SINGAPUR (dpa-AFX) - Mapletree Pan Asia Commercial Trust (N2IU.SI, MPCMF) reported higher profit in its third quarter, despite weak gross revenues and net property income.

In the third quarter, profit attributable to Unitholders grew 3.3 percent to S$108.16 million from last year's S$104.66 million

Distribution per Unit was 2.05 Singapore cents, up 2.5 percent from 2.00 Singapore cents a year ago.

Gross revenue, meanwhile, dropped 1.9 percent to S$219.45 million from S$223.67 million in the prior year.

Net property income was S$164.94 million, down 1.2 percent from S$166.92 million a year ago.

The company attributed the decline in gross revenue and net property income largely to lower overseas contributions and the absence of full-period contributions from TS Ikebukuro Building and ABAS Shin-Yokohama Building, which were divested on August 22, 2025 and August 28, 2025, respectively.

However, Singapore's gross revenue grew 3.5 percent and NPI increased 5.3 percent.

Regarding the proposed divestment of the office component of Festival Walk, the company said the divestment is targeted for completion in February 2026, and is not expected to have a material impact on MPACT's net asset value as at 31 March 2026, and NPI for fiscal 2026.

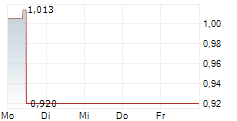

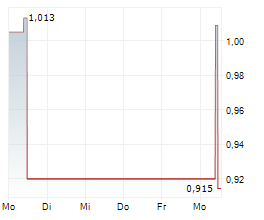

In Singapore, the shares were losing around 0.7 percent, trading at S$1.4600.

For more earnings news, earnings calendar, and earnings for stocks, visit rttnews.com.

Copyright(c) 2026 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2026 AFX News