Lund, Sweden - Clinical Laserthermia Systems AB (publ) ("CLS" or the "Company") today publishes its Year-end report for January - December 2025.

Highlights of the Year-end report 2025

The year 2025 represents the continued and disciplined execution of the strategic change initiated in 2024. During the year, CLS further strengthened its position as a commercially focused, partnership-driven company with a clear priority on neurosurgery.

As previously communicated to the market, CLS has established the following financial targets:

- Positive cash flow in the fourth quarter of 2026

- Increase gross margin to above 60% by 2026

- Reduce operating expenses by 30% in 2025 compared to 2024

- Grow revenue by double digits in 2025 and 2026

In 2025, CLS delivered a gross margin of 67%, clearly exceeding the long-term target. Operating expenses were reduced by 38% compared to 2024, surpassing the communicated cost reduction objective. Within neurosurgery, sales of Prism products increased by 14% year-over-year, reflecting continued underlying procedure growth through our strategic partner.

Fourth Quarter

- Fourth quarter sales of Prism products negatively impacted by alignment discussions with CLS partner in neurosurgery on the scaling of the Prism business going forward.

- Positive results from CLS-sponsored clinical safety study at Skåne University Hospital presented at CNS Annual Meeting, further reinforcing the clinical foundation of the Prism platform.

- Application submitted for CE marking of the ClearPoint Prism branded Neuro Laser Therapy System, seeking regulatory approval in Europe for use with 1.5T and 3.0T MRI guidance, allowing for further acceleration of growth, upon approval.

- The first 1.5T Prism system installations were completed in the U.S. following expanded FDA clearance.

Full year

- CLS's sales of Prism products grew by 14% year-over-year as a response to our neuro partner's growing market share and doubling of Prism procedures in the U.S.

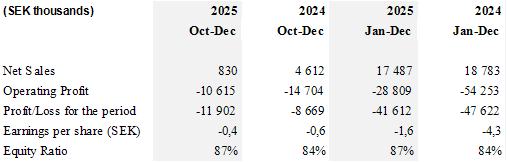

- CLS's total net sales reached SEK 17.5 million compared to SEK 18.8 million in 2024, a decline of 7% attributed to reduced net sales outside of neurosurgery and alignment discussions on scaling in neurosurgery.

- Through strict cost control and higher operational efficiency, CLS delivered a strong improvement in operating profit of SEK 25.4 million compared to 2024.

- Gross margin improved to 67% compared to 51% in 2024, exceeding the long-term target of 60%.

- Operating expenses were reduced by 38% compared to 2024, well above target of 30% reduction.

- CLS strengthened its financial base through a capital raise of SEK 35 million in 2025. CLS remains debt-free and have no interest expenses.

- Expanded FDA clearance of the ClearPoint Prism® Neuro Laser Therapy System to include both 3.0T and 1.5T MRI guidance, significantly broadening U.S. market access and more than doubling the addressable market from September 2025, opening for accelerated growth going forward.

- CLS strengthened its board of directors, with skilled and highly experienced members, active in the field, to provide governance and support to management in the transition of CLS into a scalable commercial organization. The annual general meeting resolved to re-elect Peter Max as a member of the Board of Directors and to elect Lena Höglund, Veronica Byfield Sköld, Thomas Binzer and Jerker Nygren. Peter Max was re-elected as Chairman of the Board.

Outlook 2026

- CLS continues to maintain communicated targets for 2026, while recognizing that continued commercial execution and aligned scaling remain key factors.

- Expanded U.S. market access, pending CE marking and product pipeline support continued growth within neurosurgery.

- The Company has initiated expansion of its partnership model outside neurosurgery to gradually broaden and balance the commercial base.

- The Board and management continuously evaluate capital structure alternatives to ensure financial flexibility under different development scenarios.

Summary of the Year-end report (relates to the Group)

Comments from CEO

Dear Shareholders,

2025 has been a year of disciplined execution and continued implementation of the strategic direction we set in 2024. CLS has further strengthened its position as a focused, commercially driven neurosurgery company built on long-term partnerships.

Our operational improvements are clearly visible. Gross margin reached 67%, exceeding our long-term target, and operating expenses were reduced by 38% compared to 2024. Within neurosurgery, sales of Prism products increased by 14%, reflecting continued growth in procedures performed through our strategic partner.

Total net sales declined by 7%, primarily due to reduced activity outside neurosurgery and alignment discussions on scaling in neurosurgery, following our strategic prioritization. At the same time, operating profit improved by SEK 25.4 million compared to 2024, strengthening the Company's financial position.

