WASHINGTON (dpa-AFX) - Kraft Heinz (KHC) has put its planned corporate split on hold as its new chief executive moves to refocus the company on operational recovery and growth.

CEO Steve Cahillane, who took over in January, said the company's problems are largely within management's control and can be addressed through disciplined execution. He indicated that returning the business to profitable growth is the immediate priority, adding that suspending separation efforts will prevent additional costs tied to the proposed breakup this year.

Alongside the pause, Kraft Heinz plans to invest $600 million into reviving its U.S. operations. The funds will be directed toward marketing, sales, research and development, product quality improvements and selective pricing actions aimed at strengthening competitiveness.

The breakup plan, first unveiled in September, would have undone much of the $46 billion merger that created the current company. While initially welcomed by investors, the merger's appeal faded over time as U.S. sales weakened and the company took write-downs on major brands such as Oscar Mayer and Maxwell House. Kraft Heinz has spent years attempting to stabilize its domestic business.

Berkshire Hathaway, which holds a significant stake in Kraft Heinz, backed the decision to pause the separation. CEO Greg Abel said management can now concentrate on improving the company's competitive position and customer service under its new leadership.

Analysts offered mixed reactions. Some viewed the strategic shift as a necessary reset under Cahillane, who previously led Kellogg through its own restructuring. Others warned the move signals the businesses may not yet be strong enough to stand independently, suggesting uncertainty remains around the long-term growth outlook.

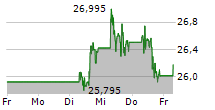

The announcement coincided with quarterly results that exceeded earnings expectations but missed revenue forecasts. Shares initially fell before recovering to trade roughly flat, reflecting divided investor sentiment on the revised strategy.

KHC currently trades at $24.86 or 0.34% higher on the NasdaqGS.

Copyright(c) 2026 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2026 AFX News