LIMONEST, 11 DECEMBER 2025, 5.45 PM

- FIRST HALF REVENUES UP 9.5% TO €266.8M

- GROSS MARGIN RATE OF 22.5%, UP 140 BASIS POINTS

- POSITIVE OPERATING EARNINGS OF €4.4M, UP €13.1M

- STRONG LEVERS FOR THE SECOND HALF AND STRATEGIC POSITIONING TO KEEP OUTPERFORMING THE MARKET

Olivier de la Clergerie, LDLC Group CEO, said: "The Group started off the 2025/2026 financial year with a solid first half performance, posting revenues up 9.5%, a gross margin rate of 22.5% and positive operating earnings of €4.4m. For the first time in three financial years, the Group has made a first half profit in terms of both operation earnings and net income.

These results illustrate the strength of the Group's business model and the appropriateness of the measures implemented in recent financial years. Backed by a solid financial base, LDLC has chosen to pursue a forward-looking strategy against a backdrop of declining demand. The organisational adaptation measures we implemented, coupled with our investments in communication and marketing campaigns and structural initiatives such as the acquisition of Rue du Commerce, constitute powerful levers today.

Backed by solid fundamentals, the LDLC Group is entering the second half of the year with confidence. In a market where momentum remains strong, the Group is well positioned to continue to outperform the market and improve its profitability. This could turn out to be one of our best years since the pandemic."

SIMPLIFIED FIRST HALF INCOME STATEMENT (1 APRIL-30 SEPTEMBER)

| €m (audited) | H1 2025/2026 6 months | H1 2024/2025 6 months | Change |

| Revenues | 266.8 | 243.7 | +23.1 |

| Gross margin | 60.0 | 51.3 | +8.7 |

| Gross margin rate | 22.5% | 21.1% | +1.4 pp |

| EBITDA1 | 8.5 | (2.5) | +10.9 |

| EBIT2 | 4.4 | (8.7) | +13.1 |

| Net financial income/(expense) | (2.6) | (0.4) | -2.1 |

| Net non-recurring income/(expense) | 0.2 | (0.5) | +0.7 |

| Income tax | (0.5) | 2.3 | -2.8 |

| Net income/(loss), Group share | 1.5 | (7.3) | +8.8 |

1 EBITDA = Operating earnings (EBIT) after goodwill amortisation and impairment + depreciation, amortisation and provisions.

2 After zero goodwill amortisation and impairment for H1 2025/2026 compared to a €36,000 charge for H1 2024/2025.

The LDLC Group consolidated financial statements for the six months ended 30 September 2025 were approved by the Management Board on 11 December 2025 and reviewed the same day by the Supervisory Board. They were subject to a limited review by the Statutory Auditors.

H1 2025/2026 revenues up 9.5% to €266.8m

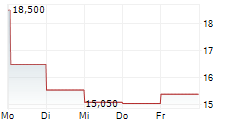

Up 7.6% in Q1 and 11.1% in Q2, first half revenues totalled €266.8m, up 9.5% year-on-year (up 8.6% at constant consolidation scope).

BtoC revenues rose 14.7% versus H1 2024/2025, up 13.4% at constant consolidation scope. Store revenues rose 7.0%, including the contribution from the LDLC Paris Madeleine store opened in late August 2025, which made a particularly strong start. Online sales were up 19.7%, including the contribution from Rue du Commerce consolidated since 10 July 2024.

BtoB revenues fell just 1.7% versus H1 2024/2025. The improvement in the trend observed over the last few quarters was confirmed by a return to growth in Q2 2025/2026 (up 0.6%).

Revenues from other businesses were down 5.0%, including a 1.4% decline for childcare brand L'Armoire de Bébé.

Gross margin rate up 140 bps to 22.5%

The Group's gross margin reached €60.0m in H1 2025/2026, up 17.0% from €51.3m in H1 2024/2025.

The gross margin rate of 22.5%, above the upper limit (21.5%) of the normalised range, reflects the Group's ability to gain market share by maintaining its business model. This performance was driven by the strong and rapid recovery in business and the positive impact of the Rue du Commerce marketplaces development on the sales mix.

EBITDA profit of €8.5m, up €10.9m

H1 2025/2026 EBITDA came to €8.5m, up €10.9m versus the H1 2024/2025 EBITDA loss of €2.5m.

The measures implemented by the Group to control its expenses are beginning to bear fruit. Against a backdrop of strong business growth, first half operating expenses (staff costs + other purchases and external expenses) were down 5.4% (€2.8m). Staff costs fell 11.5% under the impact of the overall austerity measures and the organisational adaptation plan in force since July 2025, the effects of which will kick in fully during the second half of 2025/2026. Other purchases and external expenses represented 8.0% of revenues, compared to 8.5% in H1 2024/2025.

