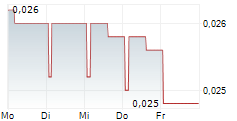

Today, December 19, 2025, Thunderful Group AB (the "Company") disclosed a press release with information that the board of directors of the Company has resolved, subject to approval by an extraordinary general meeting of the Company's shareholders, to carry out a directed share issue to one of its largest shareholders Atari SA (the "Shareholder"). If the extraordinary general meeting resolves on the directed share issue, Atari SA will hold more than 90 percent of the total number of shares and votes in the Company, after which the Shareholder intends to initiate compulsory redemption of the remaining shares in the Company and to seek a delisting of the Company's shares from Nasdaq First North Growth Market. The press release further stated that available funds in the Company are assessed to finance the Company's operations until March 2026.

The rules of Nasdaq First North Growth Market state that an issuer can be given observation status if there is uncertainty in respect of the issuer's financial position and if any other circumstance exists that results in a substantial uncertainty regarding the issuer or the pricing of its financial instruments.

With reference to the above, Nasdaq Stockholm AB decides that the shares in Thunderful Group AB (THUNDR, ISIN code SE0015195888, order book ID 210109) shall be given observation status.

For further information about this exchange notice please contact Enforcement & Investigations, telephone +46 8 405 70 50.