LIMONEST, 29 January 2026, 5.45 PM

- BTOC REVENUES UP 8.7% AND RECOVERY CONFIRMED IN BTOB (UP 3.7%)

- MARKED RETURN TO GROWTH IN L'ARMOIRE DE BÉBÉ (UP 29.0%)

- 9-MONTH REVENUES UP 8.8% TO €431.3M

- 2025/2026: RECORD YEAR EXCLUDING THE COVID PERIOD

Olivier de la Clergerie, LDLC Group CEO, said: "Third-quarter performance was excellent, reflecting the Group's efforts to increase its visibility, strengthen its positioning and consolidate its proximity to its customers. Even though the exceptional rise in prices that we are currently observing, linked to the memory chip market, is, given its scale, likely to lead to the postponement of certain purchases, this decline in volumes, or in activity trends, is not such as to have an impact on gross margin or profitability at this stage. It should be noted that the current financial year could be one of our best since the pandemic.

In light of the work carried out on our procurement, our product mix and the development of Rue du Commerce, and if the trend is confirmed, we are also considering the possibility of revising our normalised gross margin level upwards from the next financial year."

9-MONTH CONSOLIDATED REVENUES AND BUSINESS VOLUMES* (1 APRIL TO 31 DECEMBER)

| €m (unaudited) | 2025/2026 | 2024/2025 | Change (%) | Change (%) At constant consolidation scope |

| Q1 revenues | 127.2 | 118.1 | +7.6% | +5.8% |

| Q2 revenues | 139.6 | 125.6 | +11.1% | +11.1% |

| Q3 revenues | 164.5 | 152.9 | +7.6% | +7.6% |

| 9-month revenues | 431.3 | 396.6 | +8.8% | +8.2% |

| Q1 business volumes | 135.2 | 122.8 | +10.1% | +6.0% |

| Q2 business volumes | 149.0 | 132.7 | +12.2% | +12.2% |

| Q3 business volumes | 177.2 | 165.0 | +7.4% | +7.4% |

| 9-Month business volumes | 461.4 | 420.5 | +9.7% | +8.5% |

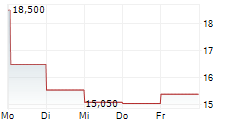

Corporate data: Q3 2025/2026 revenues €150.5m, 9-month revenues €387.6m

* including the LDLC franchise chain and the LDLC and Rue du Commerce marketplaces

9-month 2025/2026 revenues of up 8.8% to €431.3m

Following growth of 9.5% in the first half of the year, the positive momentum continued. Third-quarter revenues were up 7.6% to €164.5m. 9-month revenues were up 8.8% to €431.3m.

Nine-month 2025/2026 Group business volumes including the LDLC franchise chain and the LDLC and Rue du Commerce marketplaces amounted to €461.4m, up 9.7% as reported. Rue du Commerce business volumes amounted to €21.5m, of which €10.3m was recorded in the third quarter, up sharply by 23.4% from Q3 2024/2025.

BTOC business: 12.4% growth in revenues over nine months

| BtoC revenues €m (unaudited) | 2025/2026 | 2024/2025 | Change (%) |

| Q1 | 91.1 | 80.6 | +13.0% |

| Q2 | 100.9 | 86.8 | +16.2% |

| Q3 | 118.1 | 108.6 | +8.7% |

| 9-month total | 310.1 | 276.0 | +12.4% |

| Online | 194.8 | 169.2 | +15.1% |

| Stores | 115.3 | 106.8 | +8.0% |

Nine-month 2025/2026 BtoC revenues totalled €310.1m, up 12.4% (up 11.6% at constant consolidation scope). Third-quarter organic growth was 8.7%, benefiting from a positive price effect and growth in business volumes. The growth rate slowed compared to the first half of the year due to price increases resulting from inflation since November 2025 on component prices, driven by the rise of artificial intelligence, which has led to a shortage of memory chips.

The Online business grew by 8.4% in the third quarter and 15.1% over the first nine months of the 2025/2026 financial year, driven by technological innovations and IT equipment upgrading. Consolidated since 10 July 2024, Rue du Commerce continues to grow, contributing €7.8m to the Online business over the first nine months (vs. €3.8m over the same period last year).