Operating earnings (EBIT) amounted to €4.4m (compared to an €8.7m EBIT loss in H1 2024/2025) after taking into account net depreciation, amortisation, provisions and goodwill impairment totalling €4.1m, down 34.6% reflecting a return to more normalised levels.

The Group posted a net financial expense of €2.6m compared to a €0.4m expense in H1 2024/2025. The increase was mainly due to the recognition of non-recurring non-cash provisions on certain Group financial investments.

Net income Group share amounted to €1.5m (compared to a €7.3m net loss in H1 2024/2025), including a €0.5m tax charge and €0.2m non-recurring income.

Sound financial structure

H1 2025/2026 cash consumption amounted to €20.0m, mainly due to the €19.1m increase in working capital driven by the strong business recovery, inventory management and outstanding payables.

Cash flow from investing activities amounted to a €3.1m outflow.

Cash flow from financing activities amounted to a €1.9m net outflow comprising €4.0m in new bank loans and €5.9m in repayments.

The Group is still in a strong financial position underpinned by its robust financial structure. At 30 September 2025, net debt amounted to €24.4m (vs. €6.3m at 31 March 2025), compared to shareholders' equity of €91.7m (vs. €90.2m at 31 March 2025), entailing a limited increase in net gearing (net debt/equity) to 26.6%.

RECENT NEWS

Customer Service of the Year award for the 12th year running

On 20 November 2025, LDLC received the "Customer Service of the Year" award for 2026[1]. For the 12th year in a row, the LDLC Group topped the rankings in the Technical Product Retail category with an even higher score of 19.80/20, well above the average among all participants (13.66/20) and the other winners (16.58/20). LDLC's 60 advisers work tirelessly to make sure customers receive the best possible advice, handling 550,000 requests per year by phone, email, live chat or on social media.

Promising opening of the LDLC Paris Madeleine flagship store

On 20 August 2025, the new LDLC Paris Madeleine store opened its doors to the general public. The store embodies a new concept offering around 3,000 high-tech products across a 1,000 m² sales area. Ideally located in central Paris, the store enjoys a strategic location close to many other consumer retail outlets. The opening of this iconic store is fully in line with the Group's strategy to strengthen its positioning among the general public by building on its hybrid "clicks-and-mortar" model involving a judicious combination of e-commerce websites and physical stores.

OUTLOOK

Building on the solid performance recorded in H1 2025/2026, the LDLC Group is entering the rest of the year with confidence as growth momentum continues to hold up well in the third quarter.

The second half of the financial year should benefit from the usual seasonal trends that inherently generate higher revenues, profitability and cash than the first half. Furthermore, the effects of the organisational adaptation plan effective since July 2025 will kick in fully during the second half, thereby driving an improvement in profitability towards more normalised levels.

The Group's financial base is also expected to strengthen, driven by the expected improvement in profitability and a return to more normalised working capital levels in the short term.

Regarding potential concerns about tensions in the supply of memory chips, the Group clarifies that, as of today, the level of available inventory allows it to handle the situation with confidence. Furthermore, even in this tense environment, the Group's supplies keep coming in and the available cash position allows the Group to secure an adequate level of safety stock. Lastly, although prices have risen sharply, current sales show no signs of abating in terms of value.

The power of the LDLC Group business model, its financial strength and the investments made to enhance its reputation, particularly among the general public, are powerful levers that should enable the Group to continue its profitable growth trajectory and outperform the market over the coming quarters.

As a result, the Group could post one of its best financial years since the pandemic.

Next meeting:

12 December 2025 at 10.00 am - H1 2025/2026 earnings videoconference presentation

Next release:

29 January 2026 after market close, Q3 2025/2026 revenues

GROUP OVERVIEW

The LDLC Group was one of the first to venture into online sales in 1997. As a specialist multi-brand retailer and a major online IT and high-tech equipment retailer, the LDLC Group targets individual customers (BtoC) as well as business customers (BtoB). It operates via 15 retail brands, has 8 e-commerce websites and has approximately 1,100 employees.

Winner of a number of customer service awards and widely recognised for the efficiency of its integrated logistics platforms, the Group is also developing an extensive chain of brand stores and franchises.

Find all the information you need at www.groupe-ldlc.com

ACTUS

Investor & Media Relations

Hélène de Watteville / Marie-Claude Triquet

hdewatteville@actus.fr - mctriquet@actus.fr

Tel.: + 33 (0)6 10 19 97 04 / + 33 (0)6 84 83 21 82

[1] Technical Product Retail category - BVA Ipsos survey - Viséo CI - Read more at escda.fr

- SECURITY MASTER Key: lW5qZMeYZ2rJyHFqZ8drmmloZpeVl5OVameXlZNsk5qVbZuSm5pom52VZnJmmmht

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-95537-groupe-ldlc-111225-rs-25-26-fr_vdef_en.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free