NEW COMPANY WILL BE A LEADING MANUFACTURER OF SURFACE PROTECTION SOLUTIONS

COMPAGNIE CHARGEURS INVEST SA TO RETAIN 25% OWNERSHIP INTEREST

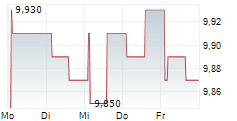

NEW YORK, Jan. 26, 2026 /PRNewswire/ -- KPS Capital Partners, LP ("KPS") announced today that, through a newly formed affiliate, it has entered into a definitive agreement under which KPS will acquire a controlling stake in Chargeurs Films de Protection SAS ("Novacel" or the "Company"). The selling shareholder, Compagnie Chargeurs Invest SA ("Chargeurs") (ENXTPA:CRI) will invest alongside KPS and retain a 25% ownership interest in the Company. Financial terms of the transaction were not disclosed. Completion of the transaction is expected in the second quarter of 2026 and is subject to customary closing conditions and approvals.

Novacel is a leading global manufacturer of surface protection solutions across building exterior, building interior & equipment, industrial, appliances and transportation end-markets. The Company offers a full suite of solutions, including process and protection films, tapes, papers and specialty machines. Novacel is headquartered in Deville, France, has approximately 700 employees and operates six manufacturing facilities and three R&D centers across France, Italy and the United States.

Pierre de Villeméjane, Partner and Co-Head of KPS Mid-Cap Investments, said, "We are excited to acquire a controlling stake in Novacel, a differentiated surface protection solutions manufacturer with a diverse product portfolio, broad geographic footprint, best-in-class R&D capabilities and an attractive customer base. The Company's solutions are essential to its customers' manufacturing processes across a wide range of applications. We look forward to working with Novacel's talented management team to build upon this great platform. Novacel's strong brand, renowned R&D capabilities and commitment to quality, combined with KPS' strategic, operational and financial resources, provide an ideal foundation for future growth."

Philippe Denoix, Chief Executive Officer of Novacel, said, "KPS, with its demonstrated track record of manufacturing excellence is the ideal next owner of Novacel as it enters this next phase of growth as an independent company. We look forward to working closely together with KPS and our talented team to expand our technical leadership and continue delivering new, innovative high-quality products that provide significant value for our customers. KPS' commitment to manufacturing excellence, operational improvement and innovation will enable us to build on Novacel's strong market position and deepen our partnerships with customers globally."

Michaël Fribourg, Chairman and Chief Executive Officer of Chargeurs, said, "We have been compelled by KPS' strategic vision for Novacel and its proven track record in managing global manufacturing and industrial businesses. Chargeurs' investment alongside KPS highlights our belief in the Company's earnings growth and value creation potential under KPS' direction, and we look forward to partnering with KPS in driving Novacel's next phase of growth, with a focus on M&A build up in the surface protection market."

Paul, Weiss, Rifkind, Wharton & Garrison LLP served as legal counsel and Rothschild & Co served as financial advisor to KPS.

About Novacel

Novacel is a leading global manufacturer of surface protection solutions across building exterior, building interior & equipment, industrial, appliances and transportation end-markets. The Company offers a full suite of solutions, including process and protection films, tapes, papers and specialty machines. Novacel is headquartered in Deville, France, has approximately 700 employees and operates six manufacturing facilities and three R&D centers across France, Italy and the United States. For more information about Novacel, visit www.novacel-solutions.com.

About Compagnie Chargeurs Invest

Compagnie Chargeurs Invest (ENXTPA:CRI) is a mixed industrial and financial company with a role as an operator and developer of global champions in industry and services, and as an investor with a culture of active portfolio management of high value-added businesses. Active in nearly 100 countries with around 2,600 employees, Compagnie Chargeurs Invest relies on the long-term commitment of Groupe Familial Fribourg, a committed controlling shareholder, and on its portfolio of assets, to meet the major challenges of its markets. Compagnie Chargeurs Invest achieved revenues of €729.6 million in 2024. For more information about Chargeurs, visit www.chargeurs.com.

About KPS Capital Partners

KPS, through its affiliated management entities, is the manager of the KPS Special Situations Funds, a family of investment funds with $19.5 billion of assets under management (as of September 30, 2025). For over three decades, the Partners of KPS have worked exclusively to realize significant capital appreciation by making controlling equity investments in manufacturing and industrial companies across a diverse array of industries, including basic materials, branded consumer, healthcare and luxury products, automotive parts, capital equipment and general manufacturing. KPS creates value for its investors by working constructively with talented management teams to make businesses better, and generates investment returns by structurally improving the strategic position, competitiveness and profitability of its portfolio companies, rather than primarily relying on financial leverage. The KPS Funds' portfolio companies have aggregate annual revenues of approximately $21.2 billion, operate 202 manufacturing facilities in 21 countries, and have approximately 55,000 employees, directly and through joint ventures worldwide (as of September 30, 2025). The KPS investment strategy and portfolio companies are described in detail at www.kpsfund.com.

KPS Mid-Cap focuses on investments in the lower end of the middle market. KPS Mid-Cap targets the same type of investment opportunities and utilizes the same investment strategy that KPS' flagship funds have for over three decades. KPS Mid-Cap leverages and benefits from KPS' global platform, reputation, track record, infrastructure, best practices, knowledge and experience. The KPS Mid-Cap investment team is managed by Partners Pierre de Villeméjane and Ryan Harrison, who lead a team of experienced and talented professionals.

Logo - https://mma.prnewswire.com/media/2868924/KPS_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/kps-capital-partners-to-acquire-controlling-stake-in-novacel-from-compagnie-chargeurs-invest-sa-302669885.html

View original content:https://www.prnewswire.co.uk/news-releases/kps-capital-partners-to-acquire-controlling-stake-in-novacel-from-compagnie-chargeurs-invest-sa-302669885.html