Calgary, Alberta--(Newsfile Corp. - January 19, 2026) - Simply Solventless Concentrates Ltd. (TSXV: HASH) ("SSC" or "the Company") is pleased to provide updates regarding its previously announced cultivation facility retrofit by its wholly owned subsidiary, Humble Grow Co. ("Humble"), and the integration of past acquisitions and related cost savings achieved.

Humble Retrofit

Jeff Swainson, SSC's President & CEO stated: "All Humble retrofit LED lights have now been ordered from existing working capital sources, and we will provide definitive installation timelines as we progress. Preliminary schedules suggest 100% retrofit production by early Q3 2026, and once this run-rate is achieved, SSC's annual gross revenue is expected to increase by $17.5-$29.5 million to $53.5-$65.5 million. With Humble fixed costs remaining consistent with pre-retrofit levels, most incremental gross margin is expected to flow to the EBITDA line, increasing SSC's annual adjusted EBITDA by $6.5-$14.5 million to $10.7-$18.7 million."

Swainson continued: "This $1.5 million net capital investment is expected to provide material increases to revenue, adjusted EBITDA, and cash flow, and with a payback period of less than one year, we are excited to capture this return on investment for our shareholders. Post-retrofit, Humble is expected to be one of the only large scale, high-quality indoor cultivation assets capable of underpinning a leading position in Canadian cannabis, and with almost all such assets currently owned by the major Canadian licenced producers, SSC will be uniquely positioned among junior Canadian licenced producers."

Humble has gathered two years of data regarding the efficacy of a retrofit at its 98,000 square foot facility located in Winnipeg, Manitoba. The retrofit uses the existing floor plan and is comprised of a lighting change to LED, table placement changes, additional irrigation, installation of dehumidifiers, and alterations to air circulation. These changes triple light intensity, and provide more consistent lighting, better nutrient uptake, and superior humidity and air circulation. The capital cost for the retrofit is approximately $2.5 million ($1.5 million net of expected government rebates).

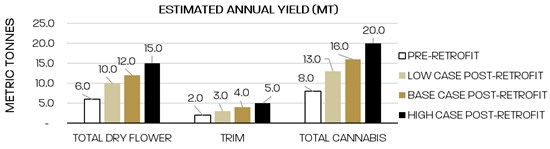

Exhibit A - Current and Post-Retrofit Low, Base, and High Case Production (in Metric Tonnes "MT")

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11433/280766_b9bc536c5412dab2_001full.jpg

All of Humble's flower is currently sold every month on a B2B basis to other licensed producers ("LPs"). This flower services the international and domestic recreational cannabis markets ("CPG").

50% B2B and 50% CPG Humble Retrofit Financial Projections

SSC has taken steps to expand its markets in anticipation of incremental retrofit production. Post retrofit, SSC will continue to service the B2B market domestically and internationally, and it expects to also participate in the recreational cannabis market on a CPG basis with its own brands. Assuming a sales mix of 50% B2B and 50% CPG, annualized financial projections by case are below:

Exhibit B - SSC Post-Retrofit Proforma Financial Highlights: 50% B2B & 50% CPG

| LOW CASE | BASE CASE | HIGH CASE | |

| Gross Revenue (Q3 2025 SSC Annualized) | $36.0M | $36.0M | $36.0M |

| Humble Increase, full year (2, 3, 4) | $17.5M | $22.5M | $29.5M |

| Proforma | $53.5M | $58.5M | $65.5M |

| Corporate Growth % Gross Revenue | 49% | 63% | 82% |

| Gross Revenue per share (7) | $0.46 | $0.51 | $0.57 |

| Adj. EBITDA, (Q3 2025 SSC Annualized) (8) | $4.2M | $4.2M | $4.2M |

| Humble Increase, full year (5,6) | $6.5M | $10.0M | $14.5M |

| Proforma | $10.7M | $14.2M | $18.7M |

| Corporate Growth % Adj. EBITDA | 155% | 238% | 345% |

| Adjusted EBITDA per share (7) | $0.09 | $0.12 | $0.16 |

- See Exhibit A for expected annual cultivation output and expected annual salable flower component of annual total cannabis production: The difference between annual cannabis production and annual saleable flower is expected production of cannabis trim, which is not ascribed any value in forecasted financial information.

- SSC is expected to enter into the dry flower category in the Canadian CPG market, and is expected to allocate approximately 50% of annual saleable flower under each of the Low Case, Base Case and High Case scenarios to the CPG market, 25% of saleable flower to the Canadian B2B market, and 25% of saleable flower to the international B2B market; subject to market conditions.

