Houston, Texas, Jan. 23, 2026 (GLOBE NEWSWIRE) -- Battalion Oil Corporation (NYSE American: BATL) ("Battalion" or the "Company") today announced several operational updates related to its gas treating arrangements and production performance.

Key Highlights

- Termination of Gas Treating Agreement ("GTA") with Wink Amine Treater, LLC ("WAT") related to its acid gas injection facility ("AGI Facility").

- Entry into a gas treating agreement with a publicly traded large-cap midstream company.

Management Comments

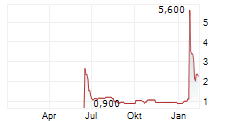

The WAT AGI Facility ceased operations on or about August 11, 2025 and remains out of service. Due to the cessation of operations, Battalion has exercised its contractual rights to terminate the GTA with WAT.

Subsequent to this termination, the Company has entered into an agreement with a publicly traded large-cap midstream provider to process Battalion's gas at an alternate processing facility. Battalion has been utilizing this midstream partner since the AGI Facility went offline. Due to a significant facility expansion completed in the fourth quarter of 2025, this provider is now able to process substantially all of the Company's gas volumes from its Monument Draw Field.

In conjunction with this facility expansion, Battalion has continued to ramp production into this alternate processing facility throughout late December and January. Most recently, the facility has been processing more than 30 MMcf/d of Battalion's gas production, compared to a December average of approximately 17.4 MMcf/d.

This increase in processing capability has allowed the Company to benefit from additional flow assurance and operational reliability, resulting in an increase in Battalion's average oil production of approximately 1,200 net barrels of oil per day month-to-date in January as compared to the Company's December average.

Forward Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements that are not strictly historical statements constitute forward-looking statements. Forward-looking statements include, among others, statements about anticipated production, liquidity, capital spending, drilling and completion plans, and forward guidance. Forward-looking statements may often, but not always, be identified by the use of such words such as "expects", "believes", "intends", "anticipates", "plans", "estimates", "projects," "potential", "possible", or "probable" or statements that certain actions, events or results "may", "will", "should", or "could" be taken, occur or be achieved. Forward-looking statements are based on current beliefs and expectations and involve certain assumptions or estimates that involve various risks and uncertainties that could cause actual results to differ materially from those reflected in the statements. These risks include, but are not limited to, those set forth in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and other filings submitted by the Company to the SEC, copies of which may be obtained from the SEC's website at www.sec.gov or through the Company's website at www.battalionoil.com. Readers should not place undue reliance on any such forward-looking statements, which are made only as of the date hereof. The Company has no duty, and assumes no obligation, to update forward-looking statements as a result of new information, future events or changes in the Company's expectations.

About Battalion

Battalion Oil Corporation is an independent energy company engaged in the acquisition, production, exploration and development of onshore oil and natural gas properties in the United States.