VANCOUVER, British Columbia, Feb. 05, 2026 (GLOBE NEWSWIRE) -- Rio Silver Inc. ("Rio Silver" or the "Company") (TSX-V: RYO | OTC: RYOOF) is providing geological and operational context for its Maria Norte Project by discussing its location within the same regional mineralized corridor as the adjacent Tangana Mining Unit, operated by Silver X Mining Corp., based on publicly available disclosures and technical reporting.

The Company believes this context is useful in illustrating the proven endowment of the district, while noting that mineralization on adjacent or nearby properties is not necessarily indicative of mineralization on the Company's property.

District Context and Structural Setting

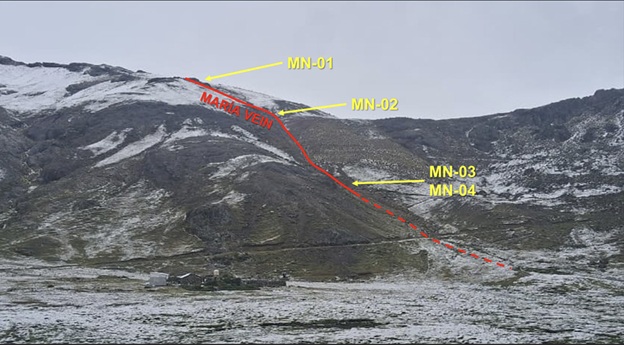

Maria Norte hosts multiple mapped mineralized structures, including the Castor, the Maria, the Pamela and Jess Veins, and additional prominent vein and vein splays, together with approximately 500 metres of the Las Animas vein set, which is also mapped within SilverX's West Tangana area. These vein systems occur along the same regional structural corridor and lie approximately 600 metres from vein extensions currently comprising SilverX's Tangana Mining Unit, separated by a regional fault.

Mineralized exposures traced at Maria Norte to date, extending up to approximately 1,000 metres to date, show elevated silver and gold values with lesser lead and zinc, consistent with a silver-dominant vein system. By comparison, the Tangana area historically operated as a lead-zinc mining camp between 1960 and 1975, during which approximately 234,098 tonnes were extracted from four principal vein sets across a combined horizontal extent of approximately 2.5 kilometres and a vertical range of approximately 960 metres, as disclosed by SilverX.

At Maria Norte, evidence of a rumoured historic tunnel or adit of approximately 400 metres is supported by the presence of a reclaimed waste dump. A single independent reference sample collected from this dump returned 12.7 ounces per tonne silver and 2.194 g/t gold. This material was historically discarded as uneconomic under previous operating conditions. This sample is not representative of mineralization at Maria Norte and should not be relied upon.

The Maria Vien metallurgical sampling locations

Adjacent Property and Economic Study Disclosure

Rio Silver controls a portion of the Tangana West vein system within the Maria Norte Project area, however the Company has not completed any economic study, including a Preliminary Economic Assessment, on this portion of the project. Silver X Mining Corp., which operates adjacent mining units within the same regional mineralized corridor, has completed a NI 43-101-compliant Preliminary Economic Assessment covering its Tangana Mining Unit (reference p. 82). That study is referenced herein solely to provide geological and operational context within the district. Information derived from Silver X's technical report is not indicative of mineralization, mineral resources, mineral reserves, or economic outcomes on Rio Silver's property and should not be relied upon.

Exploration and Development Opportunity

Maria Norte has been held for approximately 18 years by prior operators, during which time exploration activity was limited primarily to surface mapping and selective sampling. Several exposed veins and vein splays remain undocumented by modern exploration methods. Subject to access and permitting, the Company plans to advance systematic surface mapping and sampling during the Q3 2026 dry season.

For context, SilverX has reported that its Tangana West area hosts multiple documented veins and vein splits adjacent to the same regional fault system. Within this corridor, Rio Silver controls approximately 500 metres of Las Animas vein outcrop mapped along approximately 1.5 kilometres of strike. Public disclosures by SilverX report vein widths and grades within the broader Tangana system; however, these data are provided for contextual purposes only and are not indicative of mineralization on Rio Silver's property.

Management Commentary

"Maria Norte sits within a proven silver district, and the structural setting gives us a compelling geological framework to work from," said Chris Verrico, Chief Executive Officer of Rio Silver. "What excites us is not only the extent of underexplored ground relative to nearby operations, but the fact that much of this mineralization was historically overlooked when silver and gold prices were a fraction of where they are today. Material that was once disregarded under past economic conditions may warrant a very different assessment in the current price environment. While adjacent mining activity provides valuable district context, our opportunity lies in advancing access to systematically evaluate what we believe is a rare opportunity to pursue high-impact development targets within a disciplined, capital-efficient framework."

Moving Ahead

The Company's near-term focus includes:

- Finalizing remaining community access agreements

- Completing access and portal preparation

- Securingall necessary permits for development and mining,

- Initiating adit development and commence driving a drift along the Maria vein

- Advancing metallurgical, processing design, and technical studies

Why This Matters to Investors

For investors, Maria Norte offers exposure to a silver-dominant mineralized system within an established mining district, where nearby operations provide real-world geological and operational context. While each project is unique and outcomes cannot be inferred from adjacent properties, the combination of structural continuity, multiple vein systems, and limited modern exploration highlights the potential for meaningful upside as Rio Silver advances access, exploration and development, alongside metallurgy, and technical work. When paired with a staged, low-capex development strategy, this positions the Company for value creation as execution milestones are achieved.

Cautionary note: the potential quantity and grade is conceptual in nature, that there has been insufficient exploration to define a mineral resource at this time and that it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Qualified Person

Jeffrey Reeder, P.Geo., is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical information contained in this news release. Mr. Reeder is a consultant to the Company and is not independent within the meaning of NI 43-101.

About Rio Silver Inc.

Rio Silver Inc. (TSX-V: RYO | OTC: RYOOF) is a Canadian resource company advancing high-grade, silver-dominant assets in Peru, the world's second-largest silver producer. The Company is focused on near-term development opportunities within proven mineral belts and is supported by a seasoned technical and operational team with deep experience in Peruvian geology, underground mining, and district-scale exploration. With a clear development strategy and a growing portfolio of highly prospective silver assets, Rio Silver is establishing the foundation to become one of Peru's next emerging silver producers.

Learn more at www.riosilverinc.com

Stay Connected with Rio Silver

Investors and stakeholders are encouraged to follow Rio Silver for the latest company updates, project milestones, and event announcements across the Company's official social media channels:

- X (formerly Twitter)

- YouTube

- Facebook

By following Rio Silver's official channels, investors can stay informed as the Company advances its silver-dominant projects and executes on key development milestones.

ON BEHALF OF RIO SILVER INC.

Chris Verrico

Director, President and Chief Executive Officer

To learn more or engage directly with the Company, please contact:

Christopher Verrico, President and CEO

Tel: (604) 762-4448

Email: chris.verrico@riosilverinc.com

Website: www.riosilverinc.com

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking statements" within the meaning of applicable Canadian securities laws. Forward-looking statements include, but are not limited to, statements regarding anticipated development activities, underground access timing, permitting progress, community engagement, processing strategies, and the Company's ability to advance toward potential production and cash flow. Forward-looking statements are subject to known and unknown risks and uncertainties that may cause actual results to differ materially. Readers are cautioned not to place undue reliance on forward-looking statements. Rio Silver undertakes no obligation to update such statements except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/26a913ae-e888-48a2-8bca-01b26cbfcd9d