VANCOUVER, BC / ACCESS Newswire / January 26, 2026 / Metallic Minerals Corp. (TSX.V:MMG)(OTCQB:MMNGF)(FSE:9MM1)("Metallic" or the "Company") is pleased to announce an updated NI 43-101 Mineral Resource Estimate (the "2026 MRE") at the Allard deposit within its La Plata project in southwestern Colorado.

The 2026 MRE expands the Inferred Resource tonnage by 23% and adds platinum, palladium and gold, supported by an additional 4,530 metres of diamond drilling completed since the previous resource estimate reported in 2023.

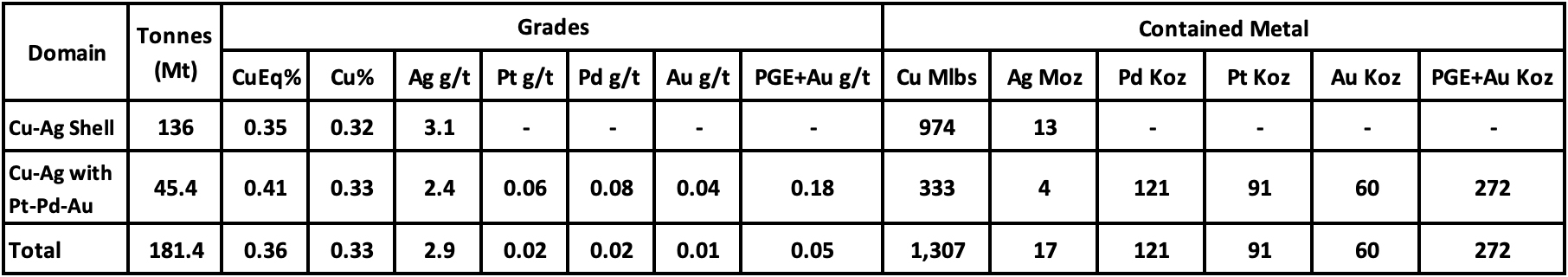

The 2026 MRE now totals 181.4 million tonnes ("Mt") at an average grade of 0.36% copper equivalent ("CuEq") (0.33% Cu and 2.9 grams per tonne ("g/t") Ag containing 1,307 million pounds ("Mlbs") of copper and 17.0 million ounces ("Moz") of silver or 1,455.1 Mlbs CuEq, constrained within a block-cave-optimized underground mining shape. The updated resource includes a 45.4 Mt subset containing 91,000 oz of platinum, 121,000 oz of palladium, and 60,000 oz of gold totalling 272,000 ounces of platinum group elements plus gold ("PGE+Au") grading 0.18 g/t PGE+Au (0.06 g/t Pt, 0.08 g/t Pd and 0.04 g/t Au). The resource is estimated using an NSR cut-off of US$18/t (See Notes to Table 1).

Highlights

The 2026 MRE consists of two continuous, adjoining mineralized shells: (i) a copper-silver shell based largely on 1950 to 1970s-era drill holes; and (ii) a copper-silver-platinum-palladium-gold shell supported by Metallic's multi-element drill core sampling.

Metallic-era drill results of 8,240 m from the 2021 to 2023 drill and underground sampling programs support the estimation of a Cu-Ag-PGE+Au bearing subset that represents 25% of the total resource tonnage.

The inclusion of co-occurring precious metals (Pt, Pd, and Au) results in a 17% higher copper-equivalent grade for the 45.4 Mt subset (0.41% CuEq vs 0.35% CuEq) relative to a copper-and-silver-only equivalent of the same subset.

