Hillerstorp 5th of February 2026, 12:30 CET

OCTOBER - DECEMBER

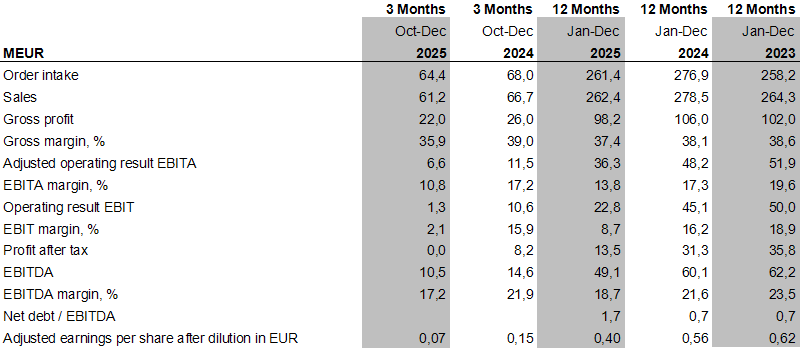

- Order intake in the quarter decreased by 5 percent compared with the same period last year and amounted to 64,4 (68,0) MEUR. Adjusted for currency and acquired and discontinued businesses, the order intake decreased by 3 percent.

- Sales in the quarter decreased by 8 percent compared with the same period last year and amounted to 61,2 (66,7) MEUR. Adjusted for currency and acquired businesses, sales decreased by 8 percent.

- Operating profit before amortizations (EBITA) decreased to 6,6 (11,5) MEUR.

- Operating margin before amortizations (EBITA margin) decreased to 10,8 (17,2) percent.

- Financial net was -1,3 (-0,4) MEUR.

- During the fourth quarter, one-off items negatively affected the result by -4.2 MEUR, of which -1.7 MEUR relates to non-cash flow impairments of assets. During the first half of 2026, one-off items are expected to negatively affect the result by -2.2 MEUR (see also page 5).

- Profit after tax decreased to 0 (8,2) MEUR.

- Adjusted earnings per share after dilution amounted to 0,07 (0,15) EUR.

- Earnings per share after dilution amounted to 0,00 (0,14) EUR.

JANUARY - DECEMBER

- Order intake in the period decreased by 6 percent compared with the same period last year and amounted to 261,4 (276,9) MEUR. Adjusted for currency and acquired and discontinued businesses, the order intake decreased by 5 percent.

- Sales in the period decreased by 6 percent compared with the same period last year and amounted to 262,4 (278,5) MEUR. Adjusted for currency and acquired businesses, sales decreased by 6 percent.

- Operating profit before amortizations (EBITA) decreased to 36,3 (48,2) MEUR.

- Operating margin before amortizations (EBITA margin) decreased to 13,8 (17,3) percent.

- Financial net was -4,9 (-4,3) MEUR.

- Profit after tax decreased to 13,5 (31,3) MEUR.

- Adjusted earnings per share after dilution amounted to 0,40 (0,56) EUR.

- Earnings per share after dilution amounted to 0,23 (0,52) EUR.

- The Board of Directors suggests a dividend of 0,24 (0,34) EUR per share.

TROAX GROUP FIGURES

2025 Q4 - COMMENTS FROM THE PRESIDENT AND CEO

When I summarize the fourth quarter of 2025 as well as the full year, I conclude that the weak and uncertain demand situation continued to characterise the market. We continued the intensive work to develop and streamline the business, and we passed several important milestones. I am also pleased that during the same quarter we were able to announce three acquisitions that will contribute both strategically and financially. The acquisition of Vichnet, the market leader in China in mesh panels and cable trays, will constitute an important platform for our continued growth journey in Asia. In addition, by acquiring parts of the Danish Dancop Group and the Italian Stommpy, we have created the conditions for growth in flexible protective barriers, which is an important piece of the puzzle in our customer offering. The fact that we have been able to successfully carry out several parallel acquisition processes also shows, in my opinion, that our new decentralized organisational model is working well.

