BWA Group Plc - Ground Truthing and Field Reconnaissance Update on the Aracari Gold Project

PR Newswire

LONDON, United Kingdom, January 21

21 January 2026

BWA Group PLC

(" BWA", or the " Company")

Ground Truthing and Field Reconnaissance Update on the Aracari Gold Project

BWA [AQUIS:BWAP], the mining investment company with licences in Cameroon and Canada, is pleased to announce highly encouraging results from ground truthing and reconnaissance exploration undertaken on the Aracari Gold project ("Aracari")in Cameroon during Q4 2025.

Highlights

- Significant sample results include 12.50 g/t Au, 9.19 g/t Au, and 1.89 g/t Au from 6 of 13 Areas of Interest (AOI), located along 62 km of strike length of the highly prospective Tcholliré-Banyo Shear Zone (TBSZ).

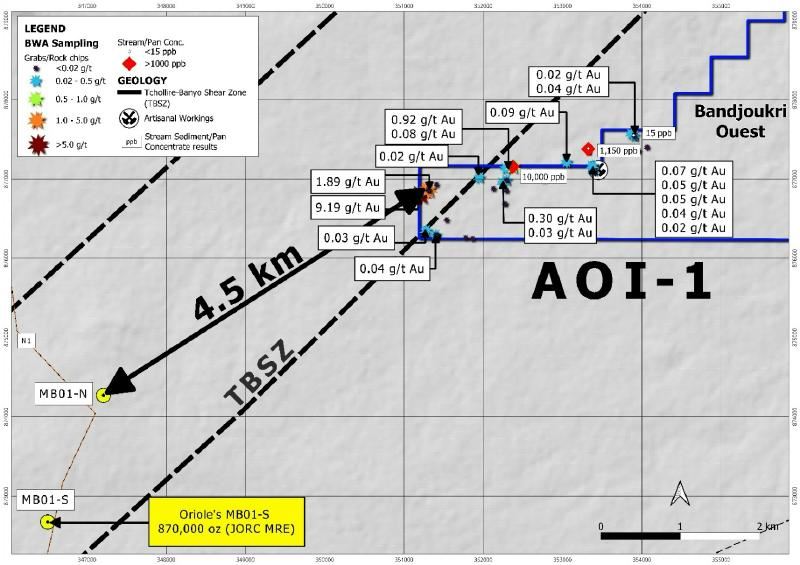

- Multiple high-grade samples of 9.19 g/t, 1.89 g/t and 0.92 g/t Au, located within Aracari's priority Area of Interest (AOI-1) which is located 6 km directly along strike on the TBSZ from Oriole Resources' JORC-compliant MRE of 870,000 oz at 1.09 g/t Au.

- Widespread visible gold in pan concentrates and stream sediment samples further confirm potential for mineralisation across the Aracari Gold project area.

- Reconnaissance samples comprising, 16 rock and stream sediments, returned greater than 0.1 g/t Au across the 1,268 km 2 of exploration permits.

- A total of 50 samples reported gold values greater than the anomalous threshold of 15 ppb across the entire Aracari gold project.