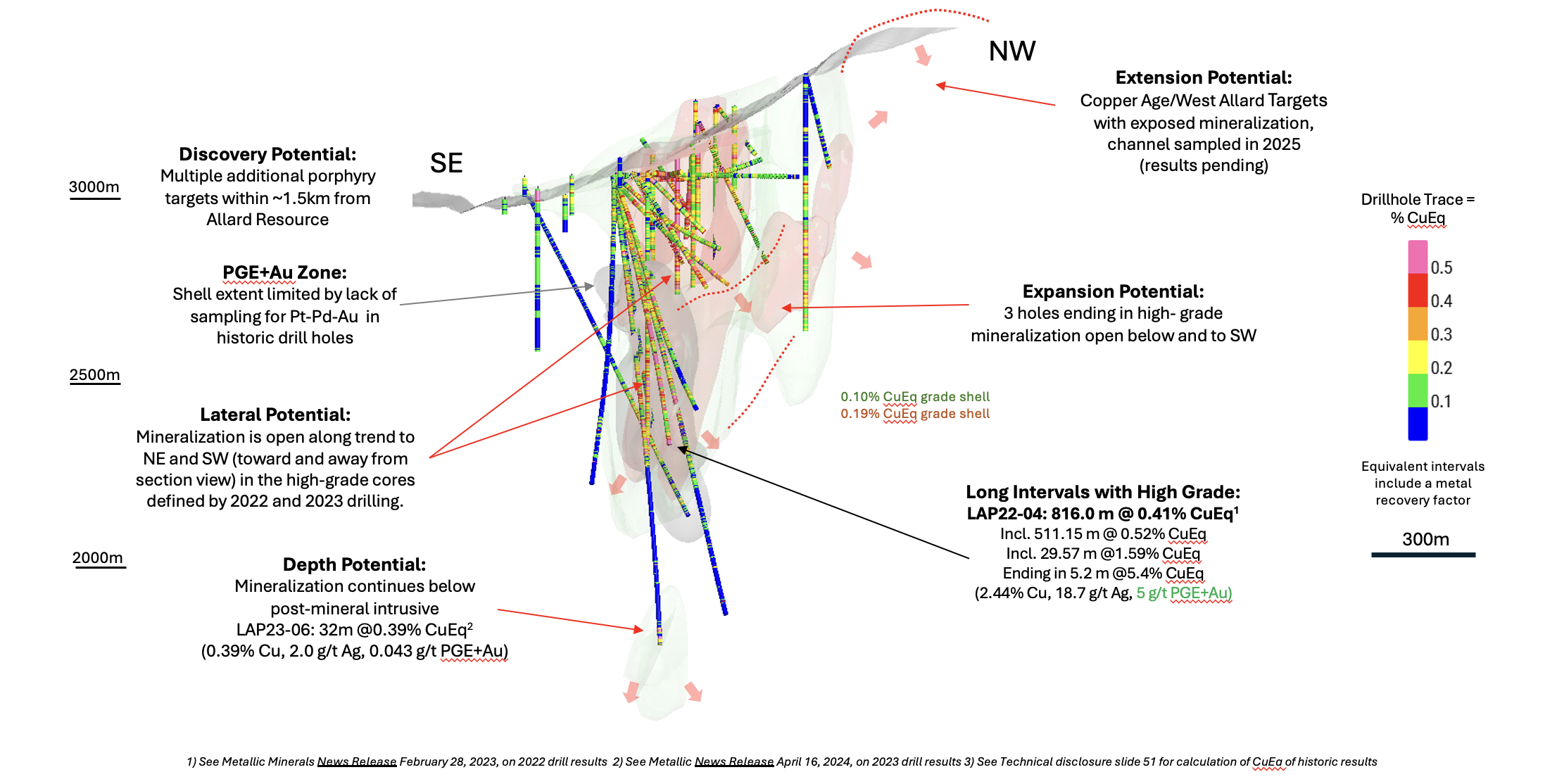

Significant upside exists for further increases in equivalent grade and precious metal content across the broader deposit with additional drilling, due to limited historic assaying for gold, platinum and palladium (see Figure 1).

The Allard resource is one of only three PGE-bearing development-stage resources in the USA and remains open to expansion at depth and along strike.

Sixteen (16) untested potential porphyry centers have been identified on the greater La Plata project area, as well as target areas with potential for significant high-grade epithermal silver, gold and telluride mineralization.

