Press release - 2025 Revenue and activity

Sainte-Marie, Monday 16 February 2026, 8 :45 p.m.

FULL YEAR 2025 CONSOLIDATED REVENUE

Solid Investment property business with economic GRI in line with the annual target

Improved momentum in the Development business in the second half of the year

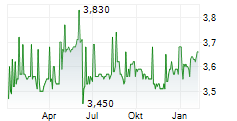

Sainte-Marie, Reunion Island-CBo Territoria, a leading real estate player in the Indian Ocean for over 20 years (operating in La Réunion and Mayotte), today announces its consolidated revenue for the fiscal year ended December 31, 2025. CBo Territoria is an income-focused real estate investment company eligible for the French PEA PME program and listed on Euronext Paris (ISIN: FR0010193979-CBOT), Compartment C)

| (€ in millions) | 2025 | 2024 | Variation | Variation |

| Gross rental income(GRI excluding equity in net income/loss of affiliates) | 26.9 | 26.6 | +0.3 | +1.3% |

| Property development | 24.9 | 38.5 | -13.6 | -35.3% |

| Ancillary activities | 1.5 | 1.6 | -0.1 | -5.0% |

| Consolidated revenue (€ in millions) | 53.3 | 66.7 | -13.3 | -20.0% |

Unaudited financial statements

In 2025, CBo Territoria delivered a solid performance from its Investment property business, with gross economic rental income in line with its annual target. The Property development business, although down year-over-year (notably due to the end of the Pinel scheme), benefited from improved trends in the second half of the year. It is now focused on two products with satisfactory margins (block sales and land plots). Itreports a solid order book.

INVESTMENT PROPERTY

CBo Territoria is a property investment company with a diversified portfolio consisting in retail, offices, business premises, restaurants, and leisure assets. The Group is pursuing its growth strategy by developing high-yield assets in La Réunion and Mayotte.

In 2025, IFRS gross rental income generated by the portfolio (excluding equity-accounted investees) amounted to €26.9 million (compared with €26.6 million in 2024). The 1.3% increase was driven by scope effects, with other factors offsetting each other.

From an overall perspective, gross rents generated by the economic portfolio([1]) amounted to €30.8 million, compared with €30.3 million in 2024, up 1.6%. This increase, in line with the annual target revised upward in September (approximately +2% vs. +1.0% previously), breaks down as follow: +1.3% (+€0.4 million) from scope effect, reflecting the positive full-year impact of the delivery of the France Travail office building in Mayotte in July 2024 and the KFC in Saint-Joseph in October 2024 (JV asset) partly offset by residential disposals completed in 2024 and 2025([2]). On a like-for-like basis, growth was +0.3% (+€0.1 million), primarily driven by +2.1% indexation (+€0.6 million), and offset by -1.9% (-€0.6 million) related to vacated assets not yet re-let at the reporting date

On December 31, 2025, CBo Territoria acquired Villa St. Joseph, a prime office building of more than 2,500 m2, ideally located in the heart of Saint-Denis in La Réunion, and benefiting from a particularly strong tenant profile. The asset will contribute to consolidated revenue in 2026.

PROPERTY DEVELOPMENT

Since its inception, CBo Territoria has been one of the leading residential developers in La Réunion. The business is now focused on two segments: bulk sales of residential buildings and sales of building plots. In the commercial segment, the Group develops projects for its own account and, on an opportunistic basis, projects on behalf of third parties.

In 2025, Property Development revenue totaled €24.9 million, compared with €38.5 million in 2024 (down €13.6 million, or -35.3%), with stronger momentum in the second half of the year (H1 revenue of €11.1 million, down €10.1 million vs. H1 2024).

The decline primarily reflects the expiration of the Pinel Dom scheme, with activity nil in 2025, representing a negative base effect of €6.1 million compared with 2024.

Based on the progress of ongoing projects, revenue from bulk sales amounted to €16.8 million in 2025 (vs. €22.7 million in 2024, down €5.9 million or -26%). The second half totaled €9.0 million (vs. €7.6 million in H1 2025), benefited from the launch of the Le Coutil development (48 units), which was formally approved and broke ground during the summer. At year-end, the Group executed a second off-plan sale (VEFA) with SHLMR (Kaloupilé 2, comprising 52 units), bringing the total to 100 units and €21.0 million for the year (compared with 76 units and €16.4 million in 2024). The backlog therefore stood at €22.8 million (compared with €18.4 million at year-end 2024).

Revenue from residential plot sales totaled €6.9 million for 43 lots (compared with €9.1 million for 53 plots in 2024, down -23.9% in value). After a very slow first half (15 parcels for €2.4 million), activity strengthened in the second half, with 28 sales totaling €4.5 million. The residential lot order book stood at €8.2 million as of December 31, 2025 (+€2.6 million vs. year-end 2024).

Total order book amounted to €22.8 million at year-end 2025 (compared with €15.3 million at year-end 2024).

Overall, reflecting the phasing of projects, CBo Territoria delivered 78 units at Beauséjour this year with the Jardin des Gardénias residence (compared with 241 units in 2024), and 251 residential units were under construction as of year-end 2025([3]) (compared with 166 units at year-end 2024).

Finally, commercial and miscellaneous revenue totaled €1.2 million (+€0.6 million vs. 2024), notably including the sale of a serviced commercial land parcel at Beauséjour.

At year-end 2025, 10 hectares of land were rezoned in the municipality of Sainte-Marie, directly extending the ACTIS I business park, whose development was completed in 2022.