- SSC has assumed the following per gram pricing for saleable cannabis flower: CPG saleable flower $3.00/gram; Canadian B2B saleable flower $1.60/gram; international B2B saleable flower $1.90/gram.

- Management expects excise taxes to apply only to revenue associated with CPG saleable flower at an estimated rate of approximately 21% of Annualized Gross Revenue of the Humble increase.

- Management expects current Humble operating costs to be maintained given the retrofit is not increasing the footprint of the Humble facility. Incremental packaging and variable costs are expected to be incurred commensurate with the increased saleable flower production, estimated to be $0.35/g for CPG saleable flower and $0.05/g for all B2B saleable flower.

- Management does not expect material increase in overhead costs or salaries post-retrofit. However, increased sales and marketing costs are expected to be incurred with the launch and continued marketing of dry flower brands and products. This is expected to impact only sales in the CPG channel and is incorporated as a reduction to the per gram price received for sales in this channel - See Note 3.

- Per share values calculated using weighted average common shares outstanding for the three months ended September 30, 2025, of 115,502,799.

- Adjusted EBITDA is a non-IFRS measure and Adjusted EBITDA per share is a non-IFRS ratio. See "Non-IFRS Financial Measures" below.

Acquisition Integration & Cost Savings Update

Over the past 18 months, SSC completed four acquisitions. See SSC's MD&A for the three and nine months ended September 30, 2025 for further information regarding these acquisitions, which is available on SSC's SEDAR+ profile at www.sedarplus.ca.

As of December 2025, the integration of these acquisitions is substantially complete.

Exhibit C - EFFECT OF SSC ACQUISITIONS AND CONSOLIDATION ON HEADCOUNT AND PAYROLL

| AGGREGATE (PRE-ACQUISITION) | AT DECEMBER 31 2025 | REDUCTION ($) | REDUCTION (%) | |

| Headcount | 319 | 175 | 144 | 45% |

| Payroll | $17.7M per Year | $9.9M per Year | $7.8M per Year | 44% |

- Aggregate of each entity's headcount and payroll on the date of each respective acquisition.

Mr. Swainson continued: "SSC has achieved an estimated $7.8 million in annual payroll cost savings (44%) when comparing pre and post acquisition levels. SSC's thesis was that consolidation would result in significant synergies and cost savings, and this has now been proven. We are encouraged by the impact that these cost savings will have on our future operations with baseline revenue levels now achieved."

About Simply Solventless Concentrates Ltd.

SSC is a public company incorporated under the Business Corporations Act (Alberta). SSC's mission is to provide pure, potent, terpene-rich ready to consume cannabis products to discerning cannabis consumers. For more information regarding SSC, please see www.simplysolventless.ca.

Simply Solventless Concentrates Ltd.

Jeff Swainson, President and CEO

Phone: 403-796-3640

Email: jeff@simplysolventless.ca

Notice on Forward Looking Information

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable securities laws. Any statements that are contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "will", "estimates", "believes", "intends", "expects", "projected" and similar expressions which are intended to identify forward-looking statements. More particularly and without limitation, this press release contains forward looking statements concerning proforma revenue and Adjusted EBITDA, plans and results related to the Humble retrofit, including timing of production from the retrofit, SSC being uniquely positioned among junior Canadian LPs, SSC entering the dry flower category in the Canadian CPG market and the cost savings from SSC's acquisitions. SSC cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, assumptions and expectations, many of which are beyond the control of SSC, including expectations and assumptions concerning SSC, the ability to realize expected revenue and cost synergies on the timelines expected, the ability to maintain relationships with customers, employees and suppliers, the timing and market acceptance of products, competition in SSC's markets, SSC's reliance on customers, fluctuations in interest rates, SSC's ability to maintain good relations with its customers, employees and other stakeholders, changes in law or regulations, SSC's ability to protect its intellectual property, as well as other risks and uncertainties, including those described in SSC's filings available on SEDAR+ at www.sedarplus.ca including SSC's most recent annual information form. The reader is cautioned that assumptions used in the preparation of any forward-looking statements may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted as a result of numerous known and unknown risks, uncertainties and other factors, many of which are beyond the control of SSC.

The reader is cautioned not to place undue reliance on any forward-looking statements. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

The forward-looking statements contained in this press release are made as of the date of this press release, and SSC does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by securities law.

