| LIMONEST, 12 JUNE 2025, 5.45 PM |

CONSOLIDATED FULL-YEAR REVENUES OF €534.5M

GROSS MARGIN RATE OF 21.2%, STILL WITHIN THE NORMALISED GROUP RANGE

EBITDA DOWN TO €2.6M DUE TO DECLINE IN BUSINESS

SOUND FINANCIAL BASE

LDLC GROUP POISED TO CAPITALISE ON THE NEXT GROWTH CYCLE

Olivier de la Clergerie, LDLC Group CEO, said: "The 2024/2025 financial year was marked overall by a complex economic and political environment prompting consumers to exercise caution and companies to postpone certain investments, thereby impacting the Group's business activity. However, this situation did not affect the gross margin rate, which remained within the normalised range of 21-22%. The decline in sales coupled with inflationary pressure on expenses naturally impacted our earnings.

During this period, we took various steps, including organisational streamlining measures, to palliate the significant decline in business and strengthen our resilience to the market situation. Nevertheless, we remain confident in the fundamentals of the sector. Demand for high-tech products is set to return in light of technological innovations and growing consumer needs.

Thanks to the work we've done on costs, a solid financial base and investments to strengthen our brand awareness and positioning among the general public, in order to gain new market share, the LDLC Group is ready to take full advantage of a recovery in demand, as soon as the trend is confirmed, thereby returning to normalised profit margins."

SIMPLIFIED FULL-YEAR INCOME STATEMENT (1 APRIL-31 MARCH)

| €m (audited) | 2024/2025 12 months | 2023/2024 12 months | Change |

| Revenues | 534.5 | 571.5 | -37.0 |

| Gross margin | 113.3 | 122.8 | -9.6 |

| Gross margin rate | 21.2% | 21.5% | |

| EBITDA1 | 2.6 | 11.4 | -8.9 |

| EBITDA margin | 0.5% | 2.0% | |

| EBIT2 | (7.3) | 1.4 | -8.7 |

| Net financial income/(expense) | (1.0) | (0.2) | -0.8 |

| Net non-recurring income/(expense) | (5.9) | (0.6) | -5.3 |

| Income tax | 3.5 | (0.2) | +3.6 |

| Net income/(loss) of consolidated companies | (10.8) | 0.4 | -11.2 |

| Net income/(loss), Group share | (10.9) | (0.2) | -10.7 |

1 EBITDA = Operating earnings (EBIT) after goodwill amortisation and impairment + depreciation, amortisation and provisions.

2 After goodwill amortisation and impairment of €36,000 for 2024/2025, compared to a €0.4m charge for 2023/2024.

The LDLC Group consolidated financial statements and the Groupe LDLC company financial statements for the financial year ended 31 March 2025 were approved by the Management Board and reviewed by the Supervisory Board at their respective meetings on 12 June 2025. The audit procedures have been carried out and the audit reports relating to the certification of the LDLC Group consolidated financial statements and the Groupe LDLC company financial statements for the year ended 31 March 2025 have been issued without reservation.

FY 2024/2025 OVERVIEW

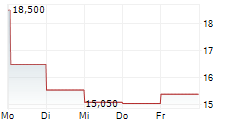

Full-year revenues of €534.5m

Full-year 2024/2025 consolidated revenues fell 6.5% to €534.5m. At constant consolidation scope, revenues were down 7.6%.

Amid a challenging economic environment despite more favourable momentum towards the end of the financial year, BtoC revenues amounted to €378.3m, down 3.6% from FY 2023/2024. Rue du Commerce contributed €6.6m to full-year revenues. Store revenues came to €142.6m, up 0.9%.

Group business volumes including the LDLC franchise chain and the LDLC and Rue du Commerce marketplaces amounted to €565.9m (including a €16.9m contribution from Rue du Commerce), down 4.8% as reported and down 7.6% at constant consolidation scope.

BtoB revenues fell 13.0% to €144.3m, strongly impacted by the macroeconomic and political environment that prompted caution and the postponement of corporate investments.

350,000 new customer accounts (BtoC and BtoB, excluding stores) were created in 2024/2025 compared to 310,000 in 2023/2024. The Group average basket value edged up to €498 excl. VAT from €486 excl. VAT the previous year.

Other businesses posted total revenues of €11.9m, down 10.4% from €13.3m the previous year. L'Armoire de Bébé posted revenues of €8.0m, down 9.4%.

Sound gross margin rate sustained at 21.2%

Amid declining business activity, the gross margin rate came to 21.2%, in line with the Group's normalised range of 21-22% and reflecting the strength of LDLC Group's fundamentals and business model. Gross margin amounted to €113.3m for FY 2024/2025.

