With patience as our hard currency, we create the conditions for change

Fourth quarter

- Net sales decreased -9.9% to MSEK 697.2 (773.4)

- Comparable growth amounted to -9.4% (1.0)

- Gross profit declined -1.1% to MSEK 301.3 (304.5) and the gross margin decreased to 43.2% (39.4)

- Adjusted EBITA totalled MSEK 37.8 (33.3) and the adjusted EBITA margin was 5.4% (4.3)

- The company's operating loss amounted to MSEK -6.2 (19.9) and the operating margin to -0.9% (2.6)

- The net loss for the quarter was MSEK -2.0 (16.0)

- Cash flow from operating activities totalled MSEK 191.3 (142.7)

- Earnings per share before dilution amounted to SEK -0.03 (0.51)

Full year

- Net sales decreased -7.9% to MSEK 2,379.1 (2,583.6).

- Comparable growth amounted to -7.5% (0.8)

- Gross profit declined -10.9% to MSEK 932.7 (1,046.9) and the gross margin decreased to 39.2% (40.5)

- Adjusted EBITA totalled MSEK 43.0 (49.1) and the adjusted EBITA margin was 1.8% (1.9)

- The company's operating loss amounted to MSEK -372.6 (13.4) and the operating margin to -15.7% (0.5)

- The net loss for the period amounted to MSEK -388.1 (-19.9)

- Cash flow from operating activities totalled MSEK 167.0 (139.2)

- Earnings per share before dilution amounted to SEK -7.49 (-0.64)

Significant events during and after the end of the quarter

- Kjell & Company outsources the operation of its warehouse following the relocation to new warehouse facilities.

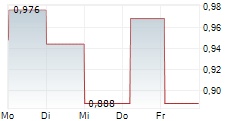

- Kjell Group publishes preliminary net sales, earnings and gross margin for Q4 2025 ahead of a proposal for share issues.

- Kjell Group announces a directed share issue of approximately MSEK 60 to Göran Westerberg, as well as a fully guaranteed rights issue of approximately MSEK 145.5.

- The Nomination Committee proposes the election of Göran Westerberg as new Chairman of the Board.

- Kjell Group has reached an agreement with Nordea regarding the terms of long-term bank financing of MSEK 500

"When operating in the midst of a transformation, the usual seasonal logic no longer applies. What is normally done as a matter of routine needs to be reconsidered. Changes create knock on effects. Short term and long term. This became clear in this quarter", says Sandra Gadd, CEO Kjell Group.

Webcast in connection with the publication of the year-end report

Sandra Gadd, CEO, and Fredrick Sjöholm, CFO, will hold a webcast in connection with the publication of the year-end report at 10:00 a.m. on 9 February 2026.

Participate via webcast:

https://kjell-group.events.inderes.com/q4-report-2025

Participate via telefonkonferens:

https://conference.inderes.com/teleconference/?id=5004591

The presentation material is available on the Group's website

https://www.kjellgroup.com/en/investors/financial-reports/.

Interim Reports

The complete year-end report for January-December 2025 and earlier reports are available on www.kjellgroup.com.

Certified adviser

FNCA Sweden AB is the company's certified adviser.

Contacts Kjell Group

Sandra Gadd, CEO +46 (0) 10 680 25 35, sandra.gadd@kjell.com

Fredrick Sjöholm, CFO +46 (0) 10 680 25 65, fredrick.sjoholm@kjell.com

About Us

Kjell Group offers one of the most comprehensive assortment of electronic accessories on the market. The company operates online in Sweden, Norway, and Denmark, as well as through 148 service points, including 117 in Sweden and 31 in Norway. Headquartered in Malmö, the company generated SEK 2.4 billion in revenue in 2025.

With Kjell & Company's customer club, which boasts over 3 million members, and its Danish subsidiary AV-Cables, the Group has a unique understanding of people's technology needs. Approximately 1,350 employees work every day to improve lives through technology.

Learn more at kjell.com or kjellgroup.com

Follow us on LinkedIn, Facebook, Instagram