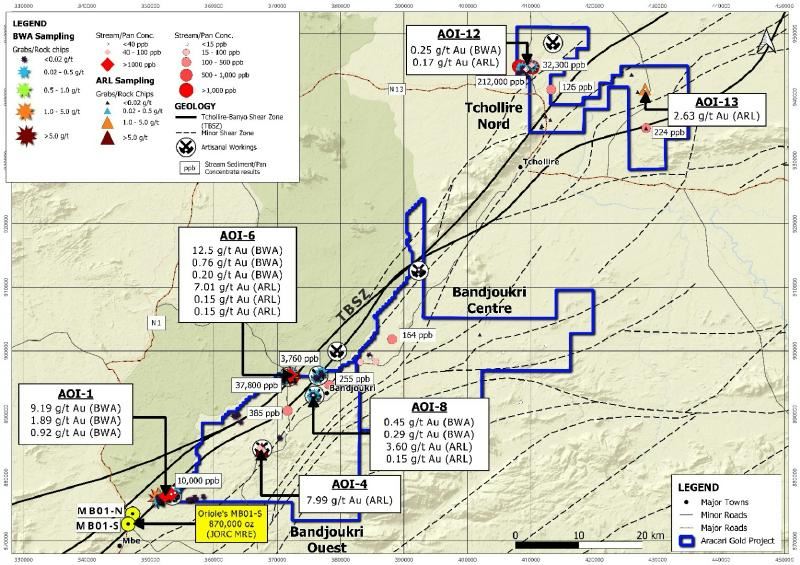

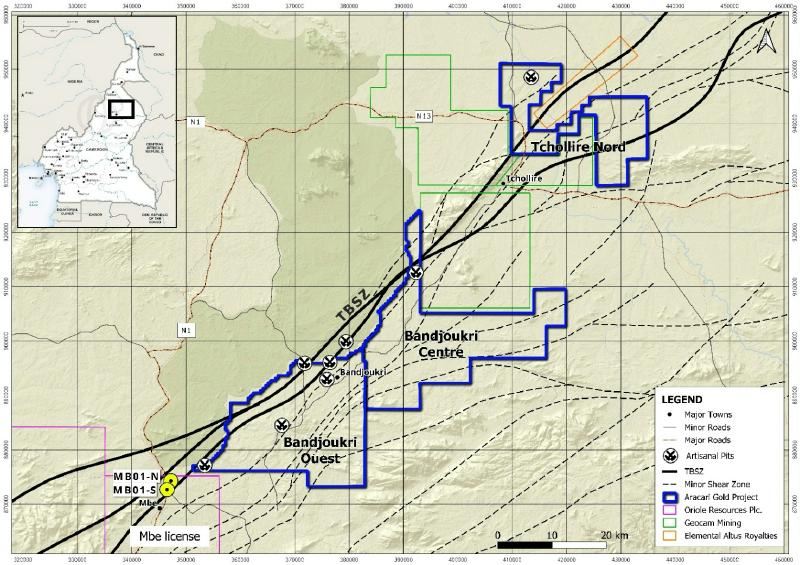

The Aracari Gold project is a portfolio of three exploration permits (Bandjoukri Ouest, Bandjoukri Centre, and Tcholliré Nord) covering approximately 1,268 km 2 within this emerging gold district in northern Cameroon. The southern boundary of Bandjoukri Ouest is contiguous with Oriole Resources Plc Mbe license, which hosts a JORC-compliant Mineral Resources Estimate (MRE) of 870,000 oz at 1.09 g/t Au at their MB01-S prospect, and MB01-N prospect where recent drilling reported significant intercepts of 21.70 m at 3.13 g/t Au from 86.80 m, and 4.00 m at 1.52 g/t Au, reinforcing the prospectivity of the regional TBSZ trend (Figure 1).

Further information can be viewed below and on the attached document.

Jonathan Wearing, Chairman of BWA Chairman, commented:

"The recent reconnaissance sampling results provide strong evidence to prove the gold prospectivity of the TBSZ across the Aracari project area, strongly suggesting potential for continuous regional scale mineralised system. The field reconnaissance significantly increased our geological, geochemical and structural confidence in the licence block with the aim of delivering early significant results and defining targets for further, more advanced exploration. We remain committed to executing an exploration strategy aimed at fully testing and defining these assets, as we advance toward unlocking their potential value for our stakeholders."

Figure 1:Location of Aracari Gold Project with neighbouring Exploration Licenses

Sources:

Prospectivity of Aracari Gold Project

The recent reconnaissance sampling results along the TBSZ and multiple associated key splay structures provide evidence to confirm gold prospectivity along the regional scale mineralised system through the Aracari project area. It is SRK EX's opinion that the grades exhibited across multiple areas of interest provide strong encouragement for follow up programmes across the Aracari project area (Figure 2).

Further encouraging results from stream and pan concentrates, including the presence of visible gold, reinforces that this exploration technique if applied across the block may define further targets associated with the TBSZ trend.

Figure 2:BWA Sample Locations and Assays Results including Location of ARL Samples |

|

Sources: |

Surface samples of rock chips and grabs from AOI-1, located 4.5 km northeast of MB01-N and along strike of TBSZ, reported best results including 9.19 g/t Au, 1.89 g/t and 0.92 g/t Au, with associated nearby stream sediment samples values up to 10.0 g/t Au with visible gold (Figure 3).

Figure 3:Distribution of Rocks and Stream sediment Assay Results within AOI-1 relative to adjacent Oriole Project |

|

Sources: |

During the reconnaissance programme a total of 193 samples were collected across parts of all three permits comprising 158 rock chips and grab samples, 21 pan concentrate and stream sediments samples, and 14 samples for QAQC purposes under the field supervision of BWA and SRK EX personnel. Surface rock samples included material collected from artisanal workings, subcrops and float boulders, and mineralisation is hosted within gneiss, quartz veins, mafic schist and intrusions with disseminated sulphide mineralogy and box work textures associated within structural zones associated with the TBSZ and its multiple splay structures.