Greg Johnson, Chairman and CEO of Metallic, stated, "The updated and expanded resource estimate at the Allard deposit is an important milestone for the Company and further validates La Plata as a large, multi-metal, district-scale system with scope for continued advancement. The 23% increase in the resource tonnage, supported by recent drilling, confirms the continuity and robustness of the deposit, while the growing contribution from platinum and palladium highlights the unique character of the La Plata porphyry system-with PGE grades that rank among the highest reported in a porphyry setting-and positions Allard as one of only three U.S.-based PGE-bearing development-stage resources."

"The shallow, higher-grade portions of the Allard resource remain open to expansion toward the southwest, and the mid- to deeper higher-grade zone remains open along trend, demonstrating significant room to continue to grow the resource with further drilling. Beyond the Allard resource area, the broader La Plata district remains significantly underexplored, with multiple untested porphyry centers, high-grade epithermal targets, and an expanding suite of U.S.-designated critical minerals. As we advance toward a focused 2026 drill program, refine targets using modern data analytics, and evaluate innovative metallurgical approaches through our collaboration with Columbia University, we believe Metallic is well positioned to unlock additional value for shareholders and demonstrate the long-term strategic importance of La Plata as a potential domestic source of copper, precious metals, and critical minerals."

"Key next steps at La Plata include completion of the initial Columbia University metallurgical test work in Q1 2026, and advancing permitting and execution of the planned 2026 drill program focused on resource expansion and high-priority district targets.

"Alongside La Plata, planning is underway for a resource expansion drill program at Keno Silver, and for targeted growth in gold and silver royalty production from the Company's Yukon-based projects."

Table 1 - 2026 Updated La Plata Inferred Mineral Resource Estimate

Notes:

The Mineral Resource Estimate has been prepared according to CIM (2014) Standards and using CIM (2019) MRMR Best Practice Guidelines.

Mineral Resources are estimated using a long-term copper price of US$4.50/lb, silver price of US$32/oz, gold price of US$2,500/oz, platinum price of US$1,300/oz, and palladium price of US$1,200/oz. Metallurgical recoveries for copper, silver, gold, platinum, and palladium are 90%, 70%, 60%, 50% and 50%, respectively.

CuEq% is calculated based on the above metal prices and recoveries, resulting in CuEq = Cu% + (Ag g/t)*0.008 + (Au g/t)*0.540 + (Pt g/t)*0.234 + (Pd g/t)*0.216

Underground Mineral Resources are reported using an NSR cut-off of US$18/t. This assumes a block caving mining method with a mining cost of US$5/t, processing cost of US$6/t and G&A cost of US$7/t.

Underground Mineral Resources are reported within a block-caving shape generated by Deswik Stope Optimizer.

A constant SG value of 2.55 has been applied to all blocks in the model.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Numbers may not add due to rounding.

An NI 43-101-compliant technical report on the 2026 La Plata Resource will be filed on sedarplus.ca within 45 days.

The QP responsible for this Mineral Resource estimate is Brian Hartman, M.S., P.Geo. of SLR USA Advisory Inc.

Figure 1 - La Plata Isometric Cross-Section showing Grade Shells and Resource Expansion Opportunities (looking SW)

Figure 1 shows the current geometry of the Allard deposit CuEq model, highlighting a vertically extensive, continuous mineralized system with a thick, higher-grade core within a broader mineralized envelope. Mineralization has been drill-defined from surface to greater than 1.5 km depth, over approximately 600 m of strike length and up to 400 m in width, supporting the potential suitability for a bulk underground, block cave mining approach. Importantly, multiple drill holes terminate in higher-grade mineralization within and below the modeled shells, indicating the system remains open along strike and at depth and highlighting significant potential for further resource expansion through step-out drilling.

The PGE+Au-bearing component of the 2026 MRE is currently constrained largely by limited historic assaying for platinum, palladium and gold outside Metallic's multi-element sampling coverage, and represents a clear opportunity to expand the precious-metals footprint through additional drilling and systematic multi-element assaying.

