22.12.2025 20:00:00 EET | Eagle Filters Group Oyj | Inside information

Based on the authorization granted by the Annual General Meeting of the Company on 15 April 2025, the Board of Directors of Eagle Filters Group Oyj ("Eagle Filters Group" or the "Company") have on 22 December 2025 resolved on a directed share issue of EUR 800 000 to a group of private investors (the "Share Issue").

In the Share Issue, 12 307 691 new shares (the "Offer Shares") were offered. The subscription price in the Share Issue was set at EUR 0.065 per Offer Share and amounts to a total of EUR 800 000. The entire subscription price of the Offer Shares will be recorded in the Company's reserve for invested unrestricted equity.

The reasons for the deviation from the shareholders' preemptive rights was to raise capital in a time and cost-effective manner. As communicated on 13 June 2025, the company has tied up working capital for a large customer project and has limited sources of additional working capital and debt financing to compensate for the temporary increase in working capital needs. Eagle is a subcontractor to this project where a large corporation has won a contract to deliver various gas turbine components. The deliveries for this project have been delayed further due to customer-related reasons, resulting in continued shortage in working capital. Eagle's deliveries for the project are expected to commence in the near future. The Board has decided that carrying out a Directed share issue is the best solution for all company shareholders, as organizing a rights issue would cause significantly higher costs and there would be a material risk that the rights issue would remain substantially undersubscribed. In addition, the timetable for organizing a rights issue would negatively affect the company's ability to carry out its business as planned. Considering the Company's operating environment, with fast-paced changes in working capital needs (due to for example new orders, delays in inbound material or customer payments) as well as the company's limited sources of working capital- and debt financing a Directed Share Issue is as this point the best way to raise capital in a time and cost-effective manner.

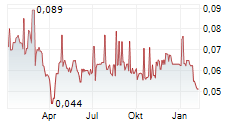

The subscription price equals to a discount of 7.1% to the closing price of the Company's share on First North Growth Market Finland on 22 December 2025. The discount related to the subscription price has been negotiated.

The Offer Shares has been offered for subscription to the following investors in deviation from the shareholders' pre-emptive subscription right:

Investor | Number of Offer Shares | Subscription price in total (EUR) |

Ville Väätäjä | 4 615 384 | 300 000 |

Jarkko joki-Tokola | 4 615 384 | 300 000 |

Joint Effects LLC | 3 076 923 | 200 000 |

12 307 691 | 800 000 |

The Offer Shares has been offered to current shareholders of the company. The reason for offering shares to the company's current shareholders is that the company has limited sources of additional working capital and debt financing to compensate for the temporary increase in working capital needs. The Company's current shareholders, to whom shares are offered have as a result of negotiations agreed to finance the company.

The Offer Shares represent approximately 5.2 % of the outstanding shares and votes in the Company after the Share Issue. Following the Share Issue, the number of issued and outstanding shares of the Company will be 235 918 555.

To execute Eagle Filters growth-strategy, management is actively evaluating ways for more effective use of capital. Due to postponed deliveries and increased levels of finished goods inventory, working capital requirements have risen, and the company is dependent on incoming proceeds from new orders. If the business does not develop as planned, Eagle Filters Group plans to cut costs accordingly and/or raise the necessary funding to support its working capital, investment needs, and liquidity.

EAGLE FILTERS GROUP OYJ

Board of Directors

For more information:

Jarkko Joki-Tokola, CEO, Eagle Filters Group Oyj. jarkko@eaglefiltersgroup.com

Eagle Filters Group Oyj discloses the information provided herein pursuant to the Market Abuse Regulation ((EU) No 596/2014, "MAR"). The information was submitted for publication by the aforementioned person on 22 December 2025 at 20:00 (EET).

About Eagle Filters Group Oyj

Eagle Filters Group is a material science company that aims to enable a green and healthy environment.

Eagle provides high performance filtration solutions that cut CO2 emissions and increase profitability of the energy industry. Eagle's technology improves performance and energy efficiency while cutting costs. The technology is being used by some of the world's largest energy utilities.

The company group is listed on First North Growth Market Finland under the ticker EAGLE. The Company's Certified Adviser is DNB Carnegie Investment Bank AB.

www.eaglefiltersgroup.com