Vancouver, British Columbia--(Newsfile Corp. - January 6, 2026) - Scottie Resources Corp. (TSXV: SCOT) (OTCQB: SCTSF) (FSE:SR80) ("Scottie" or the "Company") is pleased to report new assays from its 2025 drilling of the Blueberry Contact Zone within the Scottie Gold Mine Project ("Scottie Gold Mine" or the "Project"). The road-accessible Scottie Gold Mine Project, which includes the 100%-owned past-producing Scottie Gold Mine and the adjacent Blueberry Contact Zone, is located 35 kilometres north of Stewart, BC, and is the subject of a newly released Preliminary Economic Assessment ("PEA") (Bird et al., October 28, 2025, Scottie Gold Mine Project, SEDAR+).

"We are very pleased to kick off 2026 with another set of strong drill results from the Blueberry Contact Zone," stated Brad Rouke, CEO. "Blueberry remains the cornerstone to our recent PEA and DSO mine plan, delivering early high-grade ounces from an open pit and then transitioning into a robust underground operation. At today's gold prices the open pit scenario alone has the potential to fund both mine construction and the development of the underground, a tremendous position for a junior company to be in."

Drilling in 2025 was designed to expand the existing resource while increasing geological confidence in the known zones, supporting the planned conversion of resources from the inferred to indicated category. Results from 2025 drilling are continuing to come in. The Scottie Gold Mine zones remain open in multiple directions, representing meaningful opportunity to continue growing the Project's overall resource base.

Highlights:

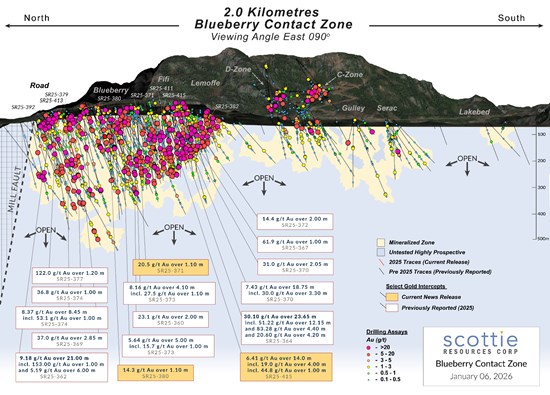

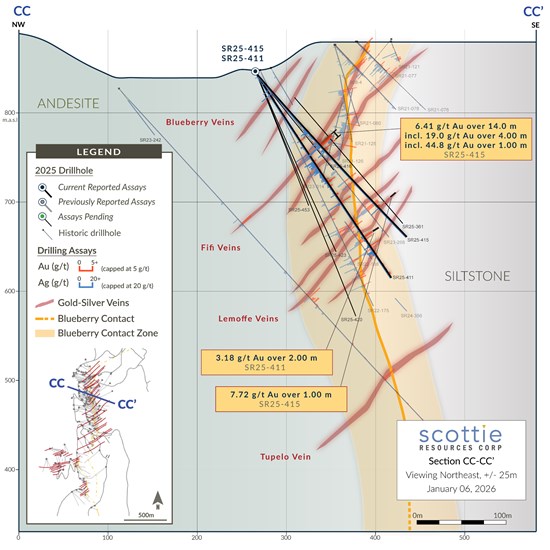

SR25-415 intersected 6.41 grams per tonne (g/t) gold over 14.00 metres (m), including 19.0 g/t gold over 4.00 m in the Fifi vein zone (Table 1, Figures 1,2,3).

SR25-413 intersected 3.50 g/t gold over 5.35 m including 6.35 g/t gold over 2.10 m at the Blueberry Vein Zone (Table 1, Figures 1,2).

SR25-371 intersected 20.50 g/t gold over 1.10 m at the Fifi vein zone (Table 1, Figures 1,2).

Table 1: Highlight results from new drill assays (uncut) - Blueberry Contact Zone

| Drill Hole | From (m) | To (m) | Width* (m) | Gold (g/t) | Silver (g/t) | Sub Zone | |