In the fourth quarter, sales were affected by alignment discussions with our neurosurgery partner regarding scaling in neurosurgery. These discussions followed CLS's regulatory expansion and reflect adjustments in commercial planning to a broader market opportunity.

During 2025, we expanded FDA clearance to include both 1.5T and 3.0T MRI guidance, more than doubling the addressable U.S. market. We also submitted our CE-mark application in Europe, positioning CLS for further geographic expansion upon approval.

When looking ahead, our favorable long-term commercial outlook for Prism remains firm, motivated by established clinical guidelines and reimbursement for LITT, limited competition, and a well-established partner with a track record of doubling the Prism LITT-procedures in 2025 compared to 2024 and their expected continued double-digit growth within the Laser Therapy and Access market in 2026.

Successful execution of an accelerated growth plan in 2026 may require increased investments by CLS. The Board and management continuously evaluate the company's capital structure to ensure that CLS is appropriately financed under different development scenarios.

As we enter 2026, CLS stands with expanded U.S. market access, strengthened clinical validation, a pending European regulatory pathway and a focused cost structure designed to support scaling of our neuro business and the potential initiation of a new strategic partnership outside neurosurgery.

I would like to thank our employees, partners, and shareholders for your continued trust as we build CLS toward sustainable profitability and long-term value creation.

Dan J. Mogren, CEO

Clinical Laserthermia Systems AB

Significant events in the fourth quarter of 2025

- CLS raised SEK 20.9 million through full subscription of Warrants of Series TO 8B. All 5,500,000 warrants of series TO 8B, issued in connection with the directed share issue in February 2025, have been exercised. The exercise added SEK 20.9 million before transaction costs to CLS, corresponding to a subscription rate of 100 percent. The total number of shares in CLS will amount to 31,166,594, corresponding to a share capital of approximately SEK 71,981,747.85.

- CLS announced positive results from a clinical safety study on laser ablation, performed using CLS proprietary LITT platform in patients with malignant brain tumor, conducted at Skåne University Hospital. Patients with recurrent malignant brain tumor that were treated with Laser Interstitial Thermal Therapy (LITT) had increased median survival compared to a matched control group treated with open surgery. The study's primary objective - to investigate whether the CLS proprietary LITT platform was safe and feasible in the treatment of brain tumors - was successfully achieved.

- CLS announced that it has formally applied for CE marking of its ClearPoint Prism branded Neuro Laser Therapy System, seeking regulatory approval in Europe for use with 1.5T and 3.0T magnetic resonance imaging (MRI) guidance in neurosurgical procedures. and follows on CLS's 2024 ISO-certification in accordance with the European Medical Device Regulation (MDR)

- CLS announced that the company has decided to transition from its current interim, part-time consulting CFO arrangement to a permanent and fully employed Chief Financial Officer and the recruitment process for this position has been initiated.

Significant events after the end of the period

- CLS announced the installation of the TRANBERG Thermal Therapy System at Andros Clinics in Amsterdam, through its distribution partner MTEC Company. The system is intended for ultrasound-guided focal laser ablation (FLA), a minimally invasive treatment option to radical prostatectomy for patients with localized prostate cancer.

This disclosure contains information that Clinical Laserthermia Systems AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out below, on February 20, 2026, at CET 08:30.

For more information, please contact:

Dan J. Mogren, CEO Clinical Laserthermia Systems AB (publ)

Phone: +46 (0)705 90 11 40

E-mail: dan.mogren@clinicallaser.com

About CLS

Clinical Laserthermia Systems AB (publ), develops and sells TRANBERG® Thermal Therapy System and ClearPoint Prism® Neuro Laser Therapy System with sterile disposables, for minimally invasive treatment of cancer tumors and drug-resistant epilepsy. The products are marketed and sold through partners for image-guided laser ablation. CLS is headquartered in Lund, Sweden, with subsidiaries in Germany, the United States and a marketing company in Singapore. CLS is listed on Nasdaq First North Growth Market under the symbol CLS B. Certified adviser (CA) is FNCA Sweden AB.

For more information about CLS, please visit the Company's website: www.clinicallaser.se

This disclosure contains information that CLS is obliged to make public pursuant to the EU Market Abuse Regulation (EU nr 596/2014). The information was submitted for publication, through the agency of the contact person, on 20-02-2026 08:45 CET.