Improvements and investments strengthen our production efficiency

We have made good progress in streamlining our factory structure during the quarter. We have completed the shutdown of our Polish production and the move to Sweden. We have also started moving into our new factory in the US, which will be fully completed by the end of the second quarter of 2026. The goal of these two major projects is to significantly strengthen our competitiveness in the medium and long term. However, in the shorter term, these projects contribute to lower results. During the fourth quarter, the Group recorded non-recurring costs totaling 4,2 MEUR related to double rental costs, relocation costs and overlapping personnel in the US, as well as restructuring costs and impairment of tangible fixed assets and inventories. During the first half of 2026, we will have additional non-recurring costs of approximately 2,2 MEUR related to the move of the factory from Chicago to Nashville, which will be recognized in the period in which they arise.

Low volumes and operational issues in North America are putting pressure on profitability

Demand remains soft and order intake decreased organically in all regions. In both Europe and North America, demand was weaker in the automotive industry than previously but was partly offset by somewhat stronger demand in the warehouse segment. In Asia, which grew strongly in 2025, development was more modest than in previous quarters. Similar to the third quarter, order intake was negatively affected by the temporary order intake stop we introduced in connection with the shutdown and relocation of our Polish operations to Sweden. Now at the beginning of 2026, I remain cautiously optimistic about the demand development going forward.

There are many positive takeaways from the fourth quarter, but the financial impact of our efforts will become more visible in 2026. The financial result for the fourth quarter is therefore at a lower level than what we can and should achieve in the long term.

Lower volumes contributed to lower gross margin and lower profitability. If we break the development down in more detail, we can see that most parts of the Group are performing well given the conditions, while the few operations we have with more complex challenges continued to struggle. In Europe, we have had a favorable product mix, stable input costs and have mainly adapted our supply chain to the lower volumes. The exception is our commercial partitioning business, which had low volume and weak results, which negatively affected the Group's results by approximately 130 bps in the quarter. The performance in North America was weak and reduced the Group's profitability by approximately 300 bps. The price increases we have implemented have not yet had an impact on the income statement. In addition, low volume and operational problems in the current facility, that is about to be phased out, contributed negatively. With adjusted prices and with our new factory establishment, the situation will improve in 2026.

The cost-saving measures implemented earlier in the year have had the desired effect and personnel costs have decreased. The increase in administrative and selling expenses is mainly attributable to our acquisitions. Due to lower sales, our administrative and selling expenses are still too high in relative terms, but will decrease as our efficiency and digitalisation projects are completed.

In summary…

With our decentralised organization, more optimized supply chain and well-chosen acquisitions, we are working tirelessly to be our customers' natural partner in industrial safety solutions. As the market improves and our transformation projects are completed, we will be in better shape than ever to grow profitably and gain more market share.

Martin Nyström, President and CEO

TEAMS WEBINAR

Invitation to presentation of the latest quarter result:

Martin Nyström, CEO, and Anders Eklöf, CFO, will present the results at a Teams webinar on the 5th of February 2026 at 13:00 CET. The conference will be held in English. For more information, please refer tohttps://www.troax.com/investors/press-releases/

For additional information, please contact:

Martin Nyström

President and CEO

martin.nystrom@troax.com

Tel: +46 370 828 31

Anders Eklöf

CFO

anders.eklof@troax.com

Tel +46 370 828 25

This information is information that Troax Group AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation 596/2014. The information was submitted for publication, through the agency of the contact person set out above, at 12:30 CET on the 5th of February 2026

About Troax

Troax Group is the leading global supplier of indoor perimeter protection for manufacturing and warehousing environments.

Troax develops high quality and innovative safety solutions to protect people, property and processes.

Troax Group AB (publ), Reg. No. 556916-4030, is a global company with a strong sales force and efficient supply chain. With local presence we offer excellent customer service and quick deliveries. We are represented in 40 countries and employ roughly 1 100 people. The Company's head office is located in Hillerstorp, Sweden and our sales amounted to 261 MEUR (2025)