Future Oriented Financial Information

This press release contains future-oriented financial information and financial outlook information (collectively, "FOFI") about gross revenue and adjusted EBITDA, which are subject to the same assumptions, risk factors, limitations and qualifications as set forth in the above paragraphs. FOFI contained in this document was approved by management as of the date of this document and was provided for the purpose of providing further information about SSC's future business operations. SSC and its management believe that FOFI has been prepared on a reasonable basis, reflecting management's best estimates and judgments, and represent, to the best of management's knowledge and opinion, SSC's expected course of action. However, because this information is highly subjective, it should not be relied on as necessarily indicative of future results. SSC disclaims any intention or obligation to update or revise any FOFI contained in this document, whether as a result of new information, future events or otherwise, unless required pursuant to applicable law. Readers are cautioned that the FOFI contained in this document should not be used for purposes other than for which it is disclosed herein. Differences in the timing of capital expenditures or revenues and variances in production estimates can have a significant impact on the key performance measures included in SSC's guidance. SSC's actual results may differ materially from these estimates.

Non-IFRS Financial Measures

This press release contains certain financial performance measures and ratios that are not recognized or defined under IFRS (termed "Non-GAAP Measures"). As a result, this data may not be comparable to data presented by other cannabis companies. For an explanation of these measures to related comparable financial information presented in the Financial Statements prepared in accordance with IFRS, refer to the discussion below. The Company believes that these Non-GAAP Measures are useful indicators of operating performance and are specifically used by management to assess the financial and operational performance of the Company. These Non-GAAP Measures include, but are not limited to adjusted EBITDA and adjusted EBITDA per share.

The definitions below should be read in conjunction with the "Cautionary Statement Regarding Non- GAAP Performance Measures" section of SSC's MD&A dated November 27, 2025, which includes a discussion of the purpose and composition of the specified financial measures and ratios and detailed reconciliations to the most directly comparable IFRS financial measures.

Adjusted EBITDA is not defined under IFRS and therefore should not be considered an alternative to, or more meaningful than net income (loss) and comprehensive income (loss). Adjusted EBITDA is calculated as net income before interest and finance costs, taxes, depreciation and amortization expenses, share based compensation, gain settlement or disposal or bargain purchase gains, non-recurring restructuring costs and acquisition costs, foreign exchange gains and losses and government rebates, and other gains or costs that are expected to be non-recurring. Adjusted EBITDA is considered a useful measure by management to understand profitability excluding the effects of capital structure, taxation and depreciation, and non-recurring items, but may not be appropriate for other purposes.

Adjusted EBITDA per share is used by the Company as a key performance indicator to evaluate the performance of SSC on a per share basis. The basic and/or diluted weighted average common shares outstanding used in the calculation of EBITDA per share is calculated using the same methodology as net income per share.

The following table reconciles net income (loss) to EBITDA and Adjusted EBITDA:

| Three months ended | Nine months ended | |||||||||||

| Sept 30, 2025 | Sept 30, 2024 | Sept 30, 2025 | Sept 30, 2024 | |||||||||

| Net and comprehensive income (loss) | (297,281 | ) | (100,061 | ) | 11,509,274 | (3,112,027 | ) | |||||

| Non-operating items | ||||||||||||

| Depreciation and amortization | 539,248 | 27,409 | 1,415,986 | 53,877 | ||||||||

| Finance costs | 996,207 | 53,654 | 2,156,260 | - | ||||||||

| Income tax recovery | (122,269 | ) | - | (219,483 | ) | 154,423 | ||||||

| Deferred income tax recovery | (358,944 | ) | - | (358,944 | ) | - | ||||||

| EBITDA | 756,961 | (18,998 | ) | 14,503,093 | (2,903,727 | ) | ||||||

| Non-operating items | ||||||||||||

| Restructuring costs | 145,050 | 225,348 | 696,225 | 225,348 | ||||||||

| Acquisition costs | - | - | 372,316 | - | ||||||||

| Foreign exchange loss | 13,872 | 3,855 | 34,723 | 3,979 | ||||||||

| Impairment of intangible assets | - | - | 63,970 | - | ||||||||

| Bargain purchase acquisition price | 538,299 | - | (7,747,902 | ) | - | |||||||

| Gain on settlement | (731,281 | ) | (15,212 | ) | (1,565,031 | ) | (446,883 | ) | ||||

| Share compensation expense | 332,247 | 288,897 | 1,148,408 | 434,554 | ||||||||

| Adjusted EBITDA | 1,055,148 | 483,890 | 7,505,802 | (2,686,729 | ) | |||||||

| Annualized Adjusted EBITDA | 4,220,592 | 1,935,560 | ||||||||||

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Not for distribution to U.S. news wire services or for dissemination in the United States.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280766

Source: Simply Solventless Concentrates Ltd.