Press release

Sainte-Marie, 5 January 2026, 8:30 p.m. (local time)

CBo Territoria announces two transactions in Réunion Island

Acquisition of a fully leased prime office building in Saint-Denis

Off-plan sale agreement with SHLMR for the Kaloupilé 2 project in Beauséjour

"These two transactions perfectly illustrate the work carried out by CBo Territoria's teams throughout the year to secure the best investment and growth opportunities for our Group. They both strengthen and diversify the assets of our tertiary real estate portfolio and support the development of a high-quality, affordable rental housing stock that is well suited to the needs of Réunion Island," said Géraldine Neyret, Chairwoman and Chief Executive Officer of CBo Territoria.

Acquisition of Villa St Joseph, 2,550 sq.m of fully leased office space in Saint-Denis

At the end of December, as part of an off-market transaction, CBo Territoria acquired, from a company 85% owned by Caisse des Dépôts, Villa St Joseph, a prime office complex delivered in 2016. The property benefits from a strategic location in the very heart of Saint-Denis, Réunion Island, and from a particularly strong tenant profile.?

Its first-rate tenants, such as Caisse des Dépôts, Icade, Banque Delubac, Bpifrance, and Transdev, offer high visibility on future rental income. With full occupancy and an average remaining lease term of five years, this asset fully aligns with an investment strategy combining rental security, yield, and long-term value creation

The acquisition, completed at an attractive initial net yield in line with the Group's objectives, was financed partly from equity and via bank financing from the Group's long-standing partners.

Off-plan sale agreement with SHLMR for the Kaloupilé 2 project in Beauséjour

Following Le Coutil last June (48 units), CBo Territoria signed at the end of December a new off-plan sale with SHLMR (Groupe Action Logement).

Located on the heights of Sainte-Marie with views over the entire northern coastline of Réunion Island, the KALOUPILE 2 residence consists of 52 intermediate rental housing units, ranging from one- to four-bedroom apartments, and includes 89 parking spaces. Construction will begin in the first quarter of 2026, with delivery expected in the first half of 2028.

The residence is organized around three small-scale buildings seamlessly integrated into the slope and surrounding landscape, allowing most of the verandas to enjoy unobstructed views of the northern coastline. Located a five-minute walk from the center of Beauséjour, future residents will benefit from a wide range of nearby shops and services, including a supermarket, bakery, food retailers, an open-air market and dining area, a medical center, a pharmacy, and a sports club with tennis courts, squash courts, and a golf driving range.

Lastly, in line with its sustainable urban development model in tropical environments, the residence will benefit from NF Habitat[1] certification, and an employment charter will be implemented to promote the professional integration of people facing difficulties accessing the labor market.

Financial calendar 2026:

2025 annual revenue - Monday, February 16 (after market close)

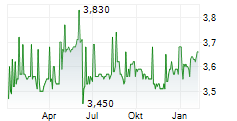

About CBo Territoria (FR0010193979, CBOT)

A leading real estate player in Réunion Island for 20 years, CBo Territoria has become a multi-regional development property investment company (€379.7m economic property portfolio value at end-June 2025). The Group operates across the entire real estate value chain (Land Developer, Property Developer and Property Investment Company), pursuing growth through its land reserves or land acquisitions.

Since inception, CBo Territoria has been committed to sustainable real estate. CSR is embedded in the company's DNA and is embodied today in its Impact Péï 2030 programme.

CBo Territoria is a dividend-paying property investment company eligible for PEA PME and listed on Euronext Paris (Compartment C).

More information about cboterritoria.com

Investor and Press Contacts

Caroline Clapier - Administrative and Financial Director - direction@cboterritoria.com

Agnès Villeret - Komodo - Tel.: 06 83 28 04 15 - agnes.villeret@agence-komodo.com

Reunion Island & Mayotte: Nathalie Cassam Sulliman - ncassam@cboterritoria.com

[1] A certification that attests to high housing quality, particularly with regard to energy performance, acoustic comfort, safety, and indoor air quality. It also reflects a responsible construction approach designed around residents' needs and expectations.

- SECURITY MASTER Key: mWqek8ptkpvHyG1vZpqbZmJoamlkkmKWbGWelpeZaJ/JnJxiyGqSaJmYZnJmnGpr

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-95755-05012026_pr_acquisition-vsj-and-vefa-kaloupile2-vdef.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free