BRUSSELS (dpa-AFX) - The Swiss franc strengthened against other major currencies in the European session on Tuesday, as European stocks traded lower extending losses from the previous session after the United States deployed military aircraft to Pituffik Space Base in Greenland, prompting Denmark to rush its Army chief and troops to the Arctic Island in a dramatic escalation of tensions.

In another significant development, U.S. President Donald Trump threatened to impose 200 percent tariffs on French wine and champagne after Paris rejected his invitation to join his proposed Board of Peace initiative aimed at resolving global conflicts, saying it 'does not intend to answer favorably.'

Traders will keep an eye on the speech from the Swiss National Bank (SNB) Chairman Martin Schlegel, later on the day.

Data from the Federal Statistical Office showed that Switzerland's producer and import prices continued to decline at the end of the year. Producer and import prices dropped 0.2 percent month-on-month in November, following a 0.5 percent decline in November. Meanwhile, prices were expected to increase by 0.2 percent.

The producer price index dropped 0.1 percent monthly in December, and import prices registered a decrease of 0.5 percent.

On a yearly basis, producer and import prices fell 1.8 percent in December, after a 1.6 percent decrease in November.

In the European trading today, he Swiss franc rose to a record high of 200.00 against the yen, from an early low of 196.08. The franc may test resistance around the 210.00 region.

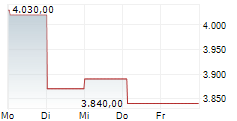

Against the euro, the pound and the U.S. dollar, the franc advanced to a 2-month high of 0.9256, nearly a 7-week high of 1.0614 and a 3-week high of 0.7885 from early lows of 0.9292, 1.0710 and 0.7985, respectively. If the franc extends its uptrend, it is likely to find resistance around 0.91 against the euro, 1.05 against the pound and 0.77 against the greenback.

Looking ahead, U.S. ADP weekly employment data is due to be released in the New York session.

Copyright(c) 2026 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2026 AFX News