EQS-News: IuteCredit Finance S.à r.l.

/ Key word(s): Mergers & Acquisitions/Investment

Iute Group Strives to Enter Ukraine with Acquisition of Banking License The purchase price is expected to amount to EUR 120 thousand and will be financed from existing Group liquidity. Iute Group applies a strict investment discipline and expects the net loss of the Ukrainian banking operations in 2026 not to exceed EUR 3 million. Following completion of the transaction, the Ukrainian bank entity is to become the legal successor to selected assets and deposit liabilities of RWS Bank. The assets to be transferred consist primarily of government bonds and cash, while loan portfolio and no related credit risk to be excluded. Approximately 13,000 retail customers together with their accounts and deposits are expected to be transferred as part of the transaction. No branch network is to be taken over. The planned entry into Ukraine is to support Iute Group's long-term objective to expand its digital-first banking model and to provide simpler, faster and fairer financial services through digital channels. Ukraine has developed into one of Europe's most digital financial markets in recent years, with a large population and high adoption of digital financial services. Iute Group's risk-controlled entry structure would allow participation in this long-term growth potential while maintaining clearly defined capital and loss limits. The bank is to be led by Arthur Muravitsky, an experienced Ukrainian banking executive with more than 22 years in the financial sector. He has most recently served as Deputy CEO and Management Board Member at TASCOMBANK and previously held senior roles at Ukrposhta, Finance Bank, and VTB Bank in Ukraine. Initial activities are planned to focus on capitalizing the bank, building the core team, and preparing the launch of digital banking services. The bank is to operate under the brand IuteBank. Kristel Kurvits, Group Chief Financial Officer (CFO) Iute Group is a digital banking group focused on everyday financial services in Southeast Europe. Established in 2008 and headquartered in Estonia, Iute serves customers in Albania, Bulgaria, Moldova, North Macedonia, and Ukraine. Through the Myiute app and its local operations, Iute provides digital financial services including payments, banking, financing, and insurance intermediation. Iute Group finances its operations through equity, deposits, and secured bonds listed on the Regulated Market of the Frankfurt Stock Exchange and the Nasdaq Baltic Main List. www.iute.com 06.01.2026 CET/CEST Dissemination of a Corporate News, transmitted by EQS News - a service of EQS Group. |

| Language: | English |

| Company: | IuteCredit Finance S.à r.l. |

| 14, rue Edward Steichen | |

| 2540 Luxembourg | |

| Luxemburg | |

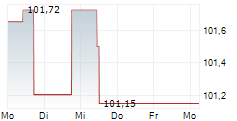

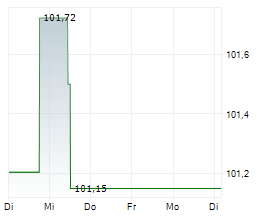

| ISIN: | XS2378483494, XS3047514446 |

| WKN: | A3KT6M, A4D95Q |

| Listed: | Regulated Market in Frankfurt (General Standard); Regulated Unofficial Market in Berlin, Dusseldorf, Hamburg, Hanover, Munich, Stuttgart, Tradegate Exchange |

| EQS News ID: | 2255026 |

| End of News | EQS News Service |

2255026 06.01.2026 CET/CEST