Store growth remained solid in the third quarter, up 9.5% (up 8.0% over nine months), benefiting from the Group's extensive network, customer proximity and the success of the flagship store on Place de la Madeleine in Paris, which opened at the end of August.

Accordingly, the Supervisory Board has decided to grant Harry De Lepine, member of the Management Board in charge of retail, the functions and title of chief executive officer, in order to strengthen the Group's organisation and support its development. He will perform his duties alongside Olivier de la Clergerie, the current CEO.

Confirmed recovery in BTOB business

| BtoB revenues €m (unaudited) | 2025/2026 | 2024/2025 | Change (%) |

| Q1 | 33.2 | 34.6 | -4.0% |

| Q2 | 35.8 | 35.6 | +0.6% |

| Q3 | 42.9 | 41.4 | +3.7% |

| 9-month total | 111.9 | 111.6 | +0.3% |

Nine-month 2025/2026 B2B revenues amounted to €111.9m, an increase of 0.3%. The improvement in the trend was confirmed quarter after quarter, with two consecutive quarters of growth.

Other businesses: recovery of L'Armoire de Bébé

| Revenues from other businesses €m (unaudited) | 2025/2026 | 2024/2025 | Change (%) |

| Q1 | 2.9 | 2.9 | -1.7% |

| Q2 | 2.9 | 3.1 | -8.1% |

| Q3 | 3.5 | 3.1 | +12.9% |

| 9-month total | 9.3 | 9.1 | +2.9% |

| o/w L'Armoire de Bébé | 6.8 | 6.3 | +8.7% |

Other businesses returned to positive territory, generating nine-month 2025/2026 revenues of €9.3m (up 2.9%). Childcare brand L'Armoire de Bébé contributed €6.8m (up 8.7% over nine months) and recorded a significant rebound in the third quarter (up 29%), notably due to the work carried out on the larmoiredebebe.com online store and on the product ranges.

As part of the organisational restructuring initiated during the last financial year, and in response to an increasingly complex regulatory and competitive environment, the LDLC Group has decided to discontinue the activities of L'École LDLC during the next financial year.

OUTLOOK

In terms of operating profitability, the current financial year is expected to post record levels, excluding the Covid period, despite a more challenging business momentum in the fourth quarter due to the combined effect of an exceptional rise in prices, linked to inflation in component costs that began in November 2025, and a more challenging comparison base. The latter is explained by the delay in the launch of new Nvidia graphics card models, initially expected in the current quarter, as in the previous financial year, but ultimately postponed until the end of 2026.

Thanks to its controlled procurement policy and solid financial base, the LDLC Group is not facing any component shortages and still has an adequate level of safety stock. Under these conditions, margins in the second half of 2025/2026 should remain at elevated levels compared with normalised levels. Thus, if these trends are confirmed, and in view of the work carried out across all its procurement and its business mix, the LDLC Group could be led to revise its normalised gross margin range upwards from the next financial year.

Next release:

30 April 2026 after market close, full-year 2025/2026 revenue

GROUP OVERVIEW

The LDLC Group was one of the first to venture into online sales in 1997. As a specialist multi-brand retailer and a major online IT and high-tech equipment retailer, the LDLC Group targets individual customers (BtoC) as well as business customers (BtoB). It operates via 15 retail brands, has 8 e-commerce websites and has approximately 1,100 employees.

Winner of a number of customer service awards and widely recognised for the efficiency of its integrated logistics platforms, the Group is also developing an extensive chain of brand stores and franchises.

Find all the information you need at www.groupe-ldlc.com

ACTUS

Investor & Media Relations

Hélène de Watteville / Marie-Claude Triquet

hdewatteville@actus.fr - mctriquet@actus.fr

Tel.: + 33 (0)6 10 19 97 04 / + 33 (0)6 84 83 21 82

- SECURITY MASTER Key: xWycYZhpl5qbl2xvk8dsnGWZl21lxZTFbmPIlZKcaJ3ImHGVmWdql5fHZnJnl2dt

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-96227-groupe-ldlc-290126-ca-t3-25-26-fr_vdef_en.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free