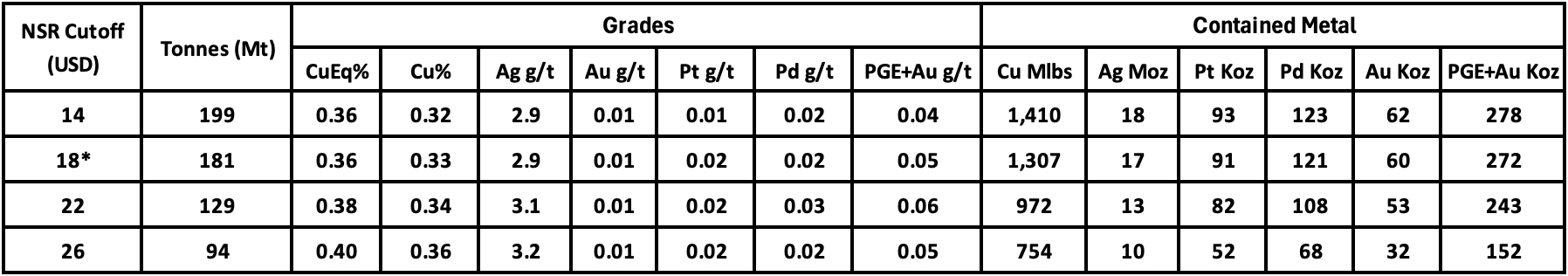

NSR Cutoff Sensitivity Analysis

In addition to the base-case Inferred Mineral Resource reported at an NSR cut-off of US$18/t [average gross value per tonne of US$32.50], a sensitivity analysis showing the Inferred Mineral Resource across a range of NSR cut-off values is shown below in Table 2. This sensitivity analysis illustrates the relationship between cut-off, tonnage, grade and contained metal under a reasonable range of potential economic assumptions. The US$18/t NSR cut-off is considered appropriate for reporting purposes and is based on conceptual underground bulk-mining (block cave) assumptions using metal prices of US$4.50/lb copper and US$32/oz silver, together with assumptions for metallurgical recoveries, payables and operating costs as described in the Notes to Table 1.

Overall, the sensitivity analysis highlights the potential flexibility of the Allard deposit, including the ability (in future technical studies) to evaluate scenarios that prioritize higher-grade material, increased precious-metal contributions, and/or staged mining approaches, subject to further technical and economic evaluation. As the NSR cut-off increases, tonnage decreases while copper-equivalent grade increases, reflecting the higher-grade core within the broader mineralized envelope. At higher cut-offs, the model also shows increasing precious metal grades (Pt, Pd and Ag), consistent with the higher-grade portions of the system.

Table 2 - Inferred Mineral Resource Sensitivity to NSR cut-off (US$/t)

Notes:

Sensitivity cases are presented for information purposes only and do not represent additional or separate mineral resources.

Mineral resources are not mineral reserves and do not have demonstrated economic viability.

La Plata Property Overview

Metallic Minerals' La Plata project covers 44 square kilometers, located approximately 20 km north of Mancos, Colorado, halfway between the larger communities of Cortez and Durango, within the historic La Plata mining district in the southwestern portion of the prolific Colorado Mineral Belt. The project is readily accessible by paved highways and improved gravel roads and is located near significant power transmission infrastructure.

The La Plata district has a long history of mining. High-grade silver and gold production has been documented from the 1870s through the early 1940s from mineralized deposits at more than 90 individual mines and prospects.1 From the 1950s to the 1970s, major mining companies-including Rio Tinto (Bear Creek) and Freeport-McMoRan (Phelps Dodge)-explored the district, focusing on the potential for bulk-tonnage disseminated and stockwork-hosted copper mineralization.2 Freeport-McMoRan retained ownership of claims in the district until 2002, when the holdings were sold to the current underlying vendors during the lows of the last metals price cycle.

A total of 25,532 meters in 88 drill holes has been completed on the property from the 1950s to present. This drilling has demonstrated a large, multi-phase porphyry system hosting copper and silver, with associated gold, platinum and palladium. More recent work has highlighted the potential for additional critical minerals, including light and heavy rare earth elements, as well as tellurium, vanadium, gallium, scandium and fluorine, which occur locally in association with copper mineralization. The broader mineralized and altered footprint covers approximately 25 km² and includes a central porphyry complex with multiple individual porphyry bodies surrounded by an associated high-grade, silver and gold-rich epithermal system that hosts 56 identified mineralized vein, replacement and breccia structures. Historical production from some of these structures included silver and gold.