| SR25-371 | 162.55 | 163.65 | 1.10 | 20.50 | 3.00 | Fifi | |

| 202.80 | 203.85 | 1.05 | 1.16 | 0.00 | Fifi | ||

| 207.35 | 208.70 | 1.35 | 7.18 | 6.00 | Fifi | ||

| SR25-379 | 26.00 | 29.00 | 3.00 | 1.17 | 0.00 | Road | |

| SR25-380 | 82.65 | 83.75 | 1.10 | 2.20 | 0.00 | BB Vein | |

| 116.95 | 117.95 | 1.00 | 14.30 | 6.00 | BB Vein | ||

| SR25-382 | 13.10 | 15.50 | 2.40 | 4.22 | 1.25 | Fifi | |

| 45.00 | 46.00 | 1.00 | 7.18 | 4.00 | Lemoffe | ||

| 76.75 | 77.75 | 1.00 | 1.72 | 12.0 | Lemoffe | ||

| SR25-392 | 129.00 | 132.00 | 3.00 | 10.0 | 7.00 | Road | |

| SR25-411 | 90.00 | 91.00 | 1.00 | 1.96 | 4.00 | BB Vein | |

| 145.45 | 147.55 | 2.10 | 2.13 | 3.00 | Fifi | ||

| 173.00 | 174.00 | 1.00 | 3.77 | 85.0 | Fifi | ||

| 219.00 | 221.00 | 2.00 | 3.18 | 3.00 | Lemoffe | ||

| 231.65 | 232.70 | 1.05 | 3.97 | 9.00 | Lemoffe | ||

| SR25-413 | 72.25 | 73.35 | 1.10 | 8.80 | 2.00 | Road | |

| 133.65 | 134.65 | 1.00 | 4.74 | 5.00 | BB Vein | ||

| 199.10 | 204.45 | 5.35 | 3.50 | 0.82 | BB Vein | ||

| including | 202.35 | 204.45 | 2.10 | 6.35 | 2.10 | BB Vein | |

| SR25-415 | 104.00 | 118.00 | 14.0 | 6.41 | 7.64 | Fifi | |

| including | 107.00 | 111.00 | 4.00 | 19.0 | 16.3 | Fifi | |

| including | 109.00 | 110.00 | 1.00 | 44.8 | 25.0 | Fifi | |

| 205.00 | 206.00 | 1.00 | 7.72 | 13.0 | Lemoffe | ||

| *True width of the intervals has not yet been established by drilling | |||||||

Figure 1: Segmented vertical long section of the Blueberry Contact Zone illustrating the distribution and status of drilled targets from the 2025 season and the reported results thus far, relative to intercepts from previous drilling campaigns.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11118/279533_32eaa6b13419194e_002full.jpg

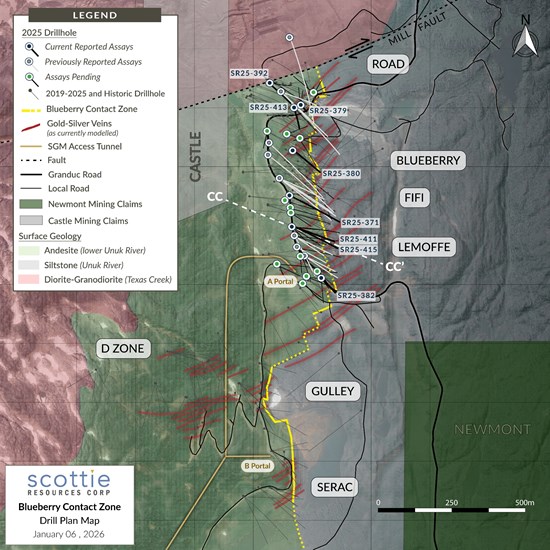

Figure 2: Overview plan view map of the Blueberry Contact Zone, illustrating the locations of the reported drill results, cross-sections (Figure 3), and the distribution of the modelled sulphide-rich cross-structures.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11118/279533_32eaa6b13419194e_003full.jpg

About the Scottie Gold Mine Project

Over the past six years, exploration at the Scottie Gold Mine Project has delivered exceptional results - highlighted by the discovery of four new high-grade zones (Blueberry Contact Zone, Domino, D-Zone, and P-Zone) and the expansion of several historically drilled targets (Scottie Gold Mine, C-Zone, Bend Vein, and Stockwork).

A clear spatial relationship has emerged between these high-grade zones and the contact with the Jurassic-aged Texas Creek Plutonic Suite, providing a powerful framework for ongoing targeting. Detailed geological, structural, mineralogical, and geochemical studies now point to a shared mineralizing event across the property - linking the deposits into a broader, interconnected system with significant growth potential.

The Blueberry Contact Zone, located 2 km northeast of the 100%-owned past producing Scottie Gold Mine in BC's Golden Triangle, has rapidly advanced from a lightly drilled high-grade vein

Figure 3: Cross-section displaying Blueberry Contact Zone intercepts from drill hole SR25-411 and 415.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11118/279533_32eaa6b13419194e_004full.jpg

showing into a major growth target. The target was significantly advanced during Scottie's 2019 drill program when an interval was intersected in a new N-S oriented zone adjacent to the main Blueberry Vein. The drill results received from 2020 - 2024, coupled with surficial mapping and sampling suggest that the N-S mineralized trend is a controlling structure that hosts an array of SW-trending, sub-parallel, sulphide-rich veins that obliquely crosscut it which host high-grade gold. As of the end of 2024, the extent of the N-S zone, defined by the contact between andesite and siltstone units of the Hazelton Formation and the presence of the cross-cutting sulfide-rich structures, has a drilled strike length of >1,550 metres and has been tested to >525 metres depth. The Blueberry Contact Zone is located on the Granduc Road, 20 kilometres north of the Ascot Resources' Premier Mine. Newmont's Brucejack Mine is located 25 kilometres to the north.