2026 Financial calendar

2025 annual results:Press release to be issued on Tuesday, March 3, 2026 (after market close)

Presentation meeting on Wednesday, March 4 at 10:00 a.m. (Paris time).

Annual General Meeting: April 28, 2026 (Sainte-Marie)

About CBo Territoria (FR0010193979, CBOT)

A leading real estate player in Réunion Island for 20 years, CBo Territoria has become a multi-regional development property investment company (€379.7m economic property portfolio value at end-June 2025). The Group operates across the entire real estate value chain (Land Developer, Property Developer and Property Investment Company), pursuing growth through its land reserves or land acquisitions.

Since inception, CBo Territoria has been committed to sustainable real estate. CSR is embedded in the company's DNA and is embodied today in its Impact Péï 2030 programme.

CBo Territoria is a dividend-paying property investment company eligible for PEA PME listed on Euronext Paris (Compartment C).

More information about cboterritoria.com

Investor and Press Contacts

Caroline Clapier - Administrative and Financial Director - direction@cboterritoria.com

Agnès Villeret - Komodo - Tel.: 06 83 28 04 15 - agnes.villeret@agence-komodo.com

Reunion Island & Mayotte: Nathalie Cassam Sulliman - ncassam@cboterritoria.com

APPENDIX

(Unaudited financial statements)

Note: Percentage changes are calculated based on exact figures; differences in totals may occur due to rounding

OPERATING PERFORMANCE

Rental revenue (PROPERTY INVESTMENT)

| (€ in millions) | 2025 | 2024 | Variation |

| Commercial | 25.0 | 24.8 | +1.2% |

| Agricultural and miscellaneous | 1.3 | 1.2 | +10.4% |

| Residential | 0.6 | 0.7 | -10.0% |

| Gross Rental revenue | 26.9 | 26.6 | +1.3% |

| Share of equity-accounted investm ent | 3.9 | 3. 7 | +3.9% |

| Gross Rental revenue (including Share of equity-accounted investees | 30.8 | 30.3 | +1.6% |

| PROPERTY DEVELOPMENT KPI | Sales | Order book at 31/12 | ||||||||||

| En M€ | 2025 | 2024 | Var (%) | 2025 | 2024 | Var (%) | ||||||

| Residential | 27.9 | 27.0 | +3.5% | 22.8 | 15.3 | +49.1% | ||||||

| Incl. Block sales (Intermediate and Social) | 21.0 | 16.4 | +28.1% | 14.6 | 9.7 | +50.1% | ||||||

| Incl. Sale of residential lots | 6.9 | 9.1 | -23.9% | 8.2 | 5.6 | +47.3% | ||||||

| Incl. Individual clients (Intermediate-Pinel DOM) | N/A | 1.5 | N/A | N/A | N/A | - | ||||||

| Commercial | - | 0.2 | - | - | - | - | ||||||

| TOTAL Property development revenue | 27.9 | 27.2 | +2.7% | 22.8 | 15.3 | +49.1% | ||||||

| Property Development Revenue (€ in millions) | 2025 | 2024 | Variation |

| Residential | 23.7 | 37.9 | -37.4% |

| Block sales (Intermediate and Social) | 16.8 | 22.7 | -26.0% |

| Sale of residential lots | 6.9 | 9.1 | -23.9% |

| Individual clients (Intermediate-Pinel DOM) | 0 | 6.1 | N/A |

| Commercial | 1.2 | 0.6 | X 2 |

| Commercial buildings | - | 0.2 | -100% |

| Sales of residential lots and other revenue | 1.2 | 0.3 | X 3.6 |

| Total Property development revenue | 24.9 | 38.5 | -35.3% |

GLOSSARY

Backlog: Remaining pre-tax revenue to be recognized from completed sales of residential and/or commercial buildings (excluding residential lot sales).

Order backlog (or reservation backlog): Total pre-tax revenue from units under reservation agreements as of the reporting date.

Units available for sale: Revenue from units offered for sale that have not yet been reserved.

Economic property portfolio: Investment properties and the share of assets held through equity-accounted investees.

Equity-accounted investee: An entity accounted for under the equity method. The equity method is an accounting technique under which the carrying amount of an investment is adjusted to reflect the parent company's share of the investee's equity, replacing the historical carrying value of the shares.

Residential lot sales-Development: Sales of buildable residential or commercial lots.

Bulk sales-Development: Acquisition of an entire building or an entire real estate development by a single purchaser.

Individual customer sales-Development: Acquisition of a completed residential unit or a lot by an individual buyer.

Top of Form

([1]) The economic portfolio consist of investment properties (commercial, agricultural land and other, and residential assets) and the Group's share of assets held in partnerships and accounted for under the equity method (equity-accounted investments). This share amounted to €3.9 million in 2025, compared with €3.7 million in 2024.

([2]) Including the full-year impact of the five units sold in 2024. In 2025, CBo sold five units individually. As of December 31, 2025, CBo Territoria owned 69 residential units, including 59 units classified as Investment Property held for sale.

[3] Le Coutil (48 units), Aloé Macra (76 units), Pierre de Lune (12 townhomes), Kaloupilé 2 (52 units), Kaisary 3 (37 units, including 2 bulk lots), Jardin des Songes 1 (26 units).

- SECURITY MASTER Key: nWyeZMWYZ5udxptqY8lrbmdmbmZplGibamOZm5aamJvHZ29pnWZmmcnLZnJnmm5p

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-96593-cbot_cr-2025-press-release-021626.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free