TORONTO, Feb. 11, 2026 (GLOBE NEWSWIRE) -- Green Shift Commodities Ltd. (TSXV: GCOM; OTCQB: GRCMF) ("Green Shift," "GCOM," or the "Company") is pleased to announce that Jaguar Uranium Corp. ("Jaguar Uranium") has successfully completed an initial public offering ("IPO") and listing of its common shares (the "Jaguar Shares") on the NYSE American Exchange (the "NYSE American").

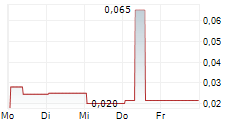

Jaguar Uranium completed its IPO with a capital raise of US$25 million, issuing Jaguar Shares at a price of US$4.00 per share. Green Shift owns 5,181,777 Jaguar Shares, which began trading on the NYSE American on February 10, 2026, under the ticker symbol "JAGU".

Trumbull Fisher, CEO of Green Shift Commodities, commented: "We are very pleased to see Jaguar Uranium reach this important milestone. Interest in the uranium sector continues to grow, and we believe Jaguar Uranium is well positioned to execute on its business plan and create additional shareholder value. This public listing underscores significant value in GCOM through the Jaguar Shares we hold. We intend to hold our investment on a long-term basis as we share Jaguar's excitement with respect to its advanced uranium asset portfolio in Argentina and Colombia".

For further information, please contact:

Trumbull Fisher

CEO and Director

Email: Tfisher@greenshiftcommodities.com

Tel: 416-917-5847

Website: www.greenshiftcommodities.com

Twitter: @greenshiftcom

LinkedIn: https://www.linkedin.com/company/greenshiftcommodities/

Forward-Looking Statements

This news release includes certain "forward looking statements". Forward-looking statements consist of statements that are not purely historical, including statements regarding beliefs, plans, expectations or intensions for the future, and include, but are not limited to, statements with respect to: the Company's intentions with respect to holding the Jaguar Shares, the future direction of the Company's strategy; and other activities, events or developments that are expected, anticipated or may occur in the future. These statements are based on assumptions, including: (i) the future price of the Jaguar Shares; (ii) Jaguar Uranium's business, financial condition and prospects (iii) actual results of our exploration, resource goals, metallurgical testing, economic studies and development activities will continue to be positive and proceed as planned; (iv) requisite regulatory and governmental approvals will be received on a timely basis on terms acceptable to Green Shift; (v) economic, political and industry market conditions will be favourable; and (vi) financial markets and the market for uranium, battery commodities and rare earth elements will continue to strengthen. Such statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in such statements, including, but not limited to: (1) Jaguar Uranium's business, financial condition and prospects not being as currently anticipated, (2) changes in general economic and financial market conditions, (3) changes in demand and prices for minerals, (4) the Company's ability to source commercially viable reactivation transactions and / or establish appropriate joint venture partnerships, (5) litigation, regulatory, and legislative developments, dependence on regulatory approvals, and changes in environmental compliance requirements, community support and the political and economic climate, (6) the inherent uncertainties and speculative nature associated with exploration results, resource estimates, potential resource growth, future metallurgical test results, changes in project parameters as plans evolve, (7) competitive developments, (8) availability of future financing, (9) exploration risks, and other factors beyond the control of Green Shift including those factors set out in the "Risk Factors" in our Management Discussion and Analysis for the three and nine months ended September 30, 2025 available on SEDAR+ at www.sedarplus.ca. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. Green Shift assumes no obligation to update such information, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.