EQS-News: CPI PROPERTY GROUP

/ Key word(s): Share Buyback

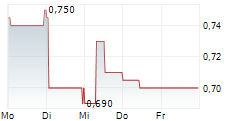

CPI Property Group Luxembourg, 14 January 2026 CPI PROPERTY GROUP - Results of the Share Buy-back Offer On 9 January 2026, CPI PROPERTY GROUP ("CPIPG" or the "Company") announced the intention to purchase up to 200,000,000 shares under CPIPG's share buy-back programme, and published the terms and conditions of the buy-back offer (the "Offer"). At the closing of the Offer period, shareholders of the Company presented a total of 192,010,309 shares for tender at a price of €0.776 per share for a total of about €149 million. In line with the terms of the Offer, the Company anticipates the signing of share transfer agreements on 15 January and the settlement on 16 January 2026. Upon completion of the buy back of the shares tendered in the Offer, CPIPG shall be the owner of own shares not exceeding 5% of the voting rights. More precisely, the Company will directly hold 192,010,309 own shares, which represent approx. 2.28% of the total 8,436,604,025 shares outstanding. In addition, the Company's indirect subsidiary, Pietroni, holds 67,000,000 Company shares (0.79% of the total shares outstanding). On a consolidated basis, the Company will thus hold and control 259,010,309 own shares, which represent approximately 3.07% of the total 8,436,604,025 shares outstanding. The voting rights attached to these 259,010,309 own shares are suspended. For further information, please contact: Investor Relations Moritz Mayer Manager, Capital Markets m.mayer@cpipg.com For more on CPI Property Group, visit our website: www.cpipg.com Follow us on X (CPIPG_SA) and LinkedIn 14.01.2026 CET/CEST Dissemination of a Corporate News, transmitted by EQS News - a service of EQS Group. |

| Language: | English |

| Company: | CPI PROPERTY GROUP |

| 40, rue de la Vallée | |

| L-2661 Luxembourg | |

| Luxemburg | |

| Phone: | +352 264 767 1 |

| Fax: | +352 264 767 67 |

| E-mail: | contact@cpipg.com |

| Internet: | www.cpipg.com |

| ISIN: | LU0251710041 |

| WKN: | A0JL4D |

| Listed: | Regulated Market in Frankfurt (General Standard); Regulated Unofficial Market in Dusseldorf, Stuttgart |

| EQS News ID: | 2260244 |

| End of News | EQS News Service |

2260244 14.01.2026 CET/CEST

© 2026 EQS Group