The Company has recently completed a PEA which evaluates a low-capital DSO operation to deliver a gold-rich gravel product to Asian copper/precious metals smelters. At a gold price of US$2600/oz the project estimates an after-tax NPV(5%) of $215.8 M CAD with an IRR of 60.3%. By design, the operation will eliminate the need for a gold processing plant and tailings facility, thereby significantly reducing the capital required and resulting in a minimal environmental footprint, resulting in an initial capital cost of $128.6 M CAD. The project envisages a shallow open pit on the Blueberry Zone to start, followed by underground production from both Blueberry and the past-producing Scottie Gold Mine. The PEA also evaluates a toll milling scenario through the nearby Premier Mill, which results in an after-tax NPV(5%) $380.1 M CAD and an IRR 89.9%.

Scottie's 2025 Bulk Sample program exemplifies the unique characteristics of this mining project, and its ability to rapidly progress. From permitting to mining, crushing, transporting, shipping and sale of the product, the program was executed in under a year, generating an estimated $9M in new revenue. With this proven pathway, Scottie's has confidence in the simplicity and efficiency of its DSO model.

Quality Assurance and Control

Results from samples taken during the 2025 field season were analyzed at SGS Minerals in Burnaby, BC. The sampling program was undertaken under the direction of Dr. Thomas Mumford. The majority of drill core was NQ in diameter, with select holes of HQ size primarily taken for geomechanical purposes. Prior to sampling drill core was cut in half lengthwise, with half sent for assay and the remaining half kept in Stewart, BC. Standards, blanks, and duplicate samples were taken at intervals and frequencies that meet or exceed industry best practices. A secure chain of custody is maintained in transporting and storing all samples. Gold was assayed using a fire assay with atomic absorption spectrometry and gravimetric finish when required (+9 g/t gold). Analysis by four acid digestion with multi-element ICP-AES analysis was conducted on all samples with silver and base metal over-limits being re-analyzed by emission spectrometry.

Dr. Thomas Mumford, P.Geo., non-independent President of the Company, a qualified person under National Instrument 43-101, has reviewed and approved the technical information contained in this news release on behalf of the Company.

ABOUT SCOTTIE RESOURCES CORP.

Scottie Resources holds 100% interest in the Scottie Gold Mine Property, which includes the high-grade, past-producing Scottie Gold Mine and the adjacent Blueberry Contact Zone. The Company also owns a 100% interest in the Georgia Project, host to the past-producing Georgia River Mine, as well as the Cambria, Sulu, and Tide North properties. In total, Scottie controls approximately 58,500 hectares of highly prospective mineral claims within the Stewart Mining Camp in British Columbia's Golden Triangle-one of the world's most prolific mineralized districts.

Scottie's current resource estimate on the Scottie Gold Mine Project includes a total of 703,000 gold ounces at an average grade of 6.1 g/t (Inferred category) in 3.6 millon tonnes, highlighting the development potential for a significant near-surface, high-grade deposit. The Company's strategy is to continue expanding this resource and to define additional mineralization around past-producing mines through systematic drilling and surface exploration.

The Company has recently completed a PEA for the Scottie Gold Mine. The PEA outlines a robust Direct-Ship Ore (DSO) development scenario with strong economics and significant upside through a potential toll-milling option utilizing excess capacity at the nearby Premier mill. The base case DSO project delivers an after-tax NPV(5%) of $215.8-$668.3 million at gold prices of US$2,600-$4,200/oz, respectively. Under the toll-milling scenario, project economics improve substantially, with an after-tax NPV(5%) of $380.1-$831.7 million (no agreement currently in place). The PEA estimates initial capital costs of $128.6 million, average annual production of ~65,400 oz gold over seven years, and a payback period of 1.7 years for the after-tax DSO case-reduced to just 0.9 years under the toll-milling opportunity at US$2,600/oz.

Additional Information

Brad Rourke

CEO

+1 250 877 9902

brad@scottieresources.com

Forward-Looking Statements

This news release may contain forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date such statements were made. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of TSX Venture Exchange) accepts responsibility for the adequacy of accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/279533

Source: Scottie Resources Corp.