This document in English is a translation of the original in Swedish. In case of any discrepancy, the Swedish original will prevail.

New customer contracts, Improved cash position

October - December 2025

- Net sales were KSEK 5 426 (6 000)

- Profit/loss after financial items was KSEK -3 678 (-3 451)

- Earnings per share were SEK 0,0 (0,0) SEK

January - December 2025

- Net sales were KSEK 26 112 (23 941)

- Profit/loss after financial items was KSEK -6 111 (-9 915)

- Earnings per share were SEK 0,0 (0,0) SEK

In 2025, Aino Health continued to execute on its strategy in a market environment characterised by heightened cost awareness and cautious investment decisions. Against this backdrop, we strengthened the foundations of our business: we expanded our license base, progressed disciplined value-based pricing, advanced product development and research, and reinforced our financing position to accelerate international growth.

Commercial development and customer base

During the year, the number of licenses increased to 116,000. Growth was driven by a combination of new customer acquisitions, continued rollouts, and increased adoption within existing customers. We are encouraged by continued demand across multiple sectors, reflecting a broad and structural need for systematic work ability management.

Revenue quality and pricing discipline

A strategic priority during 2025 was to improve the quality of recurring revenue by gradually strengthening average pricing. This was done in close dialogue with customers and with a focus on aligning pricing with delivered value and future product and service commitments. While this approach supports long-term sustainability, it can create short-term volatility. During the year, one major customer relationship ended primarily due to the customer's financial circumstances. We view such outcomes as important learning inputs to further develop our segmentation, packaging, value communication, and renewal processes, while maintaining a disciplined approach to pricing and customer portfolio management.

Strengthened financing to support international expansion

In November 2025, our financing position was strengthened through a total financing package of SEK 7.7 million, comprising a loan from Finnvera (EUR 560,000, approximately SEK 6.2 million) and additional funding from major shareholders. We regard Finnvera's participation as an important external validation of Aino's growth potential. The proceeds are intended to be used exclusively to accelerate international growth, supporting focused market expansion and the capabilities required to scale effectively.

Product development, research, and AI initiatives

Aino's mission is to enable organisations to manage work ability systematically and proactively. In 2025, we continued to develop the platform with new functionality to strengthen customers' work ability management effectiveness and to improve adoption and usability. In parallel, we progressed broad research and development initiatives related to the impact and methods of work ability management, and we continued deep work on the application of AI across key work ability management processes. We pursue AI development with an emphasis on trust, transparency, and responsible use-enhancing decision support while preserving human accountability.

We also continued to observe interest from academic and research institutions in the potential of our platform and data to support evidence-based study of work ability, wellbeing, and productivity-an encouraging sign of relevance and differentiation.

Quality, information security, and compliance

Trust and governance are fundamental to Aino's ability to scale, particularly in enterprise and regulated environments. Alongside our existing ISO 9001 management system certification, we initiated the process towards ISO 27001 certification. Our quality and information security management framework is designed to support applicable requirements, including GDPR and NIS2, and to meet the expectations of customers with elevated compliance and security needs. These initiatives are integral enablers of international expansion and larger customer engagements.

Outlook and priorities for 2026

Aino enters 2026 with strengthened operational foundations and clear priorities:

Accelerate time-to-value through successful deployments and customer success execution.

Increase expansion within existing customers through deeper adoption and broader use cases.

Execute focused international growth supported by strengthened financing and disciplined go-to-market operations.

Continue investment in product, security, and evidence-based impact to maintain differentiation and trust.

The demand for measurable, proactive work ability management is driven by structural factors-including demographics, labour market constraints, and the rising importance of workforce sustainability. We believe Aino is well-positioned to address this need through a scalable SaaS platform, strengthened commercial execution, and ongoing investments in enterprise readiness and research-backed impact.

On behalf of the Board of Directors and the entire Aino team, I would like to thank our customers, partners, employees, and shareholders for your continued trust and support.

This information is information that Aino Health is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2026-02-12 08:30 CET.

For more information

Jyrki Eklund, CEO Aino Health

Phone: +358 40 042 4221

Email: jyrki.eklund@ainohealth.com

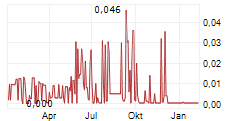

Aino Health AB (publ) is listed on Nasdaq Stockholm First North Growth Market (Ticker: AINO).

Certified Adviser

Tapper Partners AB

More info:?https://investors.ainohealth.com/certified-adviser/

About Aino Health (publ)

Aino Health is the leading provider of Software as a Service (SaaS) solutions for Corporate Health Management. Our platform helps organizations reduce sickness absences, identify root causes of health challenges, and systematize proactive support for employees. For more information, please visit?ainohealth.com.