Porphyry copper systems are among the world's largest sources of copper and precious metals and are frequently cornerstone assets for major mining companies. Approximately 30% of porphyry systems are classified as precious-metals-rich and only about 5% report significant PGE enrichment.4The western USA is host to five of the ten largest porphyry copper systems globally, including three of the world's top six precious metals rich porphyry systems.5 The La Plata porphyry system is notable as a silver-rich porphyry and for its elevated PGE values, with individual platinum and palladium grades in drill samples reported up to 5 g/t.

Critical Minerals and U.S. Strategic Relevance

The Allard deposit at La Plata represents a significant potential source of copper and silver-important industrial metals used broadly in modern technologies, including electrification and energy transition applications. Recent and historical work also indicates that the broader La Plata district may host additional critical minerals identified by the U.S. Government as important to economic and national security.4

In 2022, the U.S. Geological Survey designated the La Plata Mountains as a focus area for potential critical minerals resources and invested over US$300,000 in regional sampling, mapping and geophysical surveys under the Earth Mapping Resources Initiative, a USGS-led program designed to identify and advance domestic sources of critical minerals.3 That effort, led by the Colorado Geological Survey in collaboration with Metallic Minerals, confirmed significant critical mineral potential in the district and identified new target areas with critical mineral potential proximal to the Allard deposit. Metallic's drilling at Allard has also demonstrated the co-occurrence of critical minerals-including light and heavy rare earth elements, vanadium, scandium, tellurium and gallium-along with copper, silver, platinum, palladium and gold. The potential for these critical minerals to contribute additional economic value will be evaluated through ongoing exploration, metallurgical work and future technical studies.

Metallurgical Test Work with Columbia University

In collaboration with Columbia University, Metallic is advancing research to evaluate innovative processing methods aimed at recovering a broader suite of metals from the La Plata project. The work is evaluating regenerative electro-hydrometallurgical technologies developed at Columbia that are designed to recover not only copper and precious metals, but also rare earth elements ("REEs") and other critical technology metals-such as vanadium, scandium, gallium, rubidium and cesium-that may co-occur within the La Plata alkalic porphyry system. The process concept includes closed-loop, reagent-regenerating electrochemical leaching and separation steps intended to minimize waste while maximizing recovery of both bulk and high-value metals.

Preliminary test work has returned high recovery levels for copper and silver, together with encouraging results for platinum, palladium, gold, REEs and other critical minerals. Results from this initial round of testing are expected in Q1 2026. If successful, this work could support evaluation of opportunities to expand the project's payable-metal suite while aligning with U.S. initiatives to develop secure, lower-impact domestic sources of critical minerals. Similar electro-hydrometallurgical approaches are being applied in battery recycling and recovery of metal from industrial residues, and the collaboration is intended to assess whether analogous methods could be adapted to La Plata to support a modernized, downstream multi-metal processing concept.

2025 Exploration Activities and 2026 Plans

During 2025, the Company completed an extensive mapping, soil and rock sampling program to advance target definition and prioritization across the La Plata district, including several hundred meters of continuous chip-channel sampling over mineralized porphyry adjacent to the Allard resource area. Building on these results, Metallic is planning a 2026 drill program focused on resource expansion at Allard and testing new high-priority targets that could support future resource growth and development.

Metallic has also implemented AI-assisted data integration through the VRIFY platform, combining machine learning, geospatial analysis and 3D visualization to further support target refinement and prioritization. In parallel, a copper-isotope surface-water sampling program was completed to assist in vectoring toward higher-value mineralization and to enhance drill targeting ahead of the planned 2026 drill campaign.

