PAREF Group, a leading European real estate management player for more than 30 years, announces the completion of the sale of its subsidiary SOLIA Paref to the RYZE Group (formerly YARD REAAS). The Italian leader in real estate consulting and integrated property services, is executing this acquisition through its wholly-owned French subsidiary VSA Ile de France.

This transaction follows the announcement in December 2025 regarding the entry into exclusive negotiations for SOLIA Paref, and it was finalized today and takes effect immediately.

This divestment aligns with the PAREF Group's strategy to refocus on its core businesses: Investment, Fund Management and Asset Management and to concentrate resources on high-value-creation activities. This move also ensures that SOLIA Paref will benefit from the backing of a solid international player, thereby guaranteeing the continuity and quality of the services currently provided by SOLIA Paref. Well-established in Italy, RYZE is pursuing its active expansion across European markets, building on several successful acquisitions over the past few years.

"This transaction represents a key milestone for PAREF Group. It enables us to implement our strategy of refocusing on Investment, Fund Management and Asset Management, while providing SOLIA Paref and its teams with the optimal conditions to pursue their growth within a leading European group that shares our core values."

Antoine Castro, CEO of PAREF Group

"Reflecting our international expansion ambitions, this acquisition significantly strengthens our footprint in France. By integrating the teams and expertise of SOLIA Paref, we aim to scale our model and reinforce our position as a leading partner for institutional and corporate clients across Europe."

Emanuele Bellani, CEO of RYZE Group

As part of this transaction, PAREF Group was advised by Racine, while RYZE was advised by KPMG and Orrick.

About PAREF Group

PAREF is a European group dedicated to sustainable real estate performance. As a leading player in real estate investment and management, the group manages over €3 billion of AUM, two-thirds of which are located outside France.

For more than 30 years, PAREF has relied on the expertise of its teams to support shareholders, investors, tenants and users.

With a strong presence in France, Germany, Italy and Switzerland, PAREF pursues an approach that combines profitability target, sustainability and client satisfaction. The Group serves both institutional and private investors, thereby contributing to the transformation of the real estate sector.

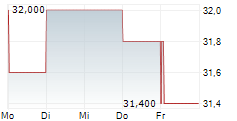

PAREF is a company listed on Euronext Paris, Compartment C, under ISIN FR0010263202 - Ticker PAR.

More information on www.paref.com

Press Contacts

| PAREF Group Samira Kadhi +33(7) 60 00 59 52 samira.kadhi@paref.com | Shan Agency Aliénor Kuentz / Laetitia Baudon +33(6) 28 81 30 83 / +33(6) 16 39 76 88 paref@shan.fr |

About the RYZE Group

RYZE is an independent group, leader in real estate consulting and integrated management of real estate services. It operates in both the institutional market and the distressed segment for Italian and foreign investors, banks, AMCs/funds, industrial groups, private equity funds and family offices. The group boasts over 30 years of experience in the Technical (Due Diligence, Project Management & Monitoring, Engineering), Environmental, ESG, Valuation and Property & Building Management sectors. In the ESG (Environmental, Social, Governance) field and investment sustainability criteria, in 2015 it was the first real estate consultancy company in Italy registered for PRI - Principles for Responsible Investment. It has over 500 internal resources, a network of 600 technicians, 1,000 valuers and approximately €80 million in revenue.

Press Contact

RYZE Group

Rosita Brambillasca

Group Head of Marketing & Communication

+39 347 9476831

rosita.brambillasca@ryze.eu

- SECURITY MASTER Key: lWhxkZaXZ2qby21pk5pqaJRnaWZilWibl2THl5dtZJjKnWtgx2hobZfLZnJnmWtt

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-96467-press-release-paref-group-closing-solia-paref-vdef.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free