EBITDA of €2.6m

Despite the expansion of the store chain, inflationary pressure on rental and payroll expenses and the impact of the consolidation of the Rue du Commerce business acquired on 10 July 2024, operating expenses were contained, up only 0.4% year-on-year thanks to the Group's cost-cutting measures. Staff costs were down 1.7% before accounting for the effects of the two redundancy plans (Plan de Sauvegarde de l'Emploi, PSE) announced last March.

FY 2024/2025 EBITDA came to €2.6m, down from €11.4m the previous year due to the decline in business activity over the period.

After depreciation, amortisation and provisions, operating earnings (EBIT) after goodwill amortisation and impairment amounted to a €7.3m loss compared to a €1.4m profit the previous year.

The Group posted a net financial expense of €1.0m.

By decision dated 28 May 2025, the competent Regional Directorate for the Economy, Employment, Labour and Solidarity (Direction Régionale de l'Économie, de l'Emploi, du Travail et des Solidarités, DREETS) approved each of the collective agreements relating to the Groupe LDLC and Olys PSEs. After setting aside €5.2m in provisions to cover the PSEs, the Group posted a net non-recurring expense of €5.9m.

The Group posted a net loss (Group share) of €10.9m for the 2024/2025 financial year, compared to a €0.2m net loss the previous year.

Sound financial structure

Operating cash flow amounted to a €15.7m inflow in 2024/2025 thanks to a significant improvement in working capital (up €13.5m) driven by rigorous, streamlined inventory management.

Net cash flow from investing activities amounted to a €16.0m outflow, mainly related to the acquisition of the Rue du Commerce business assets along with an equity investment by LDLC INVEST in the LDLC Arena.

During the year, the LDLC Group repaid €9.9m of borrowings and took out new loans totalling €15.0m. The Group paid €2.5m in respect of the remaining dividend for the 2023/2024 financial year.

Overall, the Group generated a net cash inflow of €2.6m during the 2024/2025 financial year.

At 31 March 2025, the LDLC Group boasted a sound financial structure with net borrowings amounting to €6.3m (vs. €3.6m at 31 March 2024) and shareholders' equity of €90.2m, giving a limited net debt-to-equity ratio (gearing) of 7.0% (vs. 3.5% at 31 March 2024).

OUTLOOK

The slowdown in business activity against an unfavourable economic and political backdrop directly impacted Group margins for the 2024/2025 financial year. However, sector fundamentals remain strong, bolstered by technological innovation and the need to upgrade high-tech products.

The Group has already taken steps to optimise its cost structure and strengthen its resilience in order to cope with this challenging economic period. These measures and initiatives will begin to bear fruit during the present financial year. The full-year savings expected from these measures are currently estimated at around €6m.

The Group is also pursuing targeted development initiatives aimed at consolidating its positioning and strengthening its brand awareness among the general public.

Building on a sound financial base, the LDLC Group is therefore well poised to take full advantage of the next growth cycle, allowing a return to normalised profit levels.

PROVISIONAL CALENDAR OF UPCOMING PUBLICATIONS AND EVENTS

| Publication* | Date | Information meeting |

| Q1 2025/2026 revenues | 31 July 2025 | |

| Annual General Meeting | 26 September 2025 | |

| Q2 2025/2026 revenues | 30 October 2025 | |

| H1 2025/2026 results | 11 December 2025 | 12 December 2025 |

| Q3 2025/2026 revenues | 29 January 2026 | |

| Q4 2025/2026 revenues | 30 April 2026 | |

| 2025/2026 full-year results | 11 June 2026 | 12 June 2026 |

*Publication after market close

Next meeting:

13 June 2025 at 10.00 am - 2024/2025 full-year results presentation

Trocadéro Conference Centre, 112 avenue Kléber, Paris 16th district

Next release:

31 July 2025 after market close, Q1 2025/2026 revenues

GROUP OVERVIEW

The LDLC Group was one of the first to venture into online sales in 1997. As a specialist multi-brand retailer and a major online IT and high-tech equipment retailer, the LDLC Group targets individual customers (BtoC) as well as business customers (BtoB). It operates via 15 retail brands, has 8 e-commerce websites and has approximately 1,100 employees.

Winner of a number of customer service awards and widely recognised for the efficiency of its integrated logistics platforms, the Group is also developing an extensive chain of brand stores and franchises.

Find all the information you need at www.groupe-ldlc.com

ACTUS

Investor & Media Relations

Hélène de Watteville / Marie-Claude Triquet

hdewatteville@actus.fr - mctriquet@actus.fr

Tel.: + 33 (0)6 10 19 97 04 / + 33 (0)6 84 83 21 82

- SECURITY MASTER Key: xm5wY8ZvlW+UnJtuYZpqmGRoaJmVw2GVl2LJxGJwlZqWnWxnl2xhb8abZnJjl2ho

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-92232-groupe-ldlc-120625-ra-24-25-gb.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free