Planning for the 2026 field season is focused on expanding the existing Allard resource and testing additional high-priority targets with strong discovery potential. Work is underway to advance federal, state and local permitting requirements for the 2026 field season, and the Company is advancing baseline environmental studies to support drilling plans for 2027 and beyond, including newly identified targets. Metallic remains committed to environmentally responsible, data-driven exploration and to transparent engagement with local communities and stakeholders throughout the permitting process.

About SLR USA Advisory Inc.

SLR USA Advisory Inc.'s mining group provides integrated technical, advisory and sustainability solutions across the complete project lifecycle from early exploration to post-closure transformation. SLR has an experienced and respected mining team focused on the domestic and international mining industry. The team has considerable experience in estimation and modeling of deposits of all types and practical and theoretical experience having realized hundreds of assessments for clients. The SLR team consists of a multi-disciplinary group of qualified persons with a strong understanding of the disclosure requirements for Mineral Resources set out in the NI 43-101 Standards of Disclosure for Mineral Projects (2016), CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and a strong understanding of the CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines 2019.

About Metallic Minerals

Metallic Minerals Corp. is a resource-stage exploration company advancing copper, silver, gold, platinum group elements and other critical minerals at the La Plata project in southwestern Colorado, and high-grade silver exploration at the Keno Silver project in the Yukon Territory, adjacent to Hecla Mining's Keno Hill silver operations. The Company is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business through partnerships with experienced mining operators.

Metallic is led by a team with a strong track record of discovery and exploration success on multiple precious and base metal deposits across North America, with extensive experience in project development, permitting and project financing. The Company integrates advanced data analytics into its exploration process to support target generation, accelerate discovery and unlock value across its portfolio.

Metallic's project districts have a history of significant mineral production and benefit from existing infrastructure, including road access and nearby power. The Company's team has been recognized for environmental stewardship practices and is committed to responsible and sustainable resource development, engaging and collaborating with Canadian First Nation groups, U.S. Tribal and Native Corporations, and local communities to support long-term project advancement.

Upcoming Events

Metallic's management team will be participating in several upcoming key industry events over the coming months and welcomes the opportunity to meet with investors and stakeholders:

VRIC 2026 - Vancouver, Canada, January 25-26, 2026.

AME Roundup - Vancouver, Canada, January 26-29, 2026.

Red Cloud Pre-PDAC 2026 Showcase - Toronto, Canada, February 26-27, 2026.

Metals Investor Forum - Toronto, Canada, February 27-28, 2026.

PDAC 2026 - Toronto, Canada, March 1-4, 2026.

Swiss Mining Institute Conference - Zurich, Switzerland, March 18-19, 2026.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: metallic-minerals.com Phone: 604-629-7800

Email: info@metallic-minerals.com Toll Free: 1-888-570-4420

Footnotes:

Eckel, USGS Prof Paper 219, Geology and Ore Deposits of the La Plata Mining District, 1949.

Bear Creek Mining (now Rio Tinto), Humble Oil (now Exxon) and Phelps Dodge (now Freeport-McMoRan) company reports.

Earth MRI Acquisitions map. https://ngmdb.usgs.gov/emri/#5045

Singer et al. 2008, USGS Open File Porphyry Deposits of the World: Database and Grade and Tonnage OF 2008-1155

Park et al., Nature Reviews, Crustal magmatic controls on the formation of porphyry copper deposits, 2021;

Qualified Persons

The La Plata project 2026 mineral resource estimate was prepared by Brian Hartman, M.S., P. Geo., of SLR USA Advisory Inc, an independent Qualified Person, in accordance with the guidelines of the Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") with an effective date of January 23, 2026. Hartman conducted a site visit to the property on September 2nd, 2025. Scott Petsel, M.S., CPG, P. Geo., a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure not pertaining to the resource estimate contained in this news release. Mr. Petsel is President of Metallic Minerals.

Forward-Looking Statements

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting timelines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, statements about expected results of operations, royalties, cash flows, financial position and future dividends as well as financial position, prospects, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, unsuccessful operations, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration, development of mines and mining operations is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/metallic-minerals-expands-la-plata-copper-silver-inferred-resource-by-23-and-adds-1130579