Phase I of Expansion Project is Anticipated to Nearly Triple Capacity from 40MW to 110MW

VANCOUVER, BC, Dec. 9, 2025 /CNW/ -- Bitzero Holdings Inc., (CSE: BITZ) (FSE: 000) ("Bitzero" or the "Company") the company redefining sustainable Blockchain and High-Performance Compute (HPC) data centers, announces that the next phase of its previously disclosed expansion program is underway at the Company's flagship data center site in Namsskogan, Norway. This expansion phase contemplates an additional 70 MW of installed capacity, which, if completed as planned, is expected to increase total site capacity to approximately 110 MW by September 2026, supplied entirely by hydro-electric energy and nearly tripling the site's power consumption.

Power Expansion

As part of the project, Bitzero plans to expand and operate an internal grid at the 132 kV level to enhance operational autonomy. The increased capacity is also expected to grow the site's exahash to approximately 7.0 EH/s, a significant step towards bringing Bitzero in line with some of the largest public miners in the industry. Simultaneously, it will significantly cut Bitzero's mining cost per Bitcoin, further reducing its already low breakeven point and boosting revenue by 3-4X, based on management's internal projections, however, actual outcomes will depend on a range of factors, including network difficulty, equipment performance, power availability and cost. The Company has ordered two high-voltage 60MVA substations, commenced site preparation, and initiated procurement of certain long-lead equipment in order to align with targeted delivery schedules and construction timelines.

"With the two high-voltage 60MVA substations ordered and delivery expected in the spring, crews have begun prepping the site, and we've already procured the other long-lead time equipment required to accelerate the timeline," said Bitzero's President and CEO Mohammed Bakhashwain. "Coming quickly on the heels of our Canadian Securities Exchange listing, this milestone is proof that we're on track to meet or beat our growth targets, enhancing our market position and driving shareholder value."

The Namsskogan site currently operates 40MW of capacity across 39 containers under favorable energy contracts, with an electricity cost of under US$0.04 per kWh. Bitzero's cost-effective, high-efficiency operation is a result of its unique approach to developing and leveraging renewable energy.

"I've said from the beginning that focusing on infrastructure investment is the smart move when it comes to high performance computing -- that an asset first strategy is the best way to capture maximum value, secure growth and minimize volatility," said high-profile Bitzero investor and world-renowned venture capitalist Kevin O'Leary. "Bitzero's 100% renewable energy supply not only makes it more sustainable, economical and community-friendly, but also a superior investment, in my opinion."

To learn more about the Namsskogan or other Bitzero sites, visit www.bitzero.com.

German Listing

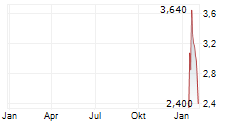

The Company is also pleased to announce that the Company's voting shares have been accepted for listing on the Frankfurt Stock Exchange (the "FSE") and commenced trading on December 8, 2025, under the symbol "000". The Company's voting shares are now cross-listed for trading on the Canadian Securities Exchange ("CSE") and the FSE.

The FSE is one of the world's largest and most liquid trading venues, providing access to a wide base of institutional and retail investors across Europe. The listing marks an important step in expanding the Company's market visibility and strengthening its international presence. By listing on the FSE, the Company expects to increase trading liquidity and broaden engagement with global investors.

About Bitzero Holdings Inc.

Bitzero Holdings Inc. is a provider of IT energy infrastructure and high-efficiency power for data centers. The Company focuses on data center development, Bitcoin mining, and obtaining strategic data center hosting partnerships. Bitzero Holdings Inc. now has four data center locations in the North American and Scandinavian regions, powered by clean, low-carbon energy sources. Visit www.bitzero.com for more information.

Bitzero Contact

Mohammed Bakhashwain

+44 777 303 0394

[email protected]

Bitzero Press Contact

Shannon Tucker

[email protected]

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities laws. Forward-looking information in this release includes, without limitation, statements regarding: the timing, scope and completion of the 70 MW expansion phase; expected installed capacity at the Namsskogan site (approximately 110 MW by September 2026); planned operation of an internal 132 kV grid and the delivery/installation of two 60 MVA substations and other equipment; expected hash rate capacity (approximately 7.0 EH/s) following completion; anticipated efficiency and operating cost impacts; and continued access to hydro-electric power and power pricing. Forward-looking information is not historical fact and is based on management's current expectations and assumptions.

Material assumptions underlying the forward-looking information include, among other things: timely equipment deliveries and construction progress; successful permitting, interconnections and commissioning; stable electricity supply and pricing; availability and performance of mining hardware consistent with specifications; workforce and contractor availability; Bitcoin network difficulty and transaction fees within ranges contemplated by the Company; and Bitcoin prices in ranges used for internal planning.

Material risk factors that could cause actual results to differ materially from the forward-looking information include, among others: construction delays; equipment delivery or performance issues; changes in power availability or cost; curtailment events; permitting or regulatory outcomes; changes in law or policy affecting data centers or digital asset mining; increases in network difficulty and/or decreases in Bitcoin price; cybersecurity events; site-specific operating risks; and the factors described under "Risk Factors" in the Company's continuous disclosure filings available at www.sedarplus.ca. Readers are cautioned not to place undue reliance on forward-looking information.

Forward-looking information is provided for the purpose of assisting readers in understanding management's current plans, objectives and expectations regarding the Project and may not be appropriate for other purposes. The Company does not undertake any obligation to update or revise the forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

SOURCE Bitzero