alleviates short-term liquidity concerns. In fact, current cash on hand should be sufficient to finance operations throughout FY2026, in our view.

Mind you, in November, the company concluded change negotiations, which, according to management, will lead to annual cost savings of € 2.5m starting from 2026. As a result, the number of employees is reduced by 8. The change negotiations were justified by the company's management as a strategic pivot, whereby the company shifts focus from product development to product commercialisation.

In our initiation report from October 2025, we had estimated the cash burn, until Aiforia reaches positive FCF, to be € 27.8m. Following the change negotiations and the capital increase, we project the additional cash requirements to be in the tune of € 19.1m. Prior to our estimate changes, we viewed positive FCF as feasible by 2030e. however, this has now changed to 2029e. The cash burn for 2026e is projected to be € 9.3m.

As mentioned above, the directed share issuance alleviates short-term liquidity concerns, while the share price has been under pressure since the start of the year (-33% ytd.) Given the company's cash burn rate, which is largely being spend on sales, the company is expected to deliver strong growth figures in H2 2025, demonstrating that the commercialisation and scale period of the business is clearly underway.

In that respect we view the results of H2 2025 as a pivot point. In H1 2025, the company grew a timid 2% yoy, which in our view has largely contributed to the recent share price weakness. In must be highlighted however, that this performance was largely due to the weak performance of the Research segment. During the same time, Clinical, which is the scalable part of the business, grew by 60%. For FY25e, we model 66% growth in the Clinical segment compared to a 16% sales decline of the Research segment, which would translate to an aggregate yearly growth of 25%, eNuW.

Management clearly views the years 2026-28e as hyperscale years for Aiforia, translating into a CAGR of 65.4% for 2026-28e.

In sum, we view the present issuance as positive, easing Aiforia's short-term liquidity concerns. Going forward, all eyes will be on Aiforia's H2 2025 results, where strong growth is expected. We update our model only to reflect the cost savings from the change negotiations, which causes our PT to increase from € 3.50 to € 3.80 while we reiterate our BUY rating.

ISIN: FI4000507934