Figure 4:Field Photos of Grab Samples from the reconnaissance field work with Assays greater than 1 g/t Au and the BWA/SRK Ex teams in the field. |

|

Sources: |

Next Steps

BWA plan to conduct a detailed structural and lithological mapping campaign including additional systematic sampling across priority areas to refine mineralisation controls. Work is to be undertaken during the dry season when roads are clear and accessibility improved. A systematic grid-based soil sampling programme, and trenching are additionally planned to delineate and enhance anomalous zones along the TBSZ and to further understand the structural controls. Magnetic geophysical surveys are planned to further define the lateral extent of geological structures, including TBSZ and its associated splay structures, which are interpreted and have now been shown to control the gold mineralisation.

Further Details

The Aracari gold project is located in northern Cameroon, approximately 65 km north of the regional capital, Ngaoundere, which hosts key infrastructure including regional hospital and a domestic airport. The Aracari project is considered prospective for orogenic-type gold mineralisation.

In 2020 and 2022, Aracari Resources Ltd. ("ARL"),undertook reconnaissance rock sampling on the Aracari project with best gold results including 7.99 g/t Au, 7.01 g/t Au, 3.60 g/t Au and 2.63 g/t Au. Stream sediment and pan concentrate samples from the sampling campaign further returned gold grades up to 212 g/t Au.

The Aracari project area is underlain by Neoproterozoic metavolcano-metasedimentary sequences and late-stage intrusive phases similar to the Birimian belts of the West African craton. The region forms part of the Neoproterozoic Pan-African-Brasiliano belt, formed during the convergence of the West African and Congo-São Francisco cratons during West Gondwana assembly. The orogenic activity resulted in major deformational zones and led to the formation of major shear zones, including the regional Tcholliré-Banyo Shear Zone (TBSZ). The TBSZ and its splay structures are considered to be the main structural control for gold mineralisation in the region. Geophysical and satellite image interpretation has indicated that the Aracari project is host to approximately 62 km strike extent of the TBSZ, passing through all the licenses within the portfolio.

Option and Earn-In Agreement Status

Subject to provision by the Aurum Parties of written notice with satisfactory supporting evidence to BWA that the exploration permit portfolio renewal has be approved (announced 15 September 2025), the Company intends to exercise the Option and proceed to the Stage 1 - 10% beneficial interest of the agreement.

Assay/Sampling Procedures and QAQC Protocols

Samples collected consist of rock samples from in situ outcrop, subcrop and float boulders as well as stream sediments from river channels. All samples were collected by BWA & SRK EX personnel, and Chain of Custody was maintained throughout to deliver to Mississauga Mining and Exploration Cameroon (MMEC) in Douala, Cameroon for sample preparation. Pulverised material representative of the field samples were shipped to Aurum Global Exploration in Kells, Ireland for QAQC sample insertion and subsequently submitted to the internationally accredited laboratory at ALS, Loughrea, Ireland for analytical analysis.

Grab and rock chip samples were analysed for gold by 50g fire assay and AAS finish (Au-AA24). Stream and pan concentrate samples were analysed for gold by 30g fire assay and ICP-AES finish (Au-ICP21). Samples returning assays exceeding 10 g/t were re-analysed using a gravimetric finish (Au-GRA22).

Competent Person Statement

The information in this announcement that relates to a summary of Exploration results and is based on, and fairly reflects, information and supporting documentation prepared by Mr Colin Rawbone, a Competent Person who is a Member of the Australasian Institute of Mining and Metallurgy (AusIMM).

Mr Rawbone is a full - time employee of SRK Exploration Ltd. and has sufficient experience relevant to the style of mineralisation and type of deposit under consideration, and to the activity being undertaken, to qualify as a Competent Person (CP) as defined in the AIM Note for Mining, Oil and Gas Companies, (effective June 2009, as updated 21 July 2019 pursuant to AIM Notice 56). Mr Rawbone consents to the inclusion in the announcement of the matters based on the information in the form and context in which it appears and confirms that this information is accurate and not false or misleading.

For further information on the Company, please visit www.bwagroupplc.com/index.htmlor:

BWA Group PLC James Butterfield Managing Director Peter Taylor Director | +44 (0) 7770 225 253 enquiries@bwagroupplc.com +44 (0) 7895 006965. |

Allenby Capital Limited Corporate Adviser | +44 (0) 20 3328 5656 Nick Harriss/Nick Naylor |

Oberon Capital Broker | +44 (0) 20 3179 5300 Nick Lovering/Adam Pollock |

Aracari Appendix |  4295366_6.jpeg |  4295366_3.jpeg |  4295366_7.jpeg |  4295366_4.jpeg |  4295366_2.jpeg |

4295366_5.jpeg |  4295366_0.jpeg |  4295366_1.jpeg |