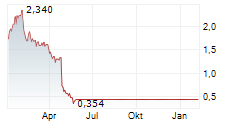

SÃO PAULO, Jan. 28, 2026 /PRNewswire/ -- Azul S.A. (B3: AZUL53, OTC: AZULQ) ("Azul" or "Company"), in compliance with Resolution No. 44 of the Brazilian Securities Commission ("CVM"), dated August 23, 2021 ("CVM Resolution 44"), and article 157, paragraph 4, of Law No. 6,404, dated December 15, 1976 ("Brazilian Corporations Law"), hereby informs its shareholders and the market that: (i) its subsidiary, Azul Secured Finance LLP (the "Issuer"), a Delaware limited liability partnership, has launched a private offering of senior secured notes due 2031 (respectively the "Notes" and the "Exit Financing Offering" or "Offering"); and (ii) updates to the credit rating previously assigned to the Company (the "Change of Rating").

Offering Launch

The Offering is intended to provide exit financing in connection with the Company's restructuring plan approved in the context of the Chapter 11 of the United States Bankruptcy Code (the "Chapter 11 Plan"), to (i) to repay the outstanding principal amount of its DIP financing (debtor-in-possession facility), and (ii) with any amount remains, support the implementation of its comprehensive and permanent restructuring plan aimed at optimizing its capital structure and enhancing its liquidity position.

The Notes will be guaranteed by the Company and its subsidiaries Azul Linhas Aéreas Brasileiras S.A., IntelAzul S.A., ATS Viagens e Turismo Ltda., Azul IP Cayman Holdco Ltd., Azul IP Cayman Ltd. and Azul Conecta Ltda. The Notes will also be secured by first-priority liens on a collateral package comprising certain receivables generated by Azul Fidelidade (the Company's loyalty program), Azul Viagens (the Company's travel package business) and Azul Cargo (the Company's cargo business), as well as certain brands, domain names and other intellectual property used by the Company's airline business, Azul Fidelidade, Azul Viagens and Azul Cargo, as well as shares and/or quotas (as applicable) of the Company's subsidiaries.

The terms of the Offering are subject to market and other conditions. There can be no assurance that the Offering or the sale of the Notes will be consummated.

Azul will keep its investors and the market informed of the progress of the Offering.

The Notes have not been and will not be registered with the CVM, the Securities and Exchange Commission (SEC), or any other jurisdiction. The Notes may not be offered and will not be sold in Brazil, except in circumstances that do not constitute a public offering or an unauthorized distribution under Brazilian law and regulations.

Credit Rating Updates

Moody's Ratings has assigned a B2 rating to the Company (Corporate Family Rating) and to the securities of the Exit Financing Offering, also with a stable outlook.

Fitch Ratings has assigned an expected B- rating to Azul and to the Exit Financing Offering, with a stable outlook, to be converted into a final rating upon the completion of the restructuring process under Chapter 11.

According to the rating agencies, such decisions considered, among other factors, the implementation of the steps contemplated in the Chapter 11 Plan.

The Company continues to implement the steps established under its Chapter 11 Plan with focus, discipline and alignment with the guidelines already defined, progressing in accordance with the expected timeline and maintaining consistency in the execution of the initiatives underway. Azul remains committed to transparency and to achieving the milestones set forth in the Plan, safeguarding the regularity of its operations and predictability for all stakeholders.

About Azul

Azul S.A. (B3: AZUL53, OTC: AZULQ) is the largest airline in Brazil in terms of number of cities served, operating approximately 800 daily flights to more than 137 destinations. With an operating passenger fleet of over 200 aircraft and more than 15,000 crewmembers, the Company operates more than 400 nonstop routes. Azul was named by Cirium (a leading aviation analytics company) as one of the two most punctual airlines in the world in 2023. In 2020, the Company was awarded the world's best airline by the TripAdvisor Travelers' Choice Awards, being the only Brazilian airline to receive this recognition. For more information, visit ri.voeazul.com.br.

SOURCE Azul S.A.