WASHINGTON (dpa-AFX) - While reporting financial results for the fourth quarter on Friday, Enbridge, Inc. (ENB, ENB.TO) again reaffirmed its distributable cash flow or DCF and adjusted EBITDA guidance for the full-year 2026.

For fiscal 2026, the company continues to project DCF in a range of C$5.70 to C$6.10 per share and adjusted EBITDA between C$20.2 billion and C$20.8 billion.

On average, 14 analysts polled expect the company to report earnings of $3.06 per share for the year. Analysts' estimates typically exclude special items.

The Company also reaffirmed its 2023 to 2026 near-term growth outlook of 7 to 9 percent for adjusted EBITDA growth, 4 to 6 percent for adjusted earnings per share growth and approximately 3 percent for DCF per share growth.

Post 2026, adjusted EBITDA, earnings per share and DCF per share are all expected to grow by approximately 5 percent annually.

Enbridge's Board of Directors has declared a 3 percent higher quarterly dividend of C$0.97 per share on its common shares, payable on March 1, 2026 to shareholders of record on February 17, 2026.

For the fourth quarter, the company reported net earnings attributable to shareholders of C$1.95 billion or C$0.89 per share, sharply higher than C$493 million or C$0.23 per share in the prior-year quarter.

Excluding items, adjusted earnings for the quarter was C$0.88 per share, compared to C$0.75 per share in the year-ago quarter.

The Street is looking for earnings of C$0.78 per share for the quarter.

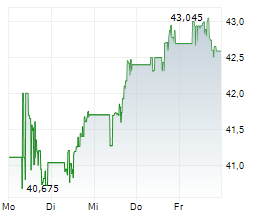

In Friday's pre-market trading, ENB is trading on the NYSE at $52.28, up $0.44 or 0.85 percent.

For more earnings news, earnings calendar, and earnings for stocks, visit rttnews.com

Copyright(c) 2